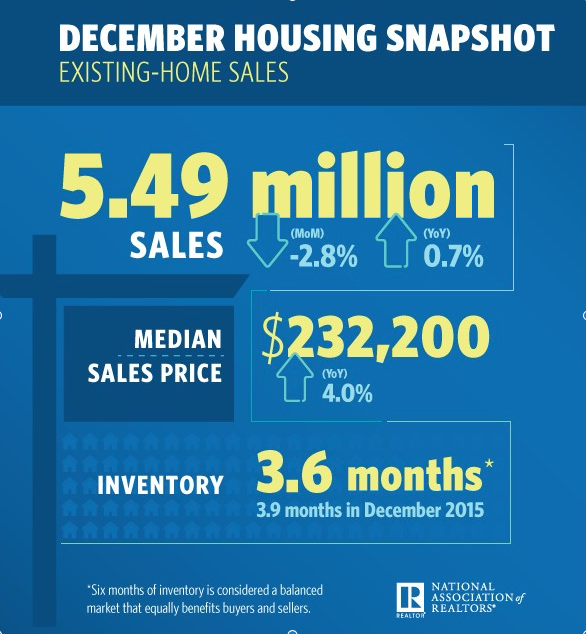

Sales of existing homes fell 2.8% in December to an annual pace of 5.49 million from the upwardly revised estimate for November and finished the year at 5.45 million sales, the highest level since 2006’s 6.48 milliion, the National Association of Realtors reported Tuesday. Still, December 2016 came in 0.7% ahead of the same month a year earlier.

“Solid job creation throughout 2016 and exceptionally low mortgage rates translated into a good year for the housing market,” said Lawrence Yun, NAR chief economist. “However, higher mortgage rates and home prices combined with record low inventory levels stunted sales in much of the country in December.”

Added Yun, “While a lack of listings and fast rising home prices was a headwind all year, the surge in rates since early November ultimately caught some prospective buyers off guard and dimmed their appetite or ability to buy a home as 2016 came to an end.”

The median existing-home price for all housing types in December was $232,200, up 4.0% from December 2015 ($223,200). December’s price increase marked the 58th consecutive month of year-over-year gains.

Single-family home sales declined 1.8% to a seasonally adjusted annual rate of 4.88 million in December from 4.97% in November, but are still 1.5% above the 4.81 million pace a year ago. The median existing single-family home price was $233,500 in December, up 3.8% from December 2015.

Existing condominium and co-op sales dropped 10.3% to a seasonally adjusted annual rate of 610,000 units in December, and are now 4.7% below a year ago. The median existing condo price was $221,600 in December, which is 5.5% above a year ago.

December existing-home sales in the Northeast slid 6.2% to an annual rate of 760,000 but are still 2.7% above a year ago. The median price in the Northeast was $245,900, 3.8% below December 2015. In the Midwest, existing-home sales decreased 3.8% to an annual rate of 1.28 million in December but are still 2.4 percent above a year ago. The median price in the Midwest was $178,400, up 4.6% from a year ago.

Existing-home sales in the South in December were at an annual rate of 2.25 million (unchanged from November) and are 0.4% above December 2015. The median price in the South was $207,600, up 6.5% from a year ago. Existing-home sales in the West fell 4.8% to an annual rate of 1.20 million in December, and are now 1.6% below a year ago. The median price in the West was $341,000, up 6.0% from December 2015.

Total housing inventory at the end of December dropped 10.8% to 1.65 million existing homes available for sale, which is the lowest level since NAR began tracking the supply of all housing types in 1999. Inventory is 6.3% lower than a year ago (1.76 million), has fallen year-over-year for 19 straight months and is at a 3.6-month supply at the current sales pace (3.9 months in December 2015).

“Housing affordability for both buying and renting remains a pressing concern because of another year of insufficient home construction,” said Yun. “Given current population and economic growth trends, housing starts should be in the range of 1.5 million to 1.6 million completions and not stuck at recessionary levels. More needs to be done to address the regulatory and cost burdens preventing builders from ramping up production.”

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage surged in December to 4.20% from 3.77% in November. December’s average commitment rate was the highest rate since April 2014 (4.32%).

First-time buyers accounted for 32% of sales in December, unchanged both from November and a year ago. First-time buyers also represented 32%of sales in all of 2016. NAR’s 2016 Profile of Home Buyers and Sellers – released in late 2016 – revealed that the annual share of first-time buyers was 35%.

“Constrained inventory in many areas and climbing rents, home prices and mortgage rates means it’s not getting any easier to be a first-time buyer,” said Yun. “It’ll take more entry-level supply, continued job gains and even stronger wage growth for first-timers to make up a greater share of the market.”

On the topic of first-time- and moderate-income buyers, NAR President William E. Brown, a Realtor® from Alamo, California, says Realtors® look forward to working with the Federal Housing Administration to express why it is necessary to follow through with the previously announced decision to reduce the cost of mortgage insurance. By cutting annual premiums from 0.85%t to 0.60%, an FHA-insured mortgage becomes a more viable and affordable option for these buyers.

“Without the premium reduction, we estimate that roughly 750,000 to 850,000 home buyers will face higher costs and between 30,000 and 40,000 would-be buyers will be prevented from entering the market,” he said.

Properties typically stayed on the market for 52 days in December, up from 43 days in November but down from a year ago (58 days). Short sales were on the market the longest at a median of 97 days in December, while foreclosures sold in 53 days and non-distressed homes took 50 days. 37% percent of homes sold in December were on the market for less than a month.

Inventory data from Realtor.com® reveals that the metropolitan statistical areas where listings stayed on the market the shortest amount of time in December were San Jose-Sunnyvale-Santa Clara, Calif., 49 days; San Francisco-Oakland-Hayward, Calif., and Nashville-Davidson-Murfreesboro-Franklin, Tenn., 50 days; and Billings, Mont., and Hanford-Corcoran, Calif., both at 51 days.

All-cash sales were 21% of transactions in December, unchanged from November and down from 24% a year ago. Individual investors, who account for many cash sales, purchased 15% of homes in December, up from 12% in November and unchanged from a year ago. Fifty-nine percent of investors paid in cash in December.

Distressed sales – foreclosures and short sales – rose to 7% in December, up from 6% in November but down from 8% a year ago. Five percent of December sales were foreclosures and 2% were short sales. Foreclosures sold for an average discount of 20% below market value in December (17% in November), while short sales were discounted 10% (16% in November).