In Brooklyn and Manhattan, cooling competition is likely heralding a slower than usual winter season for the New York housing market, according to the October 2016 StreetEasy® Market Reports. Manhattan resale prices, while still increasing, are growing at their slowest pace in five years. In Brooklyn, competition is decreasing. In both boroughs, fewer homes went into contract last month than in October 2015.

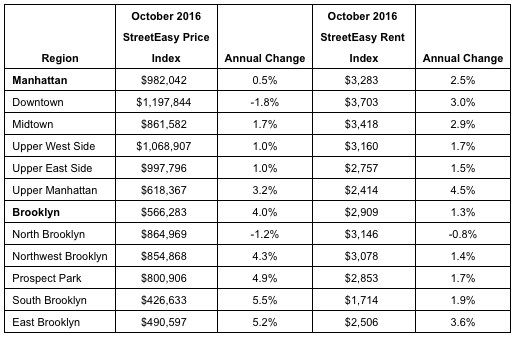

In October, Brooklyn’s median resale price grew 4% year-over-year to $566,283, the lowest appreciation in October since 2012. The number of pending sales, or homes that went into contract, fell 12.6% compared to this time last year, an even greater decline than recorded the year prior.

Competition decreased most notably in Brooklyn’s highest-priced submarket, North Brooklyn, which is comprised of Williamsburg, East Williamsburg and Greenpoint. North Brooklyn was the only submarket in the borough where resale prices fell, decreasing 1.2% year-over-year to $864,969 in October. All other Brooklyn submarkets recorded median resale price increases exceeding 4%.

In other signs of waning competition, the North Brooklyn submarket had the highest share of price cuts among all other submarkets at 44.3%. Sellers received 92% of their asking price, down from 99.6% in October of last year. Homes in the area also took longer to go into contract than this time last year, with median time on market increasing from 35 days to 88 days – more than double the median of any other Brooklyn submarket. Homes in Williamsburg, in particular, took a median of 90 days to go into contract.

Manhattan’s median resale price increased 0.5% since last year to $982,042, the slowest pace of annual growth since February 2011. Similar to Brooklyn, fewer homes went into contract this October than in years past, with the number of pending sales dropping 16.2% year-over-year, compared to a drop of only 1.2% in 2015.

Resale prices in the Downtown submarket, the borough’s most expensive submarket, declined 1.8% year-over-year to $1,197,844. By contrast, resale prices in Upper Manhattan grew 3.2% year-over-year, followed by Midtown (1.7%), the Upper West Side (1.0%) and Upper East Side (1.0%). Homes in the Downtown submarket took a median of 13 days longer to go into contract than this time last year.

“Approaching winter, high-end sellers are already cutting prices as they adjust to a more restrained market. Buyers looking in formerly ultra-competitive areas may find the ball is back in their court,” said StreetEasy economist Krishna Rao. “In Williamsburg, it will be particularly interesting to see if price declines continue as the L-train closure approaches. For those who don’t mind dealing with restricted transit options over the next few years, this could present an opportunity for investment that will ultimately pay off.”

The complete StreetEasy Market Reports for Manhattan and Brooklyn with additional analysis, neighborhood data and graphics can be viewed at streeteasy.com/blog/market-reports.