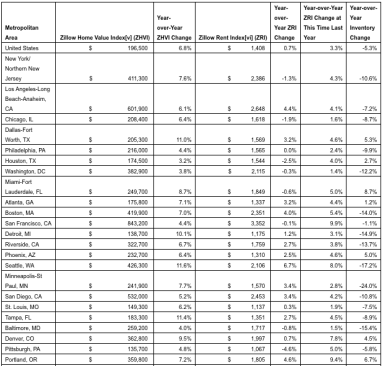

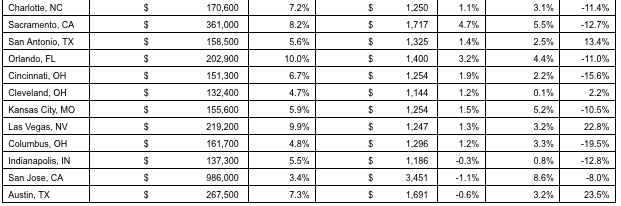

Rents across the country rose 0.7% from last March, the slowest rate of appreciation since November 2012, as new construction began to meet renter demand and soften the market. The median rent payment in the U.S. is now $1,408, according to the March Zillow® Real Estate Market Reportsi.

Rents in the Bay Area have slowed more than any other large metropolitan area over the past year. In San Francisco, rents are down 0.1% after appreciating almost 10% annually at this time last year. Rents in San Jose were rising at almost 9% annually a year ago, but fell 1.1% over the past year to a median rent payment of $3,451.

Even in hot West Coast markets, where rental growth is notoriously strong, rent appreciation is starting to slow. In Seattle, rents are up 6.7%, but their pace of appreciation has been slowing since August 2016. Rents in Sacramento are up 4.7%, but were rising at almost 7% annually toward the end of last year.

“The slowdown in rental appreciating is mainly due to new construction finally meeting demand, and even outpacing demand in some areas,” said Zillow’s Chief Economist Dr. Svenja Gudell. “But, rents are the highest they’ve ever been, weighing heavily on renters’ budgets and making it extremely difficult for those renters hoping to become homeowners to save enough money for a down payment. In most markets, a monthly mortgage payment is more affordable than a monthly rent payment, but the most difficult aspect of home buying for many aspiring home owners is coming up with enough money for the down payment.”

The median home value across the country is $196,500, up 6.8% since this time last year. Seattle, Tampa, Fla. and Dallas reported the highest year-over-year home value appreciation among the 35 largest U.S. metros. In Seattle, home values rose almost 12% to a median value of $426,300. Home values in Tampa and Dallas are up about 11% since this time last year.

Low inventory continues to be a problem for home shoppers across the country — there are 5% fewer homes to choose from than a year ago, paving the way for an extremely competitive home shopping season.

Minneapolis, Columbus, Ohio and Seattle reported the greatest drop in inventory among the 35 largest U.S. metros. In Minneapolis, there are 24% fewer homes to choose from than a year ago, and 19.5% fewer to choose from in Columbus. In Seattle, where home values are growing the fastest, buyers will have 17% fewer homes to choose from than a year ago.

Mortgage rates are down from their December highs, but still well above where they were before the election. In March, mortgage rates on Zillow ended at 3.94%, down from a high of 4.13%. The month low was 3.93%.