Beazer Homes USA, Inc. (NYSE: BZH) late Thursday reported net income from continuing operations of $13.4 million for its fiscal third quarter ended June 30, an increase of $6.3 million from the third quarter of fiscal 2017. Diluted earnings per share was $0.41, which was up 86.4% from the same period last year. Anaylsts were looking for a gain of $0.39 per share.

Third quarter Adjusted EBITDA of $46.6 million was up $2.4 million, or 5.3%, compared to the same period last year.

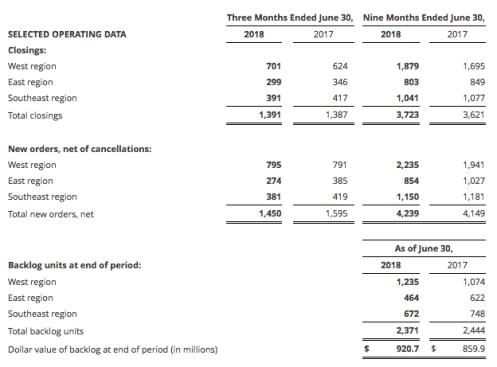

Third quarter closings of 1,391 homes were 0.3% above the level achieved in the same period last year. Combined with a 7.0% increase in the average selling price to $364.5 thousand, home building revenue rose 7.3% over the prior year to $507.0 million.

Net new orders for the third quarter decreased 9.1% from the prior year. The drop in net new orders was driven by a decrease in the absorption rate to 3.1 sales per community per month, down from a strong 3.4 the previous year, but in line with third quarter absorptions throughout the upturn. The cancellation rate was 18.6%.

The dollar value of homes in backlog as of June 30, 2018 increased 7.1% to $920.7 million, or 2,371 homes, which compared to $859.9 million, or 2,444 homes, at the same time last year. The average selling price of homes in backlog rose 10.4% year over year to $388.3 thousand.

Home building gross margin (excluding impairments, abandonments and interest amortized) was 20.8% for the third quarter, down 50 basis points from the same period in fiscal 2017. Our results last year included approximately 30 basis points of warranty related benefits.

Selling, general and administrative expenses, as a percentage of total revenue, were 12.1% for the quarter, an improvement of 30 basis points compared to the prior year.

The company ended the quarter with approximately $336.3 million of available liquidity, including $136.3 million of unrestricted cash and $200.0 million available on its secured revolving credit facility.

The company continued to make progress with its Gatherings rollout during the third quarter of fiscal 2018. In Orlando’s Gatherings at Lake Nona, building one was completed and delivered its first closings in early July, while construction continued on building two. In addition to Lake Nona, projects are underway in Dallas, Nashville, and Atlanta. The company continues to review a large pipeline of potential communities spread across its geographic footprint and expects to see Gatherings acquisition activity accelerate into fiscal 2019.

As previously disclosed, the company acquired Venture Homes, a leading private home builder in the metropolitan Atlanta area. In the cash transaction, which closed on July 13, Beazer purchased more than 1,000 lots spread across 9 active communities and 18 future communities, which are being integrated into the Company’s existing operations in Atlanta. With nearly 500 homes closed during the trailing 12 months, the combined operation ranks among the top 10 builders in the market. Looking forward, the acquisition is expected to be accretive to both earnings per share and return on assets in fiscal 2019.