Beazer Homes USA, Inc. (NYSE: BZH) late Thursday reported net income from continuing operations of $10.6 million, or $0.35 per share, for its second fiscal quarter ended March 31. The gain compared to net loss from continuing operations of $100.8 million, or -$3.28 per share, in fiscal second quarter 2019, which included an impairment charge of $147.6 million pre-tax. The gain was in-line with analyst estimates.

Among the results:

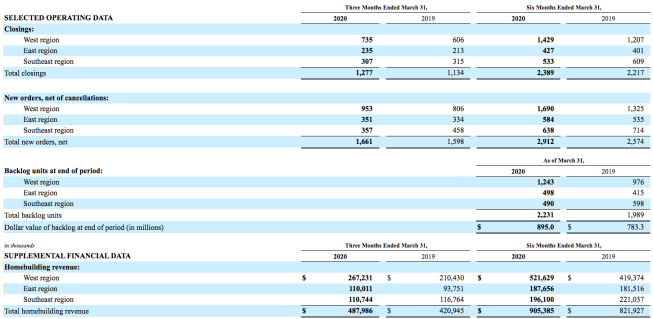

• Home building revenue of $488.0 million, up 15.9% on a 12.6% increase in home closings to 1,277 and a 2.9% increase in average selling price to $382.1 thousand.

• Home building gross margin was 16.1%. Excluding impairments, abandonments and amortized interest, home building gross margin was 20.8%, up 100 basis points.

• SG&A as a percentage of total revenue was 12.0%, down 70 basis points year-over-year.

• Unit orders of 1,661, up 3.9% on a slight increase in orders/community/month to 3.3. The increase in net new orders was primarily driven by a 2.2% increase in average community count to 167. The cancellation rate for the quarter was 15.8%, up 130 basis points year-over-year.

• Dollar value of backlog of $895.0 million, up 14.3%, or 2,231 homes, compared to $783.3 million, or 1,989 homes, at the same time last year. The average selling price of homes in backlog was $401.2 thousand, up 1.9% year-over-year.

At the close of the second quarter, total liquidity was $294.3 million including a fully drawn $250.0 million revolving credit facility. This compares to total liquidity of $221.4 million at March 31, 2019, including cash of $86.4 million and undrawn revolving credit facility capacity of $135.0 million.

“We generated strong second quarter results, highlighted by growth in revenue, margin and profitability, said Allan P. Merrill, Chairman and Chief Executive Officer of Beazer Homes. “Of course, these results were overshadowed by the effects of the COVID-19 pandemic beginning in mid-March. We have made significant operational changes to help protect the health and safety of our team, our customers and our trade partners and simultaneously taken steps to enhance our liquidity.”

BZH suspended 2020 guidance due to the pandemic.