Beazer Homes USA, Atlanta (NYSE:BZH) took a net loss from continuing operations of $130.6 million for its fiscal first quarter ended Dec. 31. The loss was driven primarily by a $112.6 million expense related to the remeasurement of the Company’s deferred tax assets as a result of a change to the Federal corporate tax rate.

Additionally, the Company recorded a $25.9 million loss on the extinguishment of debt for the quarter following its refinancing activities in October. Minus the writedowns, first quarter Adjusted EBITDA of $28.4 million was up $4.0 million, or 16.2%, compared to the same period last year.

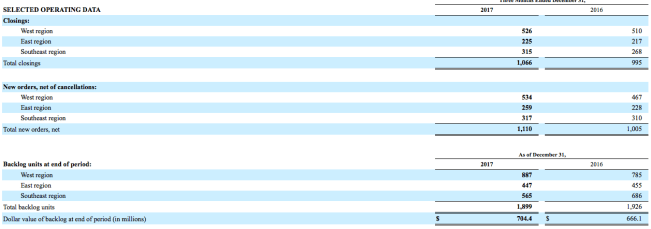

The operating metrics were all up. Net new orders for the first quarter increased more than 10% from the prior year, which was achieved while average community count remained relatively flat at 155. The growth in net new orders was driven by an increase in the absorption rate to 2.4 sales per community per month, up nearly 11% from the previous year. The cancellation rate was 18.9%, down 230 basis points from the first quarter of last year.

First quarter closings of 1,066 homes were 7.1% above the level achieved in the same period last year. Additionally, homebuilding revenue for the quarter increased 9.4% over the prior year to $367.8 million, as the average selling price rose 2.1% to $345.0 thousand.

The dollar value of homes in backlog as of December 31, 2017 increased 5.7% to $704.4 million, or 1,899 homes, compared to $666.1 million, or 1,926 homes, for the same period last year. At the same time, the average selling price of homes in backlog increased 7.2% from the prior year to $370.9 thousand.

Home building gross margin for the first quarter was 16.4%. Excluding amortized interest, home building gross margin was 20.9%, up 40 basis points versus the prior year.SG&A Expenses. Selling, general and administrative expenses, as a percentage of total revenue, were 13.9% for the quarter, flat compared to the prior year after excluding a $2.7 million charge related to the write-off of a legacy investment that the company took in the first quarter of Fiscal 2017.

The company ended the quarter with approximately $343.6 million of available liquidity, including $177.8 million of unrestricted cash and $165.8 million available on its secured revolving credit facility, after adjusting for outstanding letters of credit.

In early October, the Company issued $400 million of 5.875% unsecured Senior Notes due 2027. The proceeds, combined with cash on the balance sheet, were used to retire $225 million of its 5.750% Senior Notes due 2019 and $175 million of its 7.250% Senior Notes due 2023 in a leverage-neutral refinancing transaction. In addition, later in October, the company increased the capacity of its existing secured revolving credit facility to $200 million from $180 million and extended the maturity to February 2020.

At the end of December, the Company acquired several communities in the Carolinas from private homebuilder, Bill Clark Homes. In the cash transaction, the Company purchased more than 450 lots spread across seven new home communities in Raleigh and Myrtle Beach which have been incorporated into its existing operations in those markets. The acquisition made an immediate impact in the first quarter, adding 4 active communities as well as 21 net new orders, and will continue to make contributions in the remainder of Fiscal 2018 and beyond.

Beazer also reported the status of it Gatherings communities. Construction began on the amenity center for Orlando’s Gatherings at Lake Nona, and in January, interior finish work commenced for building 1, with building 2 scheduled to start construction during the second quarter. In Dallas, Gatherings at Mercer Crossing entered the final stages of land development, with building 1 construction scheduled for a second quarter start. Additionally, the Company began land development operations at its Gatherings at Herrington Springs project in Atlanta, and anticipates construction starting before the end of the fiscal year. The Company is currently reviewing a large pipeline of potential communities which exceeds 2,000 homes spread across its geographic footprint and expects to see Gatherings acquisition activity accelerate throughout Fiscal 2018.

“Our first quarter operating results showed year-over-year improvement in nearly every operational metric, with notable gains in our sales pace, gross margin and EBITDA” said Allan Merrill, president and CEO. “Our strong performance in the first quarter has us well positioned to reach both our “2B-10” target of $200 million of EBITDA and our debt reduction plan of $100 million during Fiscal 2018. We believe that our commitment to provide customers with extraordinary value at an affordable price will drive further improvements in profitability and returns as we continue to push toward generating a double-digit return on assets.”