M.D.C. Holdings, Inc., Denver, (NYSE: MDC) on Thursday reported net income of $61.2 million, or $1.16 per diluted share, for the third quarter ended September 30, 2017, up 132% from the same quarter in 2016. The gain included a pretax gain on the sale of municipal bond investments related to a master plan in which the company is involved of $52.2 million. Analysts were expecting income of $0.57 per share.

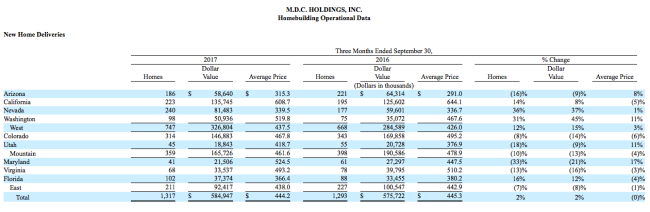

Home sale revenues for the 2017 third quarter increased 2% to $584.9 million, driven by a 2% improvement in deliveries, which was mostly the result of a 2% year-over-year increase in our homes in beginning backlog. Deliveries were negatively affected by costs related to defective Weyerhaeuser joists in Colorado and Hurricane Irma in Florida. The deliveries of approximately 115 homes that were previously scheduled to close during the 2017 third quarter were delayed to later quarters as a result of these issues.

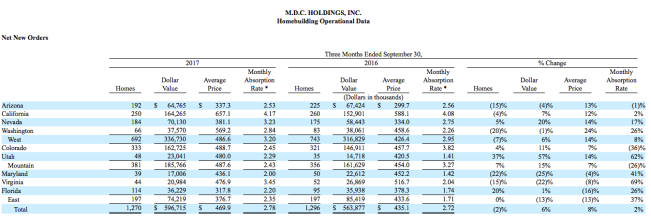

The dollar value of net new orders for the 2017 third quarter increased 6% year-over-year to $596.7 million, as an 8% increase in the average selling price of net new orders was slightly offset by a 2% decline in the number of net new orders. The year-over-year change in average selling price of net new orders was driven by price increases in existing communities due to robust demand and the mix of sales between markets, partially offset by an increase in the percentage of sales coming from our more affordable product lines. The slight decline in the number of net new orders was caused by a 4% decrease in average active community count, partially offset by a 2% increase in our monthly sales absorption rate.

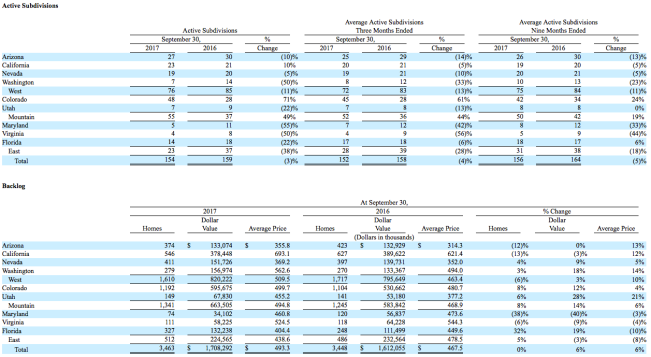

Backlog value at the end of the 2017 third quarter was up 6% year-over-year to $1.71 billion, due mostly to a 6% increase in the average selling price of homes in backlog. The change in average selling price is consistent with that explained for our net new orders.

Gross margin from home sales percentage was 16.3%, an 80 basis point improvement from 15.5% in the prior year period. During the 2017 and 2016 third quarters, the company recorded inventory impairments of $4.5 million and $4.7 million, respectively. The impairments recorded for each period negatively impacted gross margin by 80 basis points. Additionally, during the 2016 third quarter, the company made adjustments of $1.8 million (a 30 basis point negative impact to gross margins) to increase warranty accrual while for the 2017 third quarter, the company recorded an adjustment to decrease warranty accrual by $0.4 million (a 10 basis point positive impact to gross margins).

Selling, general and administrative expenses for the 2017 third quarter were $69.1 million, up $7.2 million from $61.9 million for the same period in 2016, due in part to an increase in employment to prepare for future growth, resulting in higher compensation-related expenses. SG&A was up 100 basis points year-over-year to 11.8%. However, absent the Weyerhaeuser joist issue and Hurricane Irma issues, M.D.C. said SG&A “might have increased by only 40 basis points year-over-year.”

Interest and other income for the three months ended September 30, 2017 and 2016 was $54.5 million and $1.9 million, respectively. The year-over-year increase was driven by a $52.2 million gain from investment sales in the 2017 third quarter. The majority of the gain relates to the sale of the company’s metropolitan district bond securities, which were held for the past ten years and relate to a master-planned community being developed by one of its home building subsidiaries.

Income before taxes for our financial services operations for the 2017 third quarter was $9.5 million, a $0.9 million decline from $10.4 million in the 2016 third quarter.

Larry A. Mizel, MDC’s chairman and CEO, stated, “Solid economic fundamentals continue to support the home building industry, driving robust demand for new homes, especially in the first-time home buyer segment. To meet this growing demand, we have taken a number of steps to grow community count. First, we substantially increased our approvals of future lots for purchase. Through the first nine months of 2017, we approved the purchase of over 7,800 lots, more than double the approvals from the same period a year ago. An increasing percentage of our lot approvals are focused on the first-time home buyer segment, which has responded favorably to one of our newest product lines, the Seasons™ collection.”

Mizel continued, “Also, we announced in September that we will commence operations in the greater Portland area, giving us additional exposure to the Pacific Northwest, where we have experienced solid results.”

Mizel concluded, “The higher liquidity provides us with additional resources to fund our increased lot approval activity, providing us the foundation for community count growth in 2018.”