Century Communities, Inc. (NYSE:CCS), Greenwood Village, Col. after market close on Tuesday reported net income for the fourth quarter 2017 ended Dec. 31 was $17.2 million, or $0.60 per share. Excluding the impact of one-time charges associated with the remeasurement of net deferred tax assets and home builder acquisitions, adjusted net income for the fourth quarter increased 90% to a record $28.8 million, or $1.01 per share, as compared to $15.1 million, or $0.71 per share, for the prior year quarter.

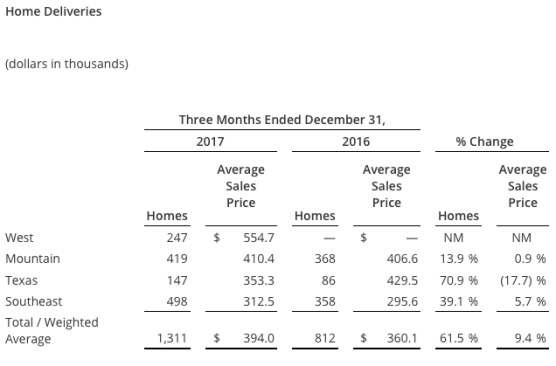

Home sales revenues for the fourth quarter 2017 increased 77% to $516.5 million, compared to $292.4 million for the prior year quarter. The growth in home sales revenues was primarily due to a 62% increase in deliveries to 1,311 homes compared to 812 homes for the prior year quarter, and a higher average sales price of home deliveries of $394,000, compared to $360,100 in the prior year quarter.

Deliveries and average sales price of home deliveries in the fourth quarter of 2017 were both favorably impacted, primarily in the West, by the acquisitions of UCP and Sundquist. Excluding the West, the company’s legacy regions experienced growth in revenue and deliveries of 22% and 31%, respectively.

Adjusted home building gross margin percentage, excluding interest and purchase price accounting, was 21.7% in the fourth quarter 2017, as compared to 21.0% in the third quarter and 21.4% in the prior year quarter, primarily as a result of favorable product and geographical mix. Home building gross margin percentage in the fourth quarter 2017 was 17.6%, as compared to 19.2% in the prior year quarter, with approximately half of the difference attributable to the impact of purchase price accounting in the fourth quarter 2017. SG&A as a percent of home sales revenues was 12.1%, compared 11.9% in the prior year quarter, largely attributable to numerous investment initiatives to support growth objectives in 2018.

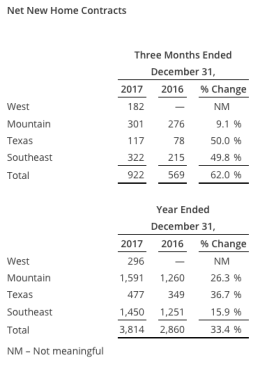

Net new home contracts in the fourth quarter 2017 increased to 922 homes, representing an increase of 62%, compared to 569 homes in the prior year quarter, attributable to the addition of the new West region and stronger demand trends in all legacy regions driving an overall increase in absorption rates. Excluding the West, the company’s legacy regions experienced a 30% increase in net new home contracts.

At the end of the fourth quarter 2017, the Company had 1,320 homes in backlog, representing $572.9 million of backlog dollar value, compared to 749 homes in backlog, representing $302.8 million of backlog dollar value in the prior year quarter, an increase of 76% in units and 89% in dollar value.

Financial services revenue was $5.2 million in the fourth quarter 2017 and financial services costs were $4.0 million. Equity in income of unconsolidated subsidiaries was $4.5 million, compared to $0.2 million in the prior year quarter.

Net income for the full year 2017 was $50.3 million, or $2.03 per share. Adjusted net income increased 42% to a record $71.1 million, or $2.87 per share, compared to $50.1 million, or $2.36 per share, for the prior year.

Home sales revenues for 2017 increased 44% to $1.4 billion, compared to $978.7 million for 2016. The increase in home sales revenues was primarily due to home deliveries increasing 29% to 3,640 homes and the average selling price of homes delivered increasing to $386,100 compared to $346,500 in the prior year, helped by a shift in regional and product mix.

Home building gross margin percentage in 2017 was 17.9%, compared to 19.7% in 2016. Adjusted home building gross margin percentage, excluding purchase price accounting and interest in cost of home sales revenues, was 21.4% compared to 21.7% in the prior year. SG&A as a percent of home sales revenues remained constant at 12.5% compared to the prior year, with tight cost controls offsetting numerous investment initiatives to support growth objectives in 2018.

Net new home contracts in 2017 increased to 3,814 homes, an increase of 33%, compared to 2,860 homes in the prior year, largely attributable to increased demand, additional open communities and acquisitions.

At the end of full year 2017, the Company had 119 open communities, an increase of 34%, compared to 89 open communities at the end of the prior year.

Financial services revenue was $9.9 million for the full year 2017 and financial services costs were $8.7 million. Equity in income of unconsolidated subsidiaries was $12.2 million, compared to $0.2 million in the prior year.

As of December 31, 2017, the company had the full $400.0 million of availability under its credit facility.

During the full year of 2017, in addition to shares issued in connection with the UCP business combination, the company issued 3.7 million shares of its common stock under its ATM Program for proceeds of $98.9 million, or $27.31 per share.

David Messenger, CFO, provided guidance for 2018: “Based on our current market outlook, we expect home deliveries to be in the range of 4,500 to 5,000 homes and our home sales revenues to be in the range of $1.75 billion to $2.0 billion. We expect our active selling community count to be in the range of 130 to 140 communities at the end of the full year 2018. With the benefit of recent U.S. tax reform, we expect to incur an income tax rate of approximately 25% in 2018.”