D.R. Horton, Inc. (NYSE:DHI) on Monday reported net income for its first fiscal quarter ended Dec. 31 of $431.3 million, or $1.16 per diluted share, up 50% and 53%, respectively, from $287.2 million and $0.76 per share in the comparable period last year.

The current quarter results include a tax benefit of $32.9 million related to federal energy efficient homes tax credits that were retroactively reinstated during the quarter.

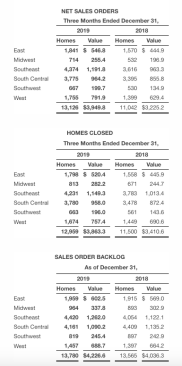

Home building revenue for the first quarter increased 14% to $3.9 billion from $3.4 billion in the same quarter of fiscal 2019. Homes closed in the quarter increased 13% to 12,959 homes compared to 11,500 homes closed in the same quarter of fiscal 2019.

Net sales orders for the first quarter ended December 31, 2019 increased 19% to 13,126 homes and 22% in value to $3.9 billion compared to 11,042 homes and $3.2 billion in the same quarter of the prior year. The company’s cancellation rate for the first quarter of fiscal 2020 was 20% compared to 24% in the prior year quarter.

The company had 30,200 homes in inventory at December 31, 2019, and its home building land and lot portfolio totaled 319,000 lots, of which 39% were owned and 61% were controlled through land purchase contracts.

The company’s return on equity (ROE) was 18.2% for the trailing twelve months ended December 31, 2019, and home building return on inventory (ROI) was 18.7% for the same period.

The company ended the first quarter with $1.2 billion of home building unrestricted cash and a home building debt to total capital ratio of 19.5%.

Donald R. Horton, chairman of the board, said, “The D.R. Horton team delivered strong results in the first fiscal quarter of 2020, highlighted by EPS increasing 53% to $1.16 per diluted share. Our consolidated pre-tax income in the first quarter increased 39% to $523.3 million on a 14% increase in revenues to $4.0 billion. Our pre-tax profit margin improved 230 basis points to 13.0%, and the value of our net sales orders increased 22%. These results reflect our experienced operational teams, industry-leading market share, broad geographic footprint and diverse product offerings across multiple brands.

“We continue to see good demand and a limited supply of homes at affordable prices across our markets, and economic fundamentals and financing availability remain solid. With 30,200 homes in inventory at the end of December, we are well-positioned for the spring selling season and the remainder of fiscal 2020.