D.R. Horton, Inc., Arlington, Texas (NYSE:DHI) early Wednesday reported net income for the first fiscal quarter of 2018 was $189.3 million, or $0.49 per diluted share, compared to $206.9 million, or $0.55 per diluted share, in the same quarter of fiscal 2017. Analysts were expecting a gain of $0.44 per share.

The current quarter results include a one-time non-cash charge to income tax expense of $108.7 million to re-measure the company’s net deferred tax assets, partially offset by a lower effective tax rate, both as a result of the Tax Cuts and Jobs Act enacted into law on December 22, 2017.

Pre-tax income for its first fiscal quarter ended December 31, 2017 increased 23% to $391.2 million compared to $318.1 million in the same quarter of the prior year.

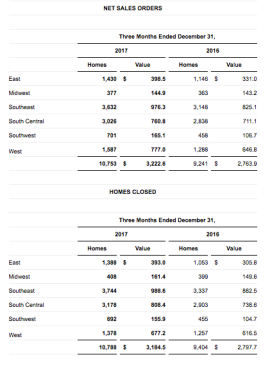

Net sales orders for the first quarter ended December 31, 2017 increased 16% to 10,753 homes and 17% in value to $3.2 billion compared to 9,241 homes and $2.8 billion in the same quarter of the prior year. The company’s cancellation rate for the first quarter of fiscal 2018 was 22%, unchanged from the prior year quarter.

Home building revenue for the first quarter of fiscal 2018 increased 14% to $3.2 billion from $2.8 billion in the same quarter of fiscal 2017. Homes closed in the quarter increased 15% to 10,788 homes compared to 9,404 homes closed in the prior year quarter.

Pre-tax profit margin for the first quarter of fiscal 2018 improved 70 basis points to 11.7% compared to 11.0% in the same quarter of fiscal 2017. The year-over-year improvement in pre-tax profit margin was driven primarily by an increase in home sales gross margin, which came in at 20.8% compared to 19.8% in the prior year quarter and 20.3% in the fourth quarter of fiscal 2017. The gross margin increase from both periods was primarily due to lower warranty, litigation and interest costs as a percentage of home building revenues. In the current housing market, the company expects its average home sales gross margin to be in the range of 20% to 21%, with quarterly fluctuations that may be outside of the range due to product and geographic mix and the relative impact of warranty, litigation and interest costs. Home building SG&A expense as a percentage of revenues in the first quarter of fiscal 2018 was 9.5%, unchanged from the prior year quarter. Home building SG&A in the current year quarter included $5.3 million of transaction costs related to the Forestar acquisition.

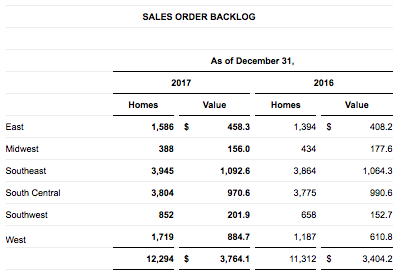

The company’s homes in inventory at December 31, 2017 increased 13% to 27,800 homes compared to 24,500 homes at December 31, 2016. The company’s homebuilding land and lot portfolio at December 31, 2017 consisted of 259,000 lots, of which 49% were owned and 51% were controlled through option contracts, compared to 212,600 lots at December 31, 2016, of which 56% were owned and 44% were controlled through option contracts.

During the quarter, D.R. Horton issued $400 million of 2.55% senior notes due 2020 and repaid $400 million principal amount of its 3.625% senior notes at par prior to their February 2018 maturity. The company ended the quarter with $558.0 million of home building unrestricted cash and a home building debt to total capital ratio of 25.9%.

Donald R. Horton, Chairman of the Board, said, “The D.R. Horton team delivered strong results in the first fiscal quarter of 2018. Our consolidated pre-tax income in the first quarter increased 23% to $391.2 million on a 15% increase in revenues to $3.3 billion. Our pre-tax profit margin improved 70 basis points to 11.7%, and the value of our net sales orders increased 17%. These results reflect the strength of our experienced operational teams, diverse product offerings from our family of brands and solid market conditions across our broad national footprint.

He continued, “Our balance sheet strength, liquidity and continued earnings growth are increasing our strategic and financial flexibility, and we plan to maintain our disciplined, opportunistic position to enhance the long-term value of our company. We continue to expect to grow our revenues and pre-tax profits at a double-digit annual pace, while generating positive annual operating cash flows and increasing returns. With 27,800 homes in inventory at the end of December and 259,000 lots owned and controlled, we are well-positioned for the spring selling season and beyond.”

During the first quarter of fiscal 2018, the company paid cash dividends of $47.0 million to its shareholders and repurchased 500,000 shares of its common stock for $25.4 million. The company’s remaining stock repurchase authorization at December 31, 2017 was $174.6 million. The company has also declared a quarterly cash dividend of $0.125 per common share that is payable on March 9, 2018 to stockholders of record on February 23, 2018.

On October 5, 2017, the Company acquired 75% of the outstanding shares of Forestar Group Inc. (NYSE:FOR) (“Forestar”) for $558.3 million in cash, pursuant to the terms of the June 2017 merger agreement (“the acquisition”). Forestar is and will continue to be a publicly-traded residential and real estate development company, which currently operates in 16 markets and 11 states.

D.R. Horton’s alignment with Forestar advances the Company’s strategy of increasing its access to high-quality optioned land and lot positions to enhance operational efficiency and returns. Both companies are identifying land development opportunities to expand Forestar’s platform, and D.R. Horton plans to acquire a large portion of Forestar’s finished lots in accordance with the master supply agreement between the two companies.

D.R. Horton issued the following fiscal 2018 guidance:

- Consolidated pre-tax profit margin of 11.8% to 12.0% compared to prior guidance of 11.5% to 11.7%

- Home sales gross margin in the range of 20% to 21%, with potential quarterly fluctuations that may be outside of this range

- Financial services operating margin of approximately 30%

- As previously announced on January 9, 2018, an income tax rate of approximately 26%, excluding the first quarter charge to reduce net deferred tax assets by $108.7 million

- Cash flow from operations of at least $700 million excluding Forestar, an increase of $200 million from initial guidance primarily due to recent tax legislation

- Consolidated revenues between $15.5 billion and $16.3 billion

- Homes closed between 50,500 and 52,500 homes

- Home building SG&A expense of around 8.7% of home building revenues

- Outstanding share count increase of less than 1%