KB Home, Los Angeles (NYSE:KBH) late Tuesday reported net income of $31.8 million, or $0.33 per diluted share, for its second quarter ended May 31, 2017. The gain was up 94% from the prior year quarter. Analysts were expecting a gain of $0.26 per share.

Among the results:

- Total revenues grew 24% to $1.00 billion.

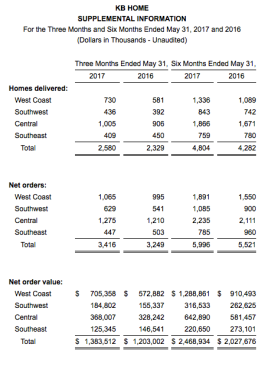

- Deliveries rose 11% to 2,580 homes, with double-digit increases in three of the company’s four regions.

- Average selling price increased 11% to $385,900.

- Net order value grew 15% to $1.38 billion on a 5% increase in net orders to 3,416, primarily reflecting strength in the West Coast and Southwest regions.

- In the West Coast region, net order value increased 23%; in the Southwest region, net order value advanced 19%.

- Company-wide, net orders per community averaged 4.8 per month, up 7%.

- Ending backlog value grew 19% to $2.18 billion, with homes in backlog up 8% to 5,612 and the average selling price of those homes rising 11%.

- The cancellation rate as a percentage of beginning backlog for the quarter improved to 19% from 21%, and as a percentage of gross orders remained steady at 21%.

- Average community count for the quarter decreased 2% to 238, reflecting a decrease in the Company’s Southeast region that was largely offset by increases in its other three regions. Ending community count was down 2% to 236.

- Home building operating income rose 91% to $49.6 million. This included inventory-related charges of $6.0 million, compared to $11.7 million in the prior year.

- Home building operating income margin increased 180 basis points to 5.0%. Excluding inventory-related charges, home building operating income margin improved 90 basis points to 5.6%.

- Housing gross profits increased 23% to $153.3 million, and the related housing gross profit margin was 15.4%.

- Housing gross profit margin excluding inventory-related charges was 16.0%, representing a year-over-year decrease of 30 basis points.

- Adjusted housing gross profit margin, a metric that excludes the amortization of previously capitalized interest and inventory-related charges, increased 30 basis points to 21.0%.

- Selling, general and administrative expenses improved 120 basis points to 10.4% of housing revenues from 11.6%, marking a second quarter record for the Company.

- Land sales generated profits of $.2 million, compared to losses of $5.4 million that mainly resulted from land sale impairments associated with the wind down of the Company’s Metro Washington, D.C. operations in 2016.

- All interest incurred was capitalized, which resulted in no interest expense, compared to $2.0 million of interest expense.

- Financial services pretax income rose to $2.8 million, up from $1.5 million, mainly due to income from the Company’s recently formed mortgage banking joint venture with Stearns Lending, LLC, which was operational in all of the Company’s served markets outside of California as of May 31, 2017. The joint venture, KBHS Home Loans, LLC, became operational in California earlier this month.

“The housing market recovery continues on a steady path, supported by favorable industry fundamentals,” said Jeffrey Mezger, chairman, president and chief executive officer. “Recent improvements in consumer sentiment and employment, combined with relatively low mortgage interest rates, are signaling further strength in the demand for housing. At the same time, the supply of available homes in many areas across the country remains insufficient to satisfy current needs. Given these dynamics in most of our served markets, and our present backlog level, we believe we are well positioned for continued growth with our strong product offerings, compelling customer value proposition and desirable community locations.”