Lennar Corporation, Miami (NYSE: LEN and LEN.B) early Tuesday reported net income of $249.2 million, or $1.06 per diluted share, for its third fiscal quarter ended August 31, 2017. The gain compared to third quarter net earnings of $235.8 million, or $1.01 per diluted share for the prior year quarter. The gain beat analyst estimates by five cents a share.

Among the results for the quarter compared to the same quarter last year:

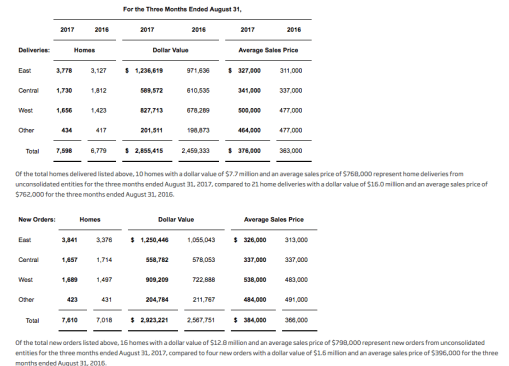

- Deliveries of 7,598 homes – up 12%

- New orders of 7,610 homes – up 8%; new orders dollar value of $2.9 billion – up 14%

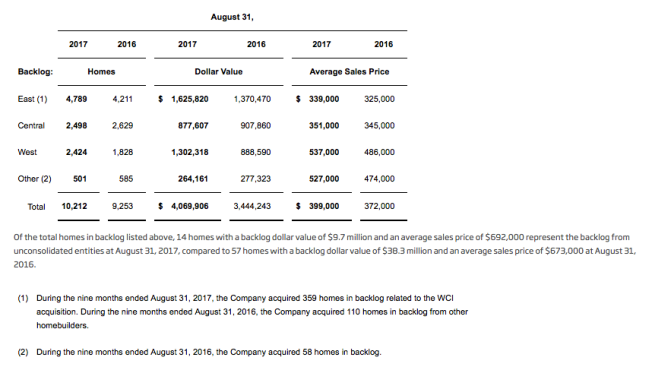

- Backlog of 10,212 homes – up 10%; backlog dollar value of $4.1 billion – up 18%

- Revenues of $3.3 billion – up 15%

- Lennar home building operating earnings of $386.3 million, compared to $344.9 million – up 12%

- Gross margin on home sales of 22.8% – improved 20 basis points

- S,G&A expenses as a % of revenues from home sales of 9.2% – improved 10 basis points

- Operating margin on home sales of 13.6% – improved 40 basis points

- Lennar Financial Services operating earnings of $49.1 million, compared to $53.2 million

- Rialto operating earnings (net of noncontrolling interests) of $3.2 million, compared to $5.9 million

- Lennar Multifamily operating earnings of $9.1 million, compared to $2.6 million

- Lennar home building cash and cash equivalents of $565 million

- Lennar redeemed the $250 million principal amount of 6.875% senior notes due 2021 that had been issued by WCI Communities, Inc.

- Lennar home building debt-to-total-capital, net of cash and cash equivalents, of 39.6%

Stuart Miller, Lennar CEO, said, “Our core home building business continued to produce strong operating results in the third quarter as our home deliveries and new orders increased 12% and 8%, respectively, compared to last year, while our gross and operating margins were 22.8% and 13.6%, respectively. Our sales incentives per home delivery in the third quarter were 5.5%, our lowest percentage since 2006. We continued to invest in new technologies throughout various aspects of our business, which helped contribute to a record low third quarter S,G&A % of home sales revenues of 9.2%.”

Miller reiterated the guidance of mid September that damage from Hurricanes Harvey and Irma was “minimal” but would likely push 950 closings from 2017 into 2018. “We expect that once we get past the short-term impact from the storms, there will be increased economic activity and an increased demand for new homes which will result in a broader range of opportunities for us as we look towards 2018,” said Miller.