Lennar Corporation (NYSE: LEN and LEN.B), Maimi, on Wednesday reported earnings of $136.2 million, or $0.53 per diluted share, for the fiscal first quarter ended Feb. 28. Wall Street was anticipating a gain of $0.76. The gain compared to first quarter earnings in 2017 of $38.1 million, or $0.16 per diluted share.

The results included $104.2 million ($0.31 per diluted share) in pretax acquisition and integration costs related to the acquisition of CalAtlantic Group, Inc. (“CalAtlantic”) and a $68.6 million ($0.27 per diluted share) one-time non-cash write down of deferred tax assets due to the reduction in the federal corporate income tax rate. Lennar completed its strategic acquisition of CalAtlantic on February 12, 2018.

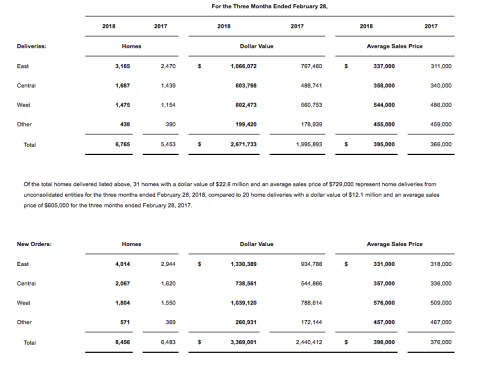

Revenues from home sales increased 34% in the first quarter of 2018 to $2.6 billion from $2.0 billion in the first quarter of 2017. Revenues were higher primarily due to a 24% increase in the number of home deliveries, excluding unconsolidated entities, and an 8% increase in the average sales price of homes delivered. New home deliveries, excluding unconsolidated entities, increased to 6,734 homes in the first quarter of 2018 from 5,433 homes in the first quarter of 2017.

There was an increase in home deliveries in all of the Company’s Homebuilding segments and Homebuilding Other as a result of the CalAtlantic acquisition. The average sales price of homes delivered was $393,000 in the first quarter of 2018, compared to $365,000 in the first quarter of 2017. Sales incentives offered to home buyers were $22,300 per home delivered in the first quarter of 2018, or 5.4% as a percentage of home sales revenue, compared to $22,700 per home delivered in the first quarter of 2017, or 5.9% as a percentage of home sales revenue, and $23,500 per home delivered in the fourth quarter of 2017, or 5.7% as a percentage of home sales revenue.

New orders rose 30% to 8,456 homes with a dollar value of $3.4 billion, up 38%, including 1,069 homes with a dollar value of $507.9 million from acquired CalAtlantic communities.

Backlog at quarter’s end was 17,566 homes – up 95%; backlog dollar value was $7.7 billion – up 118% including 7,190 homes with a dollar value of $3.6 billion from acquired CalAtlantic communities.

Gross margins on home sales were $516.6 million, or 19.5%, in the first quarter of 2018. Excluding the backlog write-up of $55.0 million related to purchase accounting adjustments on CalAtlantic homes in backlog and homes completed that were delivered in the first quarter of 2018, gross margins on home sales were $571.7 million or 21.6%. This compared to gross margins on home sales of $419.2 million, or 21.1%, in the first quarter of 2017. Gross margin percentage on home sales increased compared to the first quarter of 2017 primarily due to an increase in the average sales price of homes delivered and increased volume. Losses on land sales were $1.4 million in the three months ended February 28, 2018, compared to gross profits of $2.0 million in the three months ended February 28, 2017.

Selling, general and administrative expenses were $257.1 million in the first quarter of 2018, compared to $204.0 million in the first quarter of 2017. As a percentage of revenues from home sales, selling, general and administrative expenses improved to 9.7% in the first quarter of 2018, from 10.3% in the first quarter of 2017, due to improved operating leverage as a result of an increase in home deliveries.

Operating earnings for the Lennar Financial Services segment were $19.7 million in the first quarter of 2018, compared to $20.7 million in the first quarter of 2017. Operating earnings were impacted by a decrease in refinance transactions.

Operating earnings for the Rialto segment were $10.4 million in the first quarter of 2018 (which included $9.2 million of operating earnings and an add back of $1.2 million of net loss attributable to noncontrolling interests). Operating earnings in the first quarter of 2017 were $12.0 million (which included a $0.8 million operating loss and an add back of $12.9 million of net loss attributable to noncontrolling interests). The decrease in operating earnings was primarily due to a decrease in Rialto Mortgage Finance (“RMF”) securitization revenues as a result of lower volume and a decrease in incentive income related to carried interest distributions from the Rialto real estate funds. These decreases to operating earnings were partially offset by a decrease in real estate owned impairments and lower general and administrative expenses.

Operating losses for the Lennar Multifamily segment were $1.2 million in the first quarter of 2018, primarily due to general and administrative expenses partially offset by the segment’s $4.1 million share of gains as a result of the sale of one operating property by one of Lennar Multifamily’s unconsolidated entities and management fee income. In the first quarter of 2017, the Lennar Multifamily segment had operating earnings of $19.2 million primarily due to the segment’s $26.0 million share of gains as a result of the sale of two operating properties by Lennar Multifamily’s unconsolidated entities.

Corporate general and administrative expenses were $67.8 million, or 2.3% as a percentage of total revenues, in the first quarter of 2018, compared to $60.7 million, or 2.6% as a percentage of total revenues, in the first quarter of 2017. The decrease in corporate general and administrative expenses as a percentage of total revenues is due to improved operating leverage as a result of an increase in home deliveries.

Net earnings (loss) attributable to noncontrolling interests were $0.6 million and ($8.4) million in the first quarter of 2018 and 2017, respectively. Net loss attributable to noncontrolling interests in the first quarter of 2017 was primarily attributable to a net loss related to the FDIC’s interest in the portfolio of real estate loans that the company acquired in partnership with the FDIC, partially offset by net earnings related to the Lennar Homebuilding consolidated joint ventures.

On February 12, 2018, the company completed the acquisition of CalAtlantic through a transaction in which CalAtlantic was merged with and into a wholly-owned subsidiary of the Company (“Merger Sub”), with Merger Sub continuing as the surviving corporation and a subsidiary of the Company (the “Merger”). The Merger took place pursuant to the Agreement and Plan of Merger dated as of October 29, 2017, among CalAtlantic, the Company and Merger Sub. CalAtlantic is a home builder which builds homes across the home building spectrum, from entry level to luxury, in 43 metropolitan statistical areas spanning 19 states. CalAtlantic provides mortgage, title and escrow services. For the three months ended February 28, 2018, our results of operations included 819 home deliveries at an average sales price of $456,000, and net new orders of 1,069 homes at an average sales price of $475,000 from acquired CalAtlantic communities. During the three months ended February 28, 2018, the Company recorded $104.2 million of acquisition and integration costs related to the Merger.

In March 2018, the Lennar Multifamily segment completed the closing of a second Lennar Multifamily Venture II LP (“Venture II”) for the development, construction and property management of class-A multifamily assets. With the first close, Venture II will have approximately $500 million of equity commitments, including a $255 millionco-investment commitment by us comprised of cash, undeveloped land and preacquisition costs. It will be seeded with 6 undeveloped multifamily assets that were previously purchased or under contract by the Lennar Multifamily segment totaling approximately 2,200 apartments with projected project costs of approximately$900 million.

In February 2018, the company exchanged in part eight notes issued by CalAtlantic into new notes issued by the company maturing between 2018 and 2027 with a total principal amount of $2.8 billion.

In March 2018, holders of $6.7 million principal amount of CalAtlantic’s 1.625% convertible senior notes due 2018 and $266.2 million principal amount of CalAtlantic’s 0.25% convertible senior notes due 2019 either caused the Company to purchase them for cash or converted them into a combination of the Company’s Class A and Class B common stock and cash, resulting in the Company’s issuing approximately 3,654,000 shares of Class A common stock and 72,000 shares of Class B common stock, and paying $51.2 million in cash to former noteholders.

In February 2018, the company amended the credit agreement governing its unsecured revolving credit facility (the “Credit Facility”) to increase the maximum borrowings from $2.0 billion to $2.6 billion and extend the maturity on $2.1 billion of the Credit Facility from June 2022 to April 2023. The $2.6 billion includes an accordion feature, subject to additional commitments. As of February 28, 2018, there was $500 million of outstanding borrowings under the Credit Facility.

In December 2017, the Tax Cuts and Jobs Act was enacted which will have a positive impact on our effective tax rate in 2018 and subsequent years. The tax reform bill reduced our expected effective tax rate in 2018 from 34% to 24%, which is lower than the company’s previous guidance of 25% primarily due to tax legislation enacted during the quarter extending the energy efficent home credit retroactively for homes closed during 2017. However, as a result of the reduction in our effective tax rate, during the three months ended February 28, 2018, we were required to record a one-time non-cash write down of our deferred tax assets of $68.6 million. Due to this, for the three months ended February 28, 2018, the company’s effective tax rate was 49.3%, instead of 23.8%. This compared to 34.4% for the three months ended February 28, 2017.

Stuart Miller, Lennar CEO, said, “As we report our first combined quarterly results with the CalAtlantic strategic acquisition now completed, we remain enthusiastic about both our current results as well as our future projections under the Lennar platform. In the first quarter of 2018, pro forma new orders and deliveries were 10,910 and 9,994, respectively, which exceeded the expectations for both companies. The integration is progressing exactly on target.”

Miller continued, “Our first quarter results begin to display the true power of this combination. Although these results do not include 2 ½ months of CalAtlantic’s operations, all company metrics have performed as expected or better and we have grown more confident in our ability to exceed our $100 million synergy target in 2018 and we are on track to meet our $365 million synergy target in 2019.”

“We continue to remain positive on the outlook of the housing industry in general. Although interest rates have ticked up, unemployment remains low, the labor participation rate has been increasing, and wages have been moving modestly higher, though we think, even higher than the data the government captures. Feedback from our new home consultants indicates that our customer base feels confident in both job security and compensation levels in spite of the political noise that abounds.”

“Against a backdrop of higher demand, the production shortage over the past years has in fact resulted in supply shortages that are the underpinnings of at least stability and probably continued expansion of this housing recovery.”