Lennar Corporation (NYSE: LEN and LEN.B) on Thursday morning reported net earnings of $398.5 million, or $1.27 per diluted share, for its first quarter ended February 29, 2020. The gain compares to first quarter net earnings attributable to Lennar in 2019 of $239.9 million, or $0.74 per diluted share. Analysts were expecting a gain of $0.85 per share.

Stuart Miller, executive chairman of Lennar, said, “Although today we are announcing our first quarter 2020 results, the events that have occurred since quarter-end currently command our focus and attention. With a near shutdown of large portions of our national economy, we are all stretching our minds to understand the parameters of the rapidly evolving landscape, while we contemplate what the future holds. Accordingly, our first quarter conference call this morning will be focused on Lennar’s oversight and management through the current crisis, and the steady-handed approach that we have applied.”

Miller continued, “First and foremost, our senior management team is evaluating every aspect of our company to determine how we protect the safety, health and hygiene of each and every one of our associates, customers and building partners, while we maintain our business. In that regard, we have engaged a distinguished medical professional, Dr. Pascal Goldschmidt, as our chief medical officer, who is assisting us in looking into every step of every business process to ensure we fully understand its impact on the health of every individual involved.

“Next, with safety, health and hygiene first, we are focused on the day to day operation of maintaining the parts of our business that are sustainable, while the national economy is struggling with a deepening pause, in order to ‘flatten the COVID-19 curve.’ Like food from the grocer is essential, our customers need a safe and secure place called ‘home,’ while the country moves from today’s landscape of uncertainty to knowing that ‘this too, shall pass.’ Balancing people, safety and pause, with production and closings is difficult, and has the undivided focus of our entire seasoned and experienced management team.

“Third, we are managing every element of our balance sheet, cash management and cash flow. We are managing the inflow, and especially the outflow, of cash to maintain a strong foundation. Lennar’s liquidity and strong balance sheet remain a stabilizing factor in enabling our company to help absorb the shock that is moving through the economy at this time. We are well positioned for stability today, as well as for opportunity when markets settle.

Miller concluded, “As you can see in the schedules in our earnings release, our first quarter results achieved and exceeded all expected metrics and we had been on track to expand on our guidance for the year. We have been focused on reducing land spend and land holdings to grow cash flow and fortify our balance sheet. That strategy was well-timed and has positioned us well. In the context of today’s widespread shutdowns, we are choosing to suspend guidance as the world resets and finds its way forward. In the meantime, the laser focus of our experienced, hands-on management team will navigate, make necessary adjustments and guide Lennar through current market conditions.”

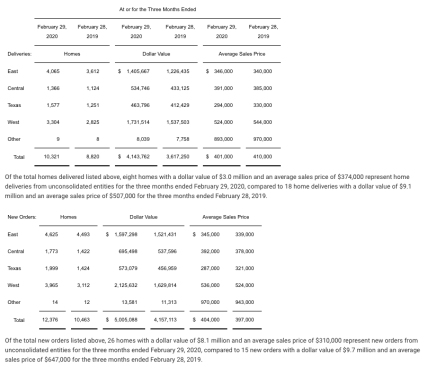

Revenues from home sales increased 15% in the first quarter of 2020 to $4.1 billion from $3.6 billion in the first quarter of 2019. Revenues were higher primarily due to a 17% increase in the number of home deliveries, excluding unconsolidated entities, partially offset by a 2% decrease in the average sales price of homes delivered. New home deliveries, excluding unconsolidated entities, increased to 10,313 homes in the first quarter of 2020 from 8,802 homes in the first quarter of 2019, as a result of an increase in home deliveries in all home building segments. The average sales price of homes delivered was $402,000 in the first quarter of 2020, compared to $410,000 in the first quarter of 2019. The decrease in average sales price primarily resulted from continuing to shift to lower-priced communities.

Gross margin on home sales was $849.0 million, or 20.5%, in the first quarter of 2020, compared to $726.1 million, or 20.1% in the first quarter of 2019. The gross margin percentage on home sales increased primarily due to reduced construction costs.

Selling, general and administrative expenses were $378.9 million in the first quarter of 2020, compared to $343.3 million in the first quarter of 2019. As a percentage of revenues from home sales, selling, general and administrative expenses improved to 9.2% in the first quarter of 2020, from 9.5% in the first quarter of 2019, due to improved operating leverage primarily as a result of an increase in home deliveries.

Operating earnings for the Financial Services segment were $58.2 million in the first quarter of 2020 (which included $47.3 million of operating earnings and an add back of $10.9 million of net loss attributable to non-controlling interests) compared to $21.8 million in the first quarter of 2019 (which included $19.0 million of operating earnings and an add back of $2.8 million of net loss attributable to non-controlling interests). Operating earnings increased due to an improvement in the mortgage business as a result of an increase in volume and margin, as well as reductions in loan origination costs driven in part by technology initiatives. Additionally, operating earnings of the Company’s title business increased primarily due to an increase in volume.

Operating earnings for the Multifamily segment were $1.8 million in the first quarter of 2020 (which included $0.1 million of net earnings attributable to non-controlling interests), compared to $6.8 million in the first quarter of 2019. Operating earnings for the Lennar Other segment were $0.9 million in the first quarter of 2020, compared to $3.1 million in the first quarter of 2019 (which included $0.1 million of net earnings attributable to non-controlling interests).

For the three months ended February 29, 2020 and February 28, 2019, we had a tax provision of $32.3 million and $79.7 million, respectively. The Company’s overall effective income tax rate was 7.5% for the three months ended February 29, 2020 and 24.9% for the three months ended February 28, 2019. The reduction in the overall effective income tax rate is primarily due to the extension of the new energy efficient home tax credit during the first quarter of 2020.

During the first quarter of 2020, the company repurchased a total 4.4 million shares of its common stock, including 4.3 million Class A shares and 0.1 million Class B shares, for $288.4 million at an average per share price of $66.42 per Class A share and $53.52 per Class B share.

At February 29, 2020, the company had $785.0 million of home building cash & cash equivalents. Also at February 29, 2020, the company had $300.0 million of outstanding borrowings under its revolving credit facility, thereby providing $2.1 billion of available capacity.