Lennar Corporation (NYSE: LEN and LEN.B) on Wednesday morning reported net earnings of $674.3 million, or $2.13 per diluted share, for its fourth quarter ended November 30, 2019. Wall Street was expecting earnings of $1.90 per share. The gain compared to $796.1 million, or $2.42 per diluted share in the fourth quarter of 2018, which included $187.5 million or $0.58 per diluted share related to gain on sale of Rialto investment and asset management platform, partially offset by non-recurring expenses.

Net earnings attributable to Lennar for the year ended November 30, 2019 were $1.8 billion, or $5.74 per diluted share, compared to $1.7 billion, or $5.44 per diluted share for the year ended November 30, 2018.

Among the results:

- Net earnings of $674.3 million, or $2.13 per diluted share, compared to $796.1 million, or $2.42 per diluted share (Q4 2018 included $0.58 per diluted share related to gain on sale of Rialto investment and asset management platform, partially offset by non-recurring expenses)

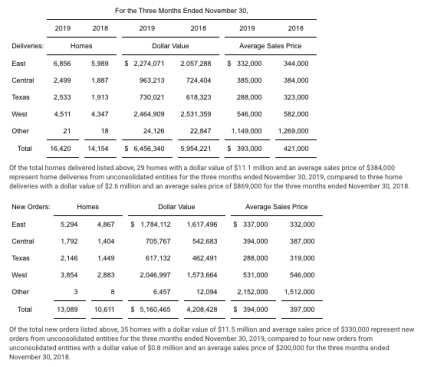

- Deliveries of 16,420 homes – up 16%

- New orders of 13,089 homes – up 23%; new orders dollar value of $5.2 billion – up 23%

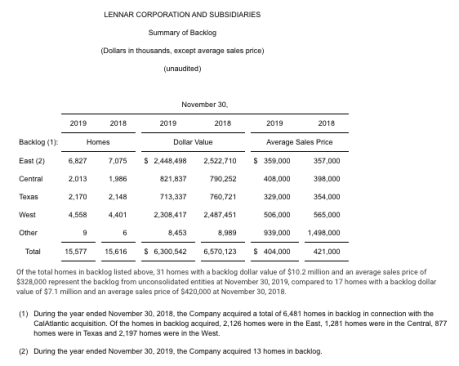

- Backlog of 15,577 homes – compared to 15,616 homes; backlog dollar value of $6.3 billion – down 4%

- Revenues of $7.0 billion – up 8%

- Home building operating earnings of $892.5 million, compared to $806.7 million

- Gross margin on home sales of 21.5%, compared to 21.4%

- S,G&A expenses as a % of revenues from home sales improved to 7.6%, compared to 7.9%

- Operating margin on home sales of 13.9%, compared to 13.5%

- Financial Services operating earnings (net of noncontrolling interests) of $81.2 million, compared to $57.6 million

- Multifamily operating earnings (net of noncontrolling interests) of $4.8 million, compared to $33.0 million

- Lennar Other operating earnings (net of noncontrolling interests) of $10.8 million, compared to loss of $48.5 million

- Home building cash and cash equivalents of $1.2 billion

- Home building debt to total capital of 32.8%

- Retired $600 million of home building senior notes

- Repurchased 1.7 million shares for $98.2 million

Stuart Miller, executive chairman of Lennar, said, “Our fourth quarter showcased our company hitting on all cylinders as our operations continued to improve cash flows and returns. We made significant progress towards becoming a land lighter company by reducing our years owned supply of home sites to 4.1 years at year-end from 4.4 years at the end of the third quarter and increasing our controlled home sites as a percentage of our total homesites to 33% from 30% during the fourth quarter.

Miller continued, “New orders and deliveries for the quarter exceeded expectations by increasing 23% and 16%, respectively, over 2018, which contributed to a fourth quarter, bottom-line performance of $674.3 million, or $2.13 per diluted share, compared to $608.6 million, or $1.84 per diluted share year in the prior year (excluding the one-time gain from the sale of Rialto and non-recurring expenses). During fiscal 2019, we generated strong home building cash flow of $1.6 billion as we retired $1.1 billion of senior notes and repurchased 9.8 million of our shares for $492.9 million.

Rick Beckwitt, CEO, said, “During the fourth quarter, the basic underlying housing market fundamentals of low unemployment, higher wages and low inventory levels remained favorable. Against this backdrop, our home-building gross margin in the fourth quarter was 21.5%, while our focus on making our home-building platform more efficient resulted in an SG&A percentage of 7.6%, an all-time, fourth quarter low. In addition, our financial services business performed extremely well with fourth quarter earnings of $81.2 million, an all-time, quarterly high.”