LGI Homes, Inc., The Woodlands, Texas (Nasdaq:LGIH) on Tuesday reported net income of $27.3 million, or $1.10 per diluted share, for the first quarter ended March 31, up 131.8% from a year earlier. stoday announced results for the three months ended March 31, 2018. Analysts were looking for a gain of $0.78 per share.

The company attributed the earnings jump to a 63.5% increase in homes closed, a 4.8% increase in average home sales price, a 58.2% decrease in the effective tax rate and a decrease in operating leverage realized related to selling, general, and administrative expenses. For the three months ended March 31, 2018, the company’s effective tax rate of 12.6% was lower than the statutory rate primarily as a result of the deductions in excess of compensation cost for share-based payments.

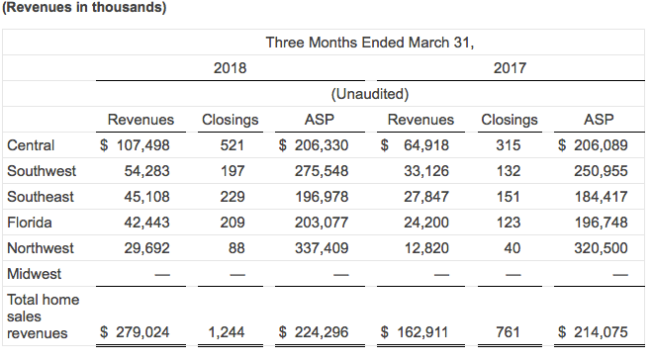

Home closings during the first quarter of 2018 increased 63.5% to 1,244 from 761 during the first quarter of 2017. Active selling communities increased to 79 at the end of the first quarter of 2018, up from 69 communities at the end of the first quarter of 2017.

Home sales revenues for the first quarter of 2018 were $279.0 million, an increase of $116.1 million, or 71.3% over the first quarter of 2017. The increase in home sales revenues is due to both the increase in the number of homes closed and an increase in the average home sales price.

The average home sales price was $224,296 for the first quarter of 2018, an increase of 4.8% over the first quarter of 2017. This increase is largely attributable to changes in product mix, price points in certain new markets, and a favorable pricing environment.

Gross margin as a percentage of home sales revenues for the first quarter of 2018 was 24.8% as compared to 26.7% for the first quarter of 2017. Adjusted gross margin (non-GAAP) as a percentage of home sales revenues for the first quarter of 2018 was 26.4% as compared to 28.0% for the first quarter of 2017. This decrease is primarily due to a combination of higher construction and lot costs partially offset by higher average home sales prices. Please see “Non-GAAP Measures” for a reconciliation of adjusted gross margin (non-GAAP) to gross margin, the most comparable GAAP measure.

The company reported 45,321 total owned and controlled lots at March 31.

“This 63.5% increase in closings, over the first quarter of last year, was a result of robust sales and a heightened focus on inventory management,” said Eric Lipar, chairman and CEO. “In addition, gross margin increased 40 basis points quarter-over-quarter and our average sales price for the quarter reached an all-time high at $224,296.”

“Starting the second quarter with great momentum, we maintain our positive outlook on the remainder of 2018 and reaffirm our guidance. For the year, we expect to close between 6,000 and 7,000 homes, believe average sales price will be between $220,000 and $230,000, and believe basic EPS will be in the range of $6.00 to $7.00 per share,” Lipar concluded.