LGI Homes, Inc., The Woodlands, Tex. (Nasdaq:LGIH) on Tuesday reported a profit of $33.7 million, $1.40 per diluted share for the third quarter ended Sept. 30, a 73% increase from the prior-year quarter. Analysts were expecting a gain of $1.33.

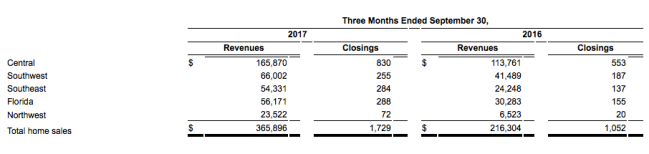

Home sales revenues increased 69.2% to $365.9 million as home closings increased 64.4% to 1,729 homes and the average sales price increased 2.9% to $211,623. Gross margin as a percentage of home sales revenues was 25.1% as compared to 26.3% in the comparable quarter last year.

The company does not report new-home orders.

Ending backlog increased 70.9% to 1,328 units. Active Selling Communities at September 30, 2017 increased to 77 from 59. The company held 37,063 owned and controlled lots at the end of the quarter.

“This has been a phenomenal year to date and our results have been outstanding,” said Eric Lipar, the Company’s CEO and chairman. “With a record-setting 1,729 home closings during the third quarter, we continued our trend of strong results and profitability highlighted by above average absorption of 7.6 closings per community per month. These results are a direct reflection of the dedication of our employees and our effective systems and processes that have enabled us to expand and replicate our success.”

Lipar concluded, “Based on our solid results during the first nine months of the year, we are well positioned to end the year very strong and are therefore raising our guidance. For the full year 2017, we now anticipate to close more than 5,400 homes and believe basic EPS will be in the range of $4.75 to $5.15 per basic share.”