William Lyon Homes, Newport Beach (NYSE: WLH) on Monday mornings reported net income of $19.0 million, up 30%, or $0.49 per diluted share, up 29%, for its second quarter ended June 30, 2017. The gain beat Wall Street expectations by a penny per share.

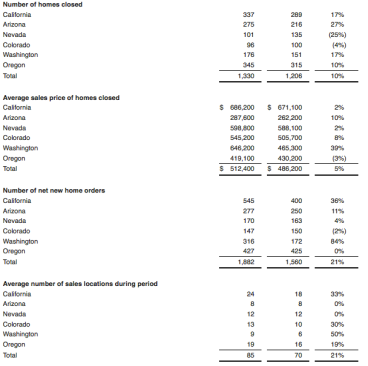

Home sales revenue for the quarter was $422.6 million, up 30% from the prior-year quarter, as new home deliveries of rose 25% to 831 homes.

Net new home orders were 1,017, up 17%, and dollar value of orders totaled $554.0 million, up 31%. Average sales locations were up 22% to 88, and the average sales price (ASP) of new homes delivered rose 4% to $508,600.

Dollar value of homes in backlog jumped 31% to $755.3 million as units in backlog were up 18% to 1,285.

Home building gross margin percentage in backlog was 18.3%; home building gross margin percentage was 16.5%; and home building gross margin was up 23% to $69.6 million with an adjusted home building gross margin percentage of 22.1%. SG&A percentage fell to 9.7% from 10.7%.

“We expect to see our gross margin improvement drive meaningful profitability growth in the balance of the year,” said Matthew R. Zaist, president and CEO. “We are pleased to see the sales momentum continue into the third quarter with July up 18% over the prior year and a monthly absorption rate of 3.0 sales per community compared to 2.8 in the prior year. The strong performance in the first half of 2017 positions us well to achieve our goals for the year and our revised expectations for the full year include new home deliveries of approximately 3,150 to 3,350, home building revenue of approximately $1.725 billion to $1.8 billion, and pre-tax income before non-controlling interest of approximately $140 million to $150 million.”

At quarter end, cash and cash equivalents totaled $32.6 million, real estate inventories totaled $1.9 billion, total assets were $2.1 billion and total equity was $813.9 million. Total debt to book capitalization was 57.9%, and net debt to total capital (net of cash) was 57.2% at June 30, 2017, compared to 61.6% and 60.8% at June 30, 2016, and 58.6% and 57.6% at December 31, 2016, respectively.