M.D.C. Holdings, Inc, Denver. (NYSE: MDC), parent of Richmond American Homes, on Tuesday morning reported net income up 26% to $33.9 million, or $0.64 per diluted share, for the quarter ended June 30, 2017, up 26% from $26.9 million or $0.52 per diluted share in the prior-year quarter. Anaylsts were expecting a gain of $0.61 per share.

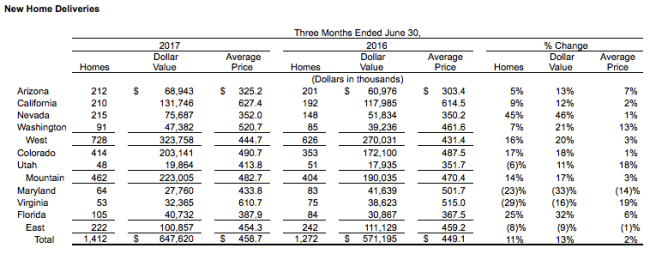

Home sale revenues for the 2017 second quarter increased 13% to $647.6 million, primarily driven by an 11% increase in deliveries to 1,412. The average selling price rose 2% to $458,700.

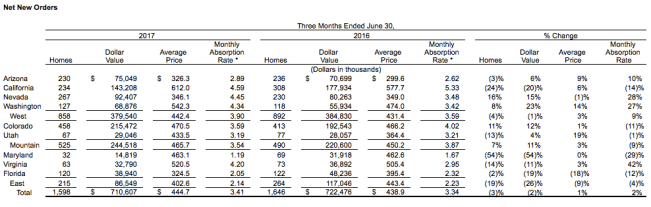

New orders fell 2% to 1,598, and the dollar value of new orders dropped 2% to $710.6 million. The average selling price of new orders fell 3% $444,700. A 4% decline in average active community count was partly offset by a 2% increase in our monthly sales absorption pace.

Backlog value at the end of the 2017 second quarter was up 4% year-over-year to $1.68 billion; backlog units rose 2% to 3,510 and the average selling price of homes in backlog was up 2% to $478,000. The increase in the number of units in backlog was driven by strong sales activity during the past twelve months. Price increases implemented in the past twelve months drove the increase in average selling price, but the price increases were slightly offset by the lower selling price of more affordable homes.

Gross margin from home sales percentage was 16.8%, a 40 basis point improvement from 16.4% in the prior year period. The 2016 second quarter included $1.6 million, or 30 basis points, of inventory impairments while our 2017 second quarter included no such inventory impairments.

Selling, general and administrative expenses for the 2017 second quarter were $70.7 million, up $6.3 million from $64.4 million for the same period in 2016 primarily due to increased compensation-related expenses driven by higher average headcount. The SG&A rate improved by 40 basis points to 10.9% for the 2017 second quarter from 11.3% in the 2016 second quarter. This decrease in our SG&A rate was primarily the result of an increased ability to leverage fixed overhead as a result of the increase in home sale revenues.

The dollar value of net new orders for the 2017 second quarter decreased 2% year-over-year to $710.6 million, as a 4% decline in our average active community count to 153 was partly offset by a 2% increase in the monthly sales absorption pace.

Income before taxes for the company’s financial services operations for the 2017 second quarter was $11.7 million, a $2.7 million increase from $9.1 million in the 2016 second quarter. This improvement was due to increased profitability in mortgage operations segment as a result of (1) year-over-year increases in the dollar value of loans locked, originated, and sold, and (2) higher gains on loans locked and originated.

“With our returns rising, we have focused increasingly on sourcing new communities to drive future growth for our core home building business,” said Larry A. Mizel, MDC’s chairman and CEO. “In the second quarter alone, we approved more than 3,300 lots for acquisition, far exceeding the activity for any other quarter in the past three years. Our acquisition activities have maintained a focus on affordability, given the success of our more affordable SeasonsTM product line, which is now selling in four states and accounted for just over 10% of total net new orders in the quarter. Overall, our outlook for the home building industry remains positive, supported by a solid macroeconomic environment and favorable dynamics in the balance between housing supply and demand.”