M.D.C. Holdings (NYSE:MDC), parent of Richmond American Homes, on Thursday reported net income of $92.6 million, or $1.42 per diluted share for its fourth quarter ended Dec. 31, up 69% from $54.7 million or $0.88 per diluted share in the prior year quarter. Analysts were expecting a gain of $1.27.

Among the results:

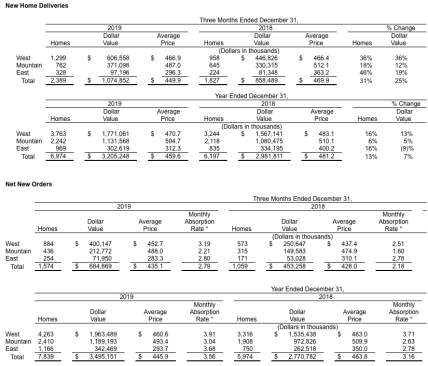

2019 Fourth Quarter Highlights and Comparisons to 2018 Fourth Quarter

• Home sale revenues up 25% to $1,074.9 million from $858.5 million

• Unit deliveries up 31% to 2,389

• Average selling price of deliveries down 4% to $450,000

• Effective tax rate of 17.5% vs. 21.0%

• Gross margin from home sales up 40 basis points to 18.5% from 18.1%

• Inventory impairments of $0.3 million vs. $10.0 million

• Selling, general and administrative expenses as a percentage of home sale revenues (“SG&A rate”) improved by 110 basis points to 9.8% from 10.9%

• Dollar value of net new orders up 51% to $684.9 million from $453.3 million

• Unit net orders increased 49% to 1,574

• Monthly sales absorption pace increased 28% to 2.8

• Average selling price of net orders up 2% to $435,000

2019 Full Year Highlights and Comparisons to 2018 Full Year

• Home sale revenues up 7% to $3.21 billion from $2.98 billion

• Unit deliveries up 13% to 6,974

• Net income of $238.3 million, or $3.72 per diluted share, up 13% from $210.8 million or $3.39 per diluted share

• Third highest net income in company history

• Gross margin from home sales of 18.8% vs. 18.3%

• Inventory impairments of $0.9 million vs. $21.9 million

• SG&A rate of 11.3% vs. 11.1%

• Dollar value of net new orders up 26% to $3.50 billion from $2.77 billion

• Unit net orders increased 31% to 7,839

• Monthly sales absorption pace increased 13% to 3.6

2020 Outlook – Selected Information

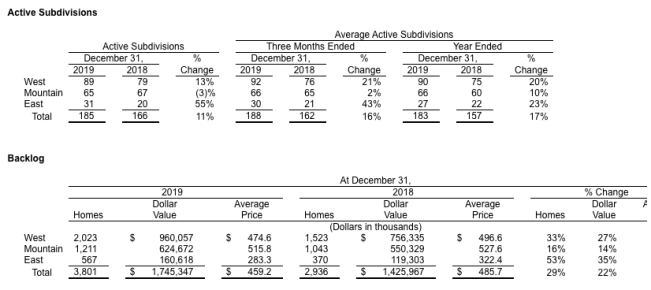

• Backlog dollar value at December 31, 2019 up 22% year-over-year to $1.75 billion

• Home deliveries for the 2020 first quarter between 1,550 and 1,650

• Average selling price for 2020 first quarter unit deliveries between $450,000 and $460,000

• Gross margin from home sales for the 2020 first quarter between 18.8% and 19.2% (excluding impairments and warranty adjustments)

• Active subdivision count at December 31, 2019 of 185, up 11% year-over-year

• Lots controlled of 27,386 at December 31, 2019, up 18% year-over-year

• Declared 10% increase in quarterly dividend to $0.33 ($1.32 annualized) in January 2020

Larry A. Mizel, MDC’s chairman and CEO, stated, “MDC finished the year on a strong note, generating fully diluted earnings per share of $1.42 in the fourth quarter, a 61% increase as compared to last year. We also achieved year-over-year improvements in our home building gross margin and SG&A leverage, resulting in home building operating margin expansion of 150 basis points. The sales environment continues to be favorable, as evidenced by the 49% growth in unit orders for the quarter. These demand trends have carried into the new year, giving our business strong momentum as we head into the spring selling season.”

Mizel continued, “For the full year 2019, we posted year-over-year improvements to both revenue and profitability, which resulted in fully diluted earnings per share of $3.72. This marks our fifth consecutive year of net income growth, and we are well positioned to continue that trend in 2020 thanks to a 29% increase in homes in backlog to start the year. We also ended the year in a strong financial position with a year-over-year decrease in our debt to capital ratio and a maturity schedule that was further enhanced earlier this month by the issuance of $300 million of 3.850% senior notes due 2030.”

Mizel concluded, “As we enter 2020, we will continue to focus on the more affordable segments of the market due to the ongoing lack of supply and broad-based demand we have witnessed. We believe this favorable supply-demand environment will remain in place for some time given the demographic shifts occurring in this country. These factors, coupled with our solid market positioning and growing backlog, provided us with the confidence to increase our cash dividend by 10% just a few days ago.”