M.D.C. Holdings, Denver (NYSE:MDC), parent of Richmond American Homes, on Tuesday reported net income of $36.8 million, or $0.56 per diluted share, for the first quarter ended March 31, down 9% from $40.6 million or $0.64 per diluted share in the prior-year quarter. Analysts were expecting a gain of $0.69 per share.

2020 First Quarter Highlights and Comparisons to 2019 First Quarter:

• Home building pretax income increased 21% to $49.7 million from $41.1 million

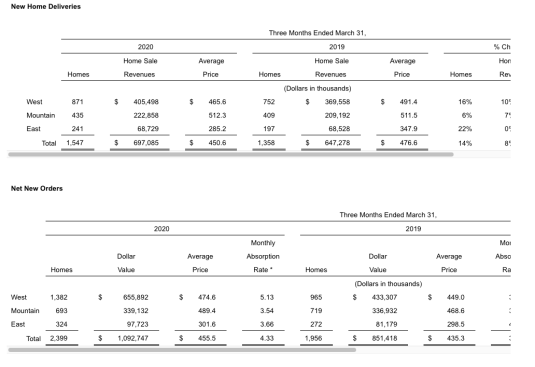

• Home sale revenues up 8% to $697.1 million from $647.3 million

• Gross margin from home sales increased 100 basis points to 19.9% from 18.9%

• Mortgage operations pretax income increased 65% to $8.2 million vs. $5.0 million

• Other financial services pretax loss of $9.4 million vs. pretax income of $9.6 million

• Unrealized losses on equity securities of $13.9 million vs. unrealized gains of $4.6 million

• Effective tax rate of 24.3% vs. 27.1%

• Dollar value of net new orders up 28% to $1.09 billion from $851.4 million

• Unit net orders increased 23% to 2,399

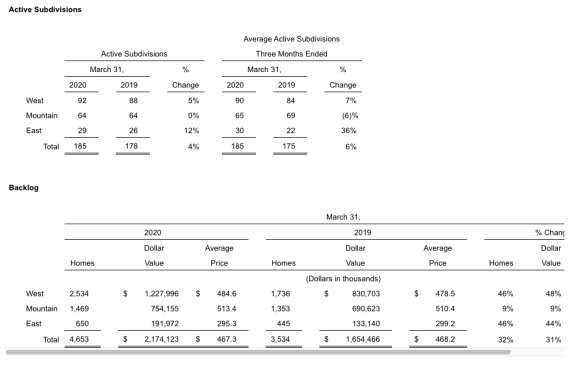

• Dollar value of ending backlog up 31% to $2.17 billion from $1.65 billion

• Unit backlog increased 32% to 4,653

• Total liquidity of $1.41 billion

• Total cash and investments of $452.8 million $959.3 million of availability under home building line of credit ($1.0 billion facility size; maturity of December 2023)

• No senior note maturities until 2024

• Quarterly cash dividend of thirty-three cents ($0.33) per share declared on April 1, 2020, up 10% from prior year

2020 April Highlights and Comparison to 2019 April (preliminary and unaudited):

• Net new home orders decreased 53% to 357 vs. 753

• Gross new home orders decreased 27% to 662 vs. 906

• Cancellations as a percentage of homes in beginning backlog of 6.6% vs. 4.3%

• New home deliveries increased 11% to 523 vs. 470

• Ending backlog units up 18% to 4,487 from 3,817

Larry A. Mizel, M.D.C.’s chairman and CEO, stated, “As our results from the first quarter demonstrate, 2020 was off to an excellent start thanks to a robust job market, elevated consumer confidence and low levels of new and existing home inventory. This positive fundamental backdrop, coupled with our continued shift to more affordable product offerings, resulted in a 21% increase in our home building pretax income for the quarter, as well as solid order and backlog growth. While demand trends deteriorated significantly at the end of March and into April, we believe the long-term outlook for our industry remains positive due to the ongoing demographic shifts taking place in our country and the lack of available housing supply.”

Mizel concluded, “Although the ultimate impact of COVID-19 on the economy is still unclear, MDC is well-positioned to weather the current economic crisis thanks to our seasoned leadership team, our strong balance sheet and our conservative operating model. With high liquidity, low leverage and limited speculative inventory, our company is built to succeed through the entirety of the home-building cycle.”