M/I Homes, Columbus (NYSE:MHO) on Thursday reported net income of $15.9 million, or $0.53 per diluted share, for the fourth quarter ended Dec. 31. This compares to net income of $20.6 million, or $0.67 per diluted share, in 2016.

For the year ended December 31, 2017, the company reported net income of $72.1 million, or $2.26 per diluted share, compared to net income of $56.6 million or $1.84 per diluted share in 2016. 2017’s net income includes the impact of a deferred tax asset re- measurement ($6.5 million), after-tax stucco-related repair costs ($5.4 million) and after-tax impairment charges ($4.9 million). Exclusive of these charges and after-tax stucco-related repair and impairment charges in 2016, net income increased 25% to $89.0 million compared to $71.1 million in 2016.

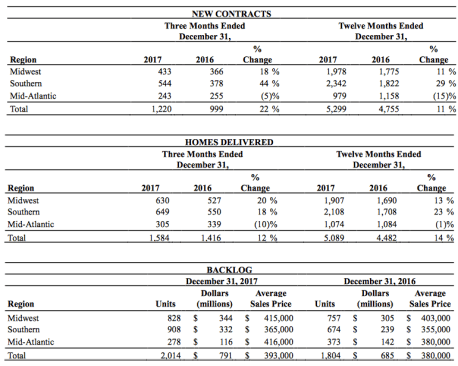

New contracts for 2017’s fourth quarter reached a fourth quarter record-high of 1,220, increasing 22% from 2016’s fourth quarter of 999. For 2017, new contracts also reached a record-high of 5,299, an 11% increase over 2016’s new contracts of 4,755. M/I Homes had 188 active communities at December 31, 2017 compared to 178 a year ago. The company’s cancellation rate was 13% in 2017’s fourth quarter.

Homes delivered of 1,584 in 2017’s fourth quarter were 12% higher than 2016’s 1,416 homes delivered. Homes delivered for the twelve months ended December 31, 2017 increased 14% to a record-high 5,089 from 2016’s deliveries of 4,482.

Homes in backlog increased 12% at December 31, 2017 to 2,014 units, with a sales value of $791 million (a 15% increase over last year), and the average sales price in backlog increased 3% to a record-high of $393,000. At December 31, 2016, the sales value of the 1,804 homes in backlog was $685 million, with an average sales price of $380,000.

Robert H. Schottenstein, CEO and president, commented, “We had strong 2017 results highlighted by all-time company records for revenue, new contracts, and homes delivered. These records led us to a 25% increase in our 2017 net income, excluding the non-operating items. For the first time in our history, we exceeded 5,000 units in both homes delivered and new contracts while reaching nearly $2 billion in revenue. Importantly, our revenue and earnings growth resulted from strong performances in many of our home building divisions, combined with another record performance by our financial services business. We also reached our highest year-end backlog level in more than 10 years, with a sales value of $791 million – a 15% increase over 2016.”

Schottenstein continued, “We are excited about our business as we move into 2018. We ended the year with $152 million of cash, no outstanding borrowings under our $475 million unsecured credit facility, shareholders’ equity of $747 million and home building debt to capital ratio of 46%. We are well positioned for continued growth in 2018 with our strong year-end backlog and a significant number of planned new community openings.”