M/I Homes, Inc. (NYSE:MHO) on Wednesday reported record fourth quarter net income of $41.8 million, or $1.44 per diluted share, for the fourth quarter ended Dec. 31. This compares to net income of $32.4 million, or $1.15 per diluted share, for the fourth quarter of 2018. Analysts were looking for a gain of $1.69.

2019 Fourth-Quarter Results:

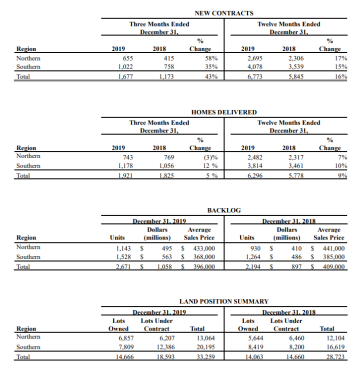

• New contracts increased 43% to a fourth quarter record of 1,677 contracts

• Backlog sales value increased 18% to a fourth quarter record $1.1 billion, and backlog units increased 22%

• Revenue increased 3% to a fourth quarter record of $742 million

• Homes delivered increased 5% to an all-time quarterly record 1,921 homes

• Pre-tax income increased 16% to $51.3 million from $44.4 million in 2018

• Net income increased 29% to a fourth quarter record $41.8 million from $32.4 million in 2018, and diluted earnings per share increased to $1.44 compared with $1.15 per diluted share.

2019 Full-Year Results:

• Record revenue of $2.5 billion, an increase of 9%

• Record homes delivered of 6,296, a 9% increase

• Record new contracts of 6,773, an increase of 16%

• Record pre-tax income of $166.0 million, an 18% increase compared to $141.3 million in 2018

• Net income increased to $127.6 million compared to $107.7 million in 2018 and diluted earnings per share increased to $4.48 from $3.70 per diluted share

• Shareholders’ equity reached an all-time record of $1.0 billion, a 17% increase from a year ago, with book value per share of $35.

Net income in the fourth quarter of 2019 included $3.8 million of after-tax impairment charges ($0.13 per diluted share), while 2018’s fourth quarter net income included $4.4 million of after-tax impairment charges ($0.15 per diluted share) and $0.5 million of after-tax acquisition-related charges ($0.02 per diluted share).

Excluding these charges, adjusted net income increased 22% to $45.6 million, and adjusted diluted earnings per share increased 19% to $1.57 per share from $1.32 per share in 2018. For the year ended December 31, 2019, the company reported net income of $127.6 million, or $4.48 per diluted share, compared to net income of $107.7 million, or $3.70 per diluted share, in 2018. Net income in 2019 included $3.8 million of after-tax impairment charges ($0.13 per diluted share) and $0.5 million of after-tax acquisition related charges ($0.02 per diluted share). Net income in 2018 included $4.4 million of after-tax impairment charges ($0.15 per diluted share) and $5.2 million of after-tax acquisition-related charges ($0.18 per diluted share). Exclusive of these charges, net income increased 12% to $131.9 million compared to $117.3 million in 2018, and adjusted diluted earnings per share increased 15% to $4.63 per share compared to $4.03 per share in 2018.

Homes delivered in 2019’s fourth quarter reached an all-time quarterly record of 1,921, increasing 5% compared to 1,825 deliveries in 2018’s fourth quarter. Homes delivered for the twelve months ended December 31, 2019 increased 9% to a record 6,296 from 2018’s deliveries of 5,778.

New contracts for 2019’s fourth quarter increased 43% to a fourth quarter record of 1,677 from 1,173 new contracts in 2018’s fourth quarter. For 2019, new contracts reached a record of 6,773, a 16% increase over 2018’s new contracts of 5,845. Homes in backlog increased 22% at December 31, 2019 to 2,671 units, with a record year-end sales value of $1.1 billion, an 18% increase over last year, and the average sales price in backlog decreased 3% to $396,000.

At December 31, 2018, the sales value of the 2,194 homes in backlog was $897 million, with an average sales price of $409,000. M/I Homes had a record 225 active communities at December 31, 2019 compared to 209 a year ago. The company’s cancellation rate was 13% in 2019’s fourth quarter and for the year.

Robert H. Schottenstein, CEO and president, commented, “2019 was a banner year for M/I Homes with record revenue, record new contracts, record homes delivered and record pre-tax income. Revenue increased 9% to $2.5 billion, new contracts increased 16% to 6,773 homes, homes delivered increased 9% to 6,296 homes, and pre-tax income, aided by improved operating leverage, increased 18% to $166 million. The strong performance of many of our home building divisions along with another very good year from our financial services business contributed to our record results. We also reached the highest year-end sales backlog in company history with a value of $1.1 billion, an 18% increase over 2018.”

Schottenstein continued, “Our financial condition remains strong. Our shareholders’ equity reached a record level of $1.0 billion at year-end, with a book value per share above $35, and we reduced our ratio of home building debt to capital to 38%. In addition, in January of this year we extended our debt maturity and improved our average borrowing rate by issuing $400 million of 8-year senior notes at 4.95% and redeemed $300 million of our 6.75% senior notes which were due in 2021. Housing market conditions remain strong and, given the strength of our record backlog and our solid competitive position across each of our 15 markets, we are well positioned for a very good 2020.”