NVR, Inc. (NYSE: NVR) on Thursday reported net income for its first quarter ended March 31, 2018 of $166,049,000, or $39.34 per diluted share, up 61% and 57%, respectively, when compared to results from the 2017 first quarter. Analysts were expecting a gain of $31.19 per share.

Revenues for the first quarter of 2018 totaled $1,529,414,000, a 20% increase from $1,277,092,000 in the first quarter of 2017.

Net income and diluted earnings per share were favorably impacted by the reduction in the company’s effective tax rate in the first quarter of 2018 to 13.1% from 22.1% in the first quarter of 2017. The reduction in the effective tax rate was primarily due to:

- The enactment of the Tax Cuts and Jobs Act in December 2017, which lowered the company’s federal statutory tax rate from 35% to 21%.

- The retroactive reinstatement of certain expired energy tax credits under the Bipartisan Budget Act of 2018, which resulted in the company recognizing a tax benefit of approximately $6,200,000 related to homes settled in 2017.

Additionally, the effective tax rate in both the first quarter of 2018 and 2017 was favorably impacted by the recognition of an income tax benefit related to excess tax benefits from stock option exercises totaling $19,567,000 and $19,900,000, respectively.

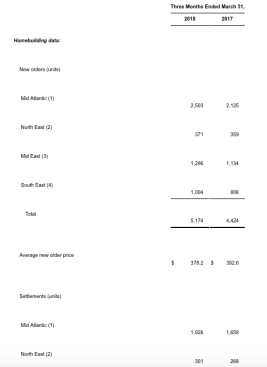

New orders in the first quarter of 2018 increased 17% to 5,174 units, when compared to 4,424 units in the first quarter of 2017. The average sales price of new orders in the first quarter of 2018 was $378,200, a decrease of 4% when compared with the first quarter of 2017. The decrease in the average sales price of new orders is primarily attributable to a shift in new orders to lower priced markets and lower priced products.

Settlements increased in the first quarter of 2018 to 3,896 units, 20% higher than the first quarter of 2017. The company’s backlog of homes sold but not settled as of March 31, 2018 increased on a unit basis by 22% to 9,809 units and increased on a dollar basis by 17% to $3,744,523,000 when compared to March 31, 2017.

Home building revenues in the first quarter of 2018 totaled $1,490,093,000, 19% higher than the year earlier period. Gross profit margin in the first quarter of 2018 increased to 18.7%, compared to 17.8% in the first quarter of 2017. Income before tax from the home building segment totaled $168,570,000 in the first quarter of 2018, an increase of 44% when compared to the first quarter of 2017.

Mortgage closed loan production in the first quarter of 2018 totaled $1,009,673,000, an increase of 20% when compared to the first quarter of 2017. Income before tax from the mortgage banking segment totaled $22,428,000 in the first quarter of 2018, an increase of 50% when compared to $14,971,000 in the first quarter of 2017.