PulteGroup, Inc., Atlanta (NYSE:PHM) on Tuesday before market open reported net income was $101 million, or $0.32 per share, for its second quarter ended June 30, 2017. The gain compares with $118 million, or $0.34 per share, in the prior-year quarter. The profit fell two cents short of analyst expectations.

Adjustments to the results included a pretax charge of $121 million associated with the company’s previously announced decision to dispose of select non-core and underutilized land assets, a net pretax benefit of $8 million relating to warranty and construction defect reserve adjustments and $24 million of net tax benefits recorded during the period.

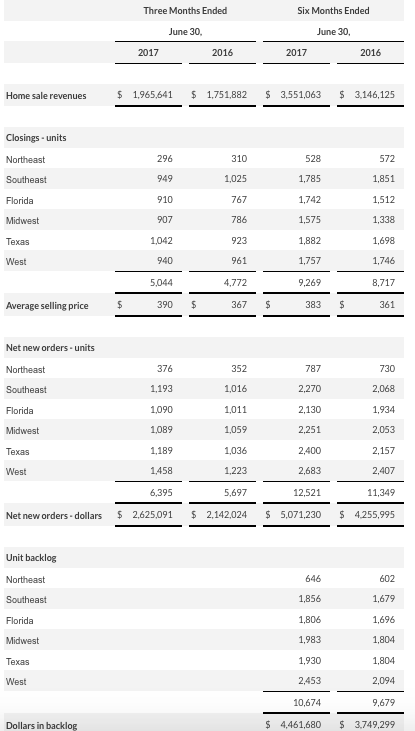

Home sale revenues for the second quarter increased 12% over the prior year to $2.0 billion. Higher revenues for the period were driven by a 6% increase in deliveries to 5,044 homes, combined with a 6% increase in average sales price to $390,000.

Reported gross margin for the second quarter was 21.1%, including the impact of land-related and warranty charges taken in the period. Exclusive of these charges, the Company’s adjusted gross margin for the quarter was 23.4%. Reported SG&A expense for the second quarter was $216 million, or 11.0% of home sale revenues, which includes a $20 million benefit relating to an insurance reserve adjustment taken in the period. Adjusted SG&A expense for the quarter was $236 million, or 12.0% of home sale revenues. Reported SG&A expense for the prior year was $256 million, or 14.6% of home sale revenues.

Net new orders for the second quarter increased 12% over the prior year to 6,395 homes. The dollar value of net new orders gained 23% to $2.6 billion. For the quarter, the Company operated out of 803 communities.

PulteGroup’s unit backlog increased 10% over the prior year to 10,674 homes. The value of homes in backlog increased 19% to $4.5 billion. The average sales price of homes in backlog is $418,000, up 8% over the average sales price in backlog in the second quarter of last year and up 7% from the average sales price of homes delivered in the second quarter of 2017.

Pretax income for the company’s financial services operations increased 11% for the quarter to $19 million, as the operations benefited from higher home-builder closing volumes and an increase in the average loan size. Mortgage capture rate for the quarter was 79%, compared with 81% in the prior year.

“U.S. housing demand continues to benefit from positive market dynamics including an improving economy and job market, high consumer confidence, low interest rates and a generally limited supply of homes across the country,” said Ryan Marshall, president and CEO. “Given these strong market supports, we believe housing demand can continue to move higher over the coming quarters.”

“Within this market environment, PulteGroup is successfully executing against its business strategies as we focus on intelligently growing our business while delivering high returns,” added Mr. Marshall. “Consistent with this focus, our second quarter results show orders up 12%, backlog value up 19% and adjusted earnings per share up 27%, while ROE improved 140 basis points to 12.8%.”