PulteGroup, Inc. (NYSE: PHM) reported reported net income of $336 million, or $1.22 per share, for its fourth quarter ended December 31, 2019, up from $238 million, or $0.84 per share, in the prior year quarter. Wall Street was expecting a gain of $1.09 per share.

Adjusted net income for the period was $312 million, or $1.14 per share, after excluding $31 million of pre-tax benefit from an insurance reserve adjustment. Adjusted net income for the fourth quarter of 2018 was $314 million, or $1.11 per share, after excluding $85 million of pre-tax land charges and a $16 million pre-tax charge for a financial services reserve adjustment.

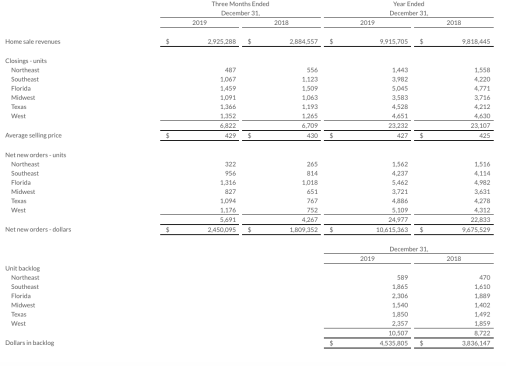

Home sale revenues for the fourth quarter increased 1% over the fourth quarter of 2018 to $2.9 billion. Higher revenues for the period reflect a 2% increase in closings to 6,822 homes, partially offset by a less than 1% decrease in average sales price to $429,000.

Home sale gross margin for the fourth quarter was 22.8%, compared with prior year reported and adjusted gross margins of 21.5% and 23.8%, respectively.

Reported fourth quarter SG&A expense of $262 million, or 8.9% of home sale revenues, included a $31 million pre-tax benefit from an insurance reserve adjustment recorded in the period. Exclusive of this benefit, adjusted SG&A expense for the quarter was $293 million, or 10.0% of home sale revenues. SG&A expense for the fourth quarter of 2018 was $292 million, or 10.1% of home sale revenues.

Net new orders for the quarter increased 33% over the fourth quarter of 2018 to 5,691 homes as results benefited from both increased community count and higher absorption pace. The value of net new orders increased 35% to $2.5 billion, up from $1.8 billion in the fourth quarter of 2018. Average community count for the fourth quarter was 865 communities, compared with 825 communities in the fourth quarter of 2018.

Unit backlog was up 20% over last year to 10,507 homes, while the backlog dollar value increased 18% to $4.5 billion. The decrease in the average price of homes in backlog reflects the company’s efforts to expand its first-time buyer business.

Pre-tax income for the company’s financial services operations was $34 million compared with $5 million in the fourth quarter of 2018. Results for the fourth quarter of 2018 included a $16 million pre-tax charge for a reserve adjustment recorded in the period. The increase in pre-tax income for the period also reflects a strong margin environment, higher loan volumes resulting from growth in the company’s home building operations and a higher mortgage capture rate. Capture rate for the fourth quarter increased to 84% from 77% last year.

During the quarter, the company repurchased 0.8 million of its common shares for $30 million, or an average price of $39.16 per share. For the year, the company repurchased 8.4 million common shares, or 3% of its outstanding shares, for $274 million, or an average price of $32.52 per share.

At year end, the company had $1.2 billion of cash and a debt-to-total capitalization of 33.6%, which is down from 38.6% at the end of 2018.

“As demonstrated by our 33% increase in orders, the recovery in housing demand that began earlier this year gained momentum through the fourth quarter as we realized strong sales across all buyer groups,” said company President and CEO Ryan Marshall. “The quarter completes an outstanding year during which we continued to invest in growing our business, generated $1.1 billion in operating cash flow, returned $397 million to shareholders, paid down $310 million of home builder debt, and realized a 20.0% return on equity.”

“Strong demand for new homes is benefiting from favorable market dynamics including improved affordability in part due to low mortgage rates, high employment and consumer confidence, and a generally balanced inventory of new homes,” added Marshall. “The sustained strength in housing demand allowed us to deliver strong fourth quarter and full-year results, and has PulteGroup well positioned to increase delivery volumes, revenues, home building gross margins and earnings in 2020.”