M/I Homes, Inc., Columbus (NYSE:MHO) on Wednesday morning reported net income of $17.0 million, or $0.55 per diluted share, for the second quarter ended June 30, compared with a net of $15.9 million, or $0.52 per diluted share, for the second quarter of 2016. Analysts were expecting a gain of $0.68 per share.

The results include an $8.5 million pre-tax charge ($0.18 per diluted share) for additional estimated future stucco-related repair costs in several Florida communities. The second quarter of 2016 included a charge of $2.8 million for such repairs. Minus the charges, earnings per share would have totaled $0.73.

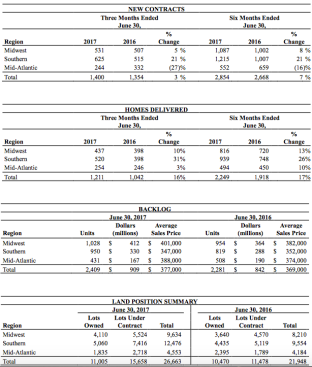

Revenue increased 14% to a second quarter record $457 million as Homes delivered increased 16% to 1,211, also a record for the quarter. New contracts increased 3% to 1,400, another record level for the second quarter. Backlog sales value increased 8% to $909 million and backlog units increased 6% to 2,409

M/I Homes had 187 active communities at June 30, 2017 compared to 174 at June 30, 2016. The company’s cancellation rate was 13% in the second quarter of 2017 and 14% in 2016.

Robert H. Schottenstein, CEO and president, commented, “2017 is shaping up to be a very good year for M/I Homes. We have a strong backlog of $909 million and a growing number of planned new community openings. Housing market conditions are generally favorable throughout most of our markets and our financial condition remains strong with shareholders’ equity of $693 million, and home-building debt to capital of 46% and, as reported last week, we have extended the maturity date of our credit facility by four years and increased our borrowing availability to $475 million, giving us additional flexibility and capital for continued growth. We will continue to focus on increasing profitability, growing our market share, and investing in attractive land opportunities.”