Taylor Morrison Home Corporation, Scottsdale (NYSE:TMHC) on Wednesday morning reported net income for the second quarter ended June 30 of $56 million, or $0.46 per share, up 23% and 24%, respectively, from the prior year quarter. The gain blew past Wall Street expectations of $0.39 per share.

Shares of TMHC closed up 3.2% at $23.35 in Tuesday trading and added another 4.9% to $24.50 in after-market trading.

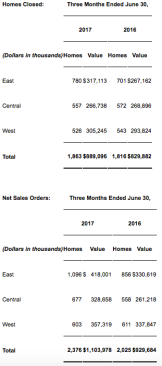

Total revenue was $908 million, a 6% increase from the prior year quarter; home closing revenue was $889.1 million, up 7.1%. Home closings were 1,863, a 3% increase from the prior year quarter, and the average selling price rose to $477,000 from $457,000.

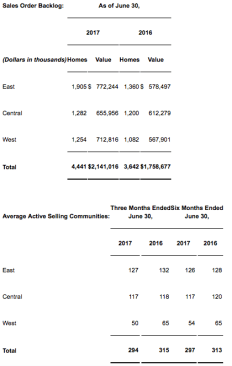

Net sales orders were 2,376, a 17% increase from the comparable quarter last year. Sales per outlet were 2.7, a 29% increase from the prior year quarter.

Backlog of homes under contract at the end of the quarter was 4,441 units with a sales value of $2.1 billion, both representing growth of 22% from the prior year quarter.

Home closings gross margin, inclusive of capitalized interest, was 18.5%.

The Company ended the quarter with $246 million in cash and a net home-building debt to capitalization ratio of 33.8%.

Home-building inventories were $3.2 billion at the end of the quarter, including 5,188 homes in inventory, compared to 4,607 homes in inventory at the end of the prior year quarter. Homes in inventory at the end of the quarter consisted of 3,333 sold units, 395 model homes and 1,460 inventory units, of which 259 were finished. The company owned or controlled approximately 38,500 lots at June 30, 2017, representing 5.0 years of supply and is focused on securing land for 2019 and beyond.

“We’ve positioned ourselves well through the initiatives we’ve put in place and our responsible approach to growth,” said Sheryl Palmer, chairman, president and CEO. “While I am extremely excited about what we’ve been able to do so far this year, it is our future that is truly encouraging. I’m optimistic about the health of our industry and the economy, our markets, our focus on being a return-driven business, and our team’s ability to continue to drive significant results.”