Taylor Morrison Home Corporation, Scottsdale (NYSE:TMHC) early Wednesday reported third-quarter total revenue of $908 million, net income of $54 million and diluted earnings per share of $0.45. The gain beat analyst expectations by two cents a share.

Among the operating metrics for the quarter ended Sept. 30:

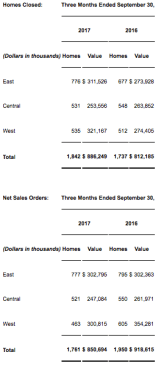

- Home closings were 1,842, a 6% increase from the prior year quarter.

- Total revenue was $908 million, a 6% increase from the prior year quarter.

- GAAP home closings gross margin, inclusive of capitalized interest, was 18.6%.-

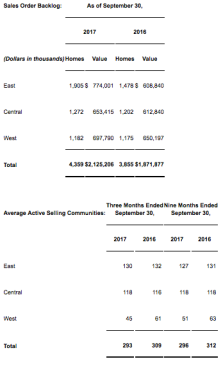

- Backlog units at the end of the quarter were 4,359 with a sales value of $2.1 billion, a 13% increase from the prior year quarter.

“The third quarter presented unique challenges with Hurricanes Harvey and Irma,” said Sheryl Palmer, chairman and CEO of Taylor Morrison. “Despite the storms, I’m pleased with our organization’s resilience and collective efforts to close another quarter of sequential growth in key operating metrics, and am happy to share that our annual closings guidance remains within our stated range.”

“Through the end of September, we’ve sold 6,562 homes, a 13% increase compared to the same period last year, and our sales pace year-to-date is 2.5, almost a 20% increase compared to the same period in 2016,” added Palmer. “That represents our highest sales growth rate over three quarters since 2013.”

As a result of the hurricanes, approximately 40% of the Company’s communities were closed for a minimum of 5-7 days and experienced three to four weeks of delays in deliveries and production.

“The impact from the hurricanes reduced our number of closings in the third quarter by about 130, equating to roughly four cents of EPS,” said Dave Cone, executive bice president and CFO. “However, this won’t be a permanent shift in our production schedule as we plan to absorb these closings into our business in the next couple of quarters.”

“Home closings gross margin, inclusive of capitalized interest, was 18.6%, and grew sequentially versus the second quarter,” added Cone. “We estimate a loss of 10 basis points of margin from the delayed closings, but continue to believe the full-year home closings margin will be accretive year-over-year.”

The company ended the quarter with $265 million in cash and a net home-building debt to capitalization ratio of 33.1%.

Land sales for the third quarter were about $4 million, a decrease of $23 million from the third quarter 2016. The company sold certain long-term strategic assets in 2016 as the tax holding period expired allowing for favorable monetization.

Home-building inventories were $3.2 billion at the end of the quarter, including 5,282 homes in inventory, compared to 4,747 homes in inventory at the end of the prior year quarter. Homes in inventory at the end of the quarter consisted of 3,537 sold units, 401 model homes and 1,344 inventory units, of which 249 were finished. The company owned or controlled approximately 40,000 lots at September 30, 2017, representing 5.1 years of supply and is focused on securing land for 2019 and beyond.