Taylor Morrison Home Corporation, Scottsdale (NYSE: TMHC) on Wednesday reported second quarter total revenue of $1.3 billion and GAAP home closings gross margin, inclusive of capitalized interest, of 18.0%, leading to net income of $82 million, up 38% over the prior year quarter, with diluted earnings per share of $0.76. Analysts were expecting a gain of $0.66 per share.

The company also announced its entry into the single-family build-to-rent community space through a partnership with Christopher Todd Communities, a Phoenix-area single-family rental company. Taylor Morrison will serve as land acquirer, developer and builder, with Christopher Todd Communities providing its build-to-rent playbook, community design and property management consultation.

“With more than 16 million single-family rental homes in the U.S. today and only 5% of that share represented by new home production, it signals an early and exciting time for this new growing segment,” said Sheryl Palmer, chairman and CEO of Taylor Morrison. “We believe this strategic partnership with Christopher Todd Communities and their established platform is in clear alignment with our focus to address affordability in our markets and serve more customers who desire the product and lifestyle of a single-family community while balancing finances, flexibility and maintenance-free living. This relationship advances our demand-side diversification while leveraging what we do every day in our core business—acquiring and developing land and quality production. What’s more, this strategy will allow us to further increase the velocity of community deliveries and we expect to enhance our time and cost-efficient production process with proven and standardized specifications and a concentrated production line building process creating a rapid land-to-lease-up pipeline.”

“We continued the momentum experienced at the end of the first quarter, which led us to exceeding expectations in our key operating metrics for the second quarter,” said Palmer.

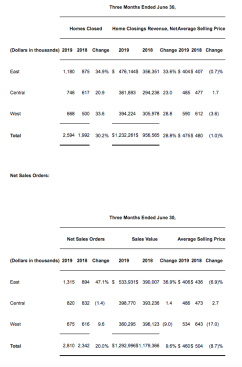

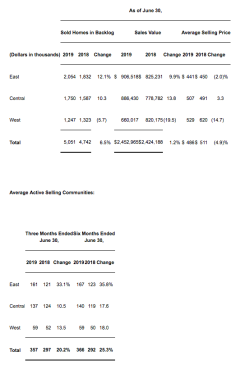

For the second quarter, net sales orders were 2,810. Average community count was 357, which resulted in an average monthly sales pace per community of 2.6 for the quarter. The company ended the quarter with 5,051 units in backlog, a year-over-year increase of 7%, with a sales value of approximately $2.5 billion.

“Closings totaled 2,594 for the quarter, representing a 30% increase over the same period last year,” added Palmer. “The inventory sales environment was particularly strong during the quarter, driving our closings results above the high end of our guidance for the period. Even with the increased inventory sales in the quarter we achieved lower incentive levels than the prior year quarter, which led to a GAAP home closings gross margin of 18%.”

“We believe our success and strong results that we’ve seen so far this year are largely due to the hard work that the entire team has put into the integration of AV Homes following the acquisition,” said Palmer. “I’m proud to share that the heavy lifting required for the integration is complete and we are now operating as one company. This has been achieved sooner than anticipated and with the integration work and negotiations complete, we are pleased to be able to take our total synergy estimate up to $50 million on an annualized basis.”

“SG&A as a percentage of home building revenue came in at 10.1%, which represented 40 basis points of leverage when compared to second quarter 2018, and the addition of AV Homes is providing further top-line leverage,” said Dave Cone, EVP and CFO. “Given our success in holding gross margins flat to last year and the SG&A leverage we gained, EBT margin came in at 8.7% for the quarter. This represents about 60 basis points of improvement when compared to Q2 2018. This was despite about $4 million of AV transaction expenses and debt extinguishment charges hitting during the quarter.”

Home building inventories were $4.1 billion at the end of the quarter, including 6,523 homes in inventory, compared to 5,599 homes in inventory at the end of the prior year quarter. Homes in inventory at the end of the quarter consisted of 3,834 sold units, 495 model homes and 2,194 inventory units, of which 440 were finished.

The company finished the quarter with $197 million in cash and a net home building debt to capitalization ratio of 43.0%. As of June 30, 2019, Taylor Morrison owned or controlled approximately 54,000 lots, representing 5.3 years of supply based on a trailing twelve months of closings including a full year of AV.