Taylor Morrison Home Corp., Scottsdale (NYSE:TMHC) on Wednesday reported net income of $31 million, or $0.26 per share, for the fourth quarter of 2017 ended Dec. 31. The gain compared to $76 million, or $0.63 per share, in the comparable quarter in 2016, with the drop related to a $57.4 million non-cash charge related to deferred tax assets and a $3.6 million charge for the mandatory deemed repatriation of proceeds related to the sale of the company’s Canadian business in 2015.

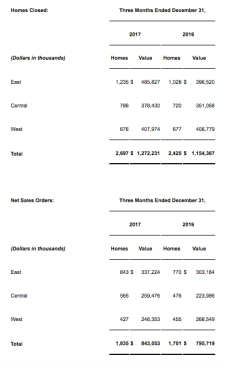

Total revenue was $1.3 billion, a 9% increase from the prior year quarter, as home closings rose 11% to 2,697. Net sales orders were 1,835, an 8% increase from the prior year quarter. Sales per outlet were 2.1, an 11% increase from the prior year quarter. Home closings gross margin was 19.0%, and SG&A came in at 8.8% of home closing revenue.

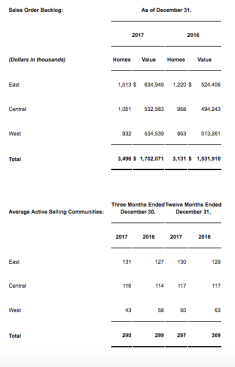

For the full year 2017, Taylor Morrison closed 8,032 homes, a 9% year-over-year increase. The full year 2017 sales pace was 2.4, a 20% increase compared to 2016. Taylor Morrison ended the year with 3,496 units in backlog, a year-over-year increase of 12%.

“Despite the challenges presented by Hurricanes Harvey and Irma in the third quarter, our impacted markets rebounded much quicker than initially thought on the active production units and other areas of the company over-performed resulting in us ending the year at the mid-point of our pre-hurricane closings guidance,” said Sheryl Palmer, chairman and CEO. “In fact, we met or exceeded most points of our initial 2017 guidance as well as our increased guidance after the second quarter.”