Toll Brothers, Inc. (NYSE:TOL), Horsham, Pa. on Tuesday reported net income of $132.1 million, or $0.83 per share diluted, for its first quarter ended January 31, 2018, compared to net income of $70.4 million, or $0.42 per share diluted in FY 2017’s first quarter. Wall Street was expecting a gain of $0.62 per share.

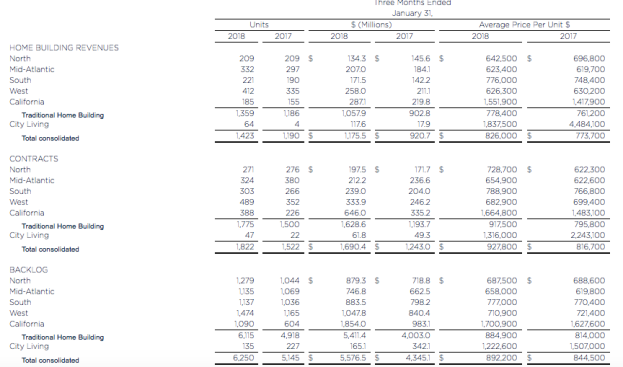

Pre-tax income was $131.6 million, compared to $109.8 million in last year’s quarter. Revenues were $1.18 billion – up 28% as home building deliveries were 1,423 units – up 20%. Net signed contract value was $1.69 billion – up 36%; contract units were 1,822 – up 20%. Backlog value at first-quarter end rose to $5.58 billion – up 28%; units totaled 6,250 – up 21%.

Gross margin, as a percentage of revenues, was 20.5%. SG&A, as a percentage of revenues, was 13.4%. Other income and Income from unconsolidated entities was $47.9 million

As a result of the Tax Cuts and Jobs Act enacted in December 2017, FY 2018’s first-quarter net income was favorably impacted by a $31.2 million tax benefit associated with the revaluation of the company’s net deferred tax liability.

The company issued the following guidance for the rest of fiscal 2018:

- Full FY 2018 deliveries of between 7,800 and 8,600 units with an average price of between $820,000 and $860,000; second-quarter deliveries of between 1,825 and 1,925 units with an average price of between $825,000 and $850,000.

- FY Adjusted Gross Margin of between 23.75% and 24.25% of revenues; second-quarter Adjusted Gross Margin of 22.8%.

- FY SG&A, as a percentage of FY revenues, of approximately 10.0%; second-quarter SG&A, as a percentage of second quarter revenues, of approximately 10.6%.

- FY Other income and Income from unconsolidated entities of between $130 million and $170 million, with approximately $15 million in the second quarter.

- FY tax rate of between 23% and 25%; second quarter tax rate of approximately 27.5%.

Douglas C. Yearley, Jr., Toll Brothers’ chief executive officer, stated: “Demand remained very strong this quarter. The California and Western regions led the way with 93% and 36% growth, respectively, in the value of contracts signed, compared to one year ago. The South was up 17% and the North was up 15%. Only in the Mid-Atlantic did we see a decline. City Living, which is primarily in metro New York City, saw growth, with the value of contracts in our wholly-owned projects up 25% and the value of contracts in our City Living joint ventured projects up as well.”

He continued, “We saw a significant acceleration in contracts per community this quarter compared to one year ago – an annualized pace of 24 sales per community up from 19 in last year’s first quarter. Even so, we have yet to reach historical norms of annualized sales paces in the high 20’s.”

Robert I. Toll, executive chairman, stated: “The new home industry appears to be building momentum with the national home ownership rate rising over the past year. Wages are increasing, home equity is building, consumer confidence is strong, the economy is improving and demand for housing is accelerating. Meanwhile, the supply of new homes is in short supply as production lags demand in many markets. These trends indicate a positive landscape for the new home market, and particularly for Toll Brothers, in the coming years.”