TRI Pointe Group, Inc. (NYSE: TPH), Irvine, Calif. after market close Tuesday reported net income of $118.0 million, or $0.85 per diluted share, for the fourth quarter of 2019, compared to net income available to common stockholders of $99.4 million, or $0.70 per diluted share, for the fourth quarter of 2018. Wall Street was expecting a gain of $0.71 per share.

The increase in net income available to common stockholders was primarily driven by lower legal settlement expenses compared to the prior year as well as a lower income tax provision in the current year as a result of the energy tax credit that was approved by Congress in December 2019.

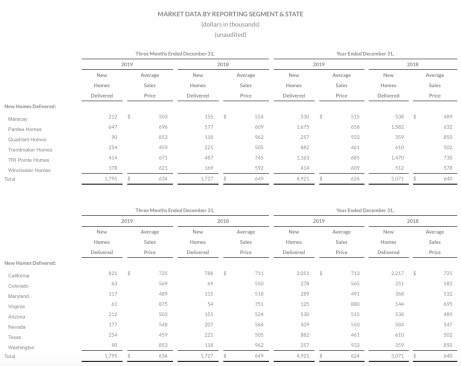

Home sales revenue was consistent at $1.1 billion for the fourth quarter of 2019 and 2018. The average selling price of homes delivered during the fourth quarter of 2019 decreased 2% to $634,000 from $649,000, offset by a 4% increase in new homes delivered in the fourth quarter of 2019 to 1,795 from 1,727.

Home building gross margin percentage was consistent at 21.9% for both the fourth quarter of 2019 and 2018. Excluding interest, impairments and lot option abandonments in cost of home sales, adjusted home building gross margin percentage was 26.2% for the fourth quarter of 2019 compared to 24.8% for the fourth quarter of 2018.*

SG&A expense for the fourth quarter of 2019 increased slightly to 9.2% of home sales revenue as compared to 9.1% for the fourth quarter of 2018.

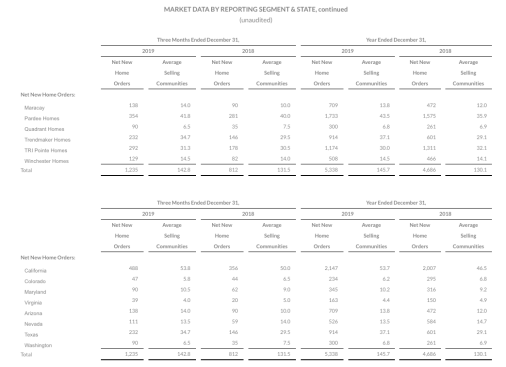

New home orders increased 52% to 1,235 homes for the fourth quarter of 2019, as compared to 812 homes for the same period in 2018. Average selling communities was 142.8 for the fourth quarter of 2019 compared to 131.5 for the fourth quarter of 2018. New home orders per average selling community for the fourth quarter of 2019 was 8.6 orders (2.9 monthly) compared to 6.2 orders (2.1 monthly) during the fourth quarter of 2018.

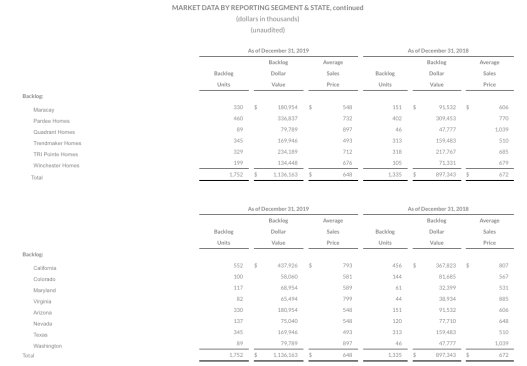

The company ended the quarter with 1,752 homes in backlog, representing approximately $1.1 billion. The average selling price of homes in backlog as of December 31, 2019 decreased $24,000, or 4%, to $648,000 compared to $672,000 at December 31, 2018.

“TRI Pointe Group continues to be recognized by its customers as a premium home builder, and I have never been more optimistic about our future,” said TRI Pointe Group President and Chief Operating Officer Tom Mitchell. “We continue to optimize our operations, and the consumer has really responded to our emphasis on design, innovation, and the customer experience.”

For the year, the company reported:

- Net income available to common stockholders was $207.2 million, or $1.47 per diluted share, compared to $269.9 million, or $1.81 per diluted share

- Home sales revenue of $3.1 billion compared to $3.2 billion, a decrease of 5%

— New home deliveries of 4,921 homes compared to 5,071 homes, a decrease of 3% — Average sales price of homes delivered of $624,000 compared to $640,000, a decrease of 3%

- Home building gross margin percentage of 19.8% compared to 21.8%, a decrease of 200 basis points

— Excluding interest, impairments and lot option abandonments, adjusted home building gross margin percentage was 23.2%

- SG&A expense as a percentage of homes sales revenue of 11.5% compared to 10.6%, an increase of 90 basis points

- New home orders of 5,338 compared to 4,686, an increase of 14%

- Active selling communities averaged 145.7 compared to 130.1, an increase of 12%

— New home orders per average selling community increased by 3% to 36.6 orders (3.1 monthly) compared to 36.0 orders (3.0 monthly) — Cancellation rate of 15% compared to 18%, a decrease of 300 basis points

- Repurchased 6,135,622 shares of common stock at an average price of $14.54 for an aggregate dollar amount of $89.2 million in the full year ended December 31, 2019

Outlook

During the first quarter of 2020, the company expects to open 15 new communities and close out of 7 communities, which would result in 145 active selling communities as of March 31, 2020. In addition, the company anticipates delivering between 875 and 950 homes at an average sales price of approximately $600,000. The company expects its home building gross margin percentage to be in the range of 19.5% to 20.5% for the first quarter of 2020 and anticipates its SG&A expense as a percentage of homes sales revenue will be approximately 15% during such period. The company expects its effective tax rate for the first quarter of 2020 to be approximately 25%.

For the full year, the company anticipates delivering between 5,100 and 5,300 homes at an average sales price between $605,000 to $615,000. In addition, the company expects home building gross margin percentage to be in the range of 19.5% to 20.5% for the full year and anticipates its SG&A expense as a percentage of homes sales revenue will be approximately 11.5%. The company expects its effective tax rate for the full year to be approximately 25%.

Stock Repurchase Program

On February 13, 2020, the board canceled the share repurchase program approved in 2019, which had approximately $60.8 million remaining in authorized repurchases, and approved a new repurchase program, which authorizes the repurchase of up to $200 million of company common stock through March 31, 2021.