TRI Pointe Group, Inc. (NYSE: TPH) on Friday reported net income of $63.7 million , or $0.42 per diluted share, for the second quarter of 2018 ended June 30. The gain compared to net income available to common stockholders of $32.7 million , or $0.21 per diluted share, for the second quarter of 2017. Analysts were expecting a gain of $0.36 per share.

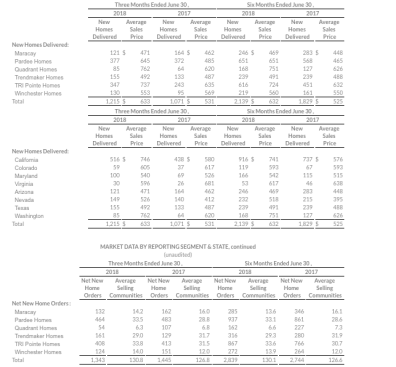

Home sales revenue increased $200.0 million , or 35%, to $768.8 million for the second quarter of 2018, as compared to $568.8 million for the second quarter of 2017. The increase was primarily attributable to a 19% increase in the average sales price of homes delivered to $633,000 , compared to $531,000 in the second quarter of 2017, and a 13% increase in new home deliveries to 1,215, compared to 1,071 in the second quarter of 2017.

New home orders decreased 7% to 1,343 homes for the second quarter of 2018, as compared to 1,445 homes for the same period in 2017. Average selling communities increased 3% to 130.8 for the second quarter of 2018 compared to 126.8 for the second quarter of 2017. The company’s overall absorption rate per average selling community decreased 10% for the second quarter of 2018 to 10.3 orders (3.4 monthly) compared to 11.4 orders (3.8 monthly) during the second quarter of 2017.

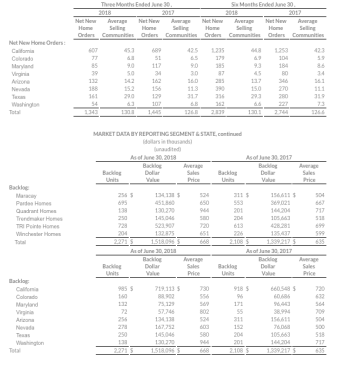

The company ended the quarter with 2,271 homes in backlog, up 8%, representing approximately $1.5 billion, up 13%. The average sales price of homes in backlog as of June 30, 2018 increased $33,000 , or 5%, to $668,000 , compared to $635,000 as of June 30, 2017 .

Home building gross margin percentage for the second quarter of 2018 increased to 21.4%, compared to 20.1% for the second quarter of 2017. Excluding interest and impairments and lot option abandonments in cost of home sales, adjusted home building gross margin percentage was 24.0% for the second quarter of 2018, compared to 22.5% for the second quarter of 2017. Gross margin percentage increased at each home building segment for the quarter as compared to the prior-year period. In addition, the percentage of deliveries from California , which generally produce gross margins above the company average, increased compared to the same period in the prior year.

Selling, general and administrative (“SG&A”) expense for the second quarter of 2018 decreased to 10.7% of home sales revenue as compared to 11.6% for the second quarter of 2017, primarily due to increased leverage as a result of a 35% increase in home sales revenue.

Said TRI Pointe Group CEO Doug Bauer, “We continue to see positive fundamentals in the overall housing market, characterized by low inventory levels, improving wage gains, employment growth and consumer demand from millennials to baby boomers. These macro fundamentals, coupled with our strong balance sheet, consistent execution and strategic focus on design and innovation have TRI Pointe Group well positioned as we head into the second half of the year.”

“While we pride ourselves on consistent execution every quarter, our attention remains squarely focused on positioning our company for longer-term success,” saidTRI Pointe Group COO Tom Mitchell . “For TRI Pointe, that meant continuing to build out the longer-dated assets we acquired in the WRECO transaction rather than booking short term land-sale profits. Now over four years removed from this transaction, these assets continue to contribute significantly to our bottom line and provide us with a healthy runway of lots. Today, we are taking the same long-term approach with each of our brands with an eye toward increasing our local market scale and creating a more diversified company.”

For the third quarter of 2018, the Company expects to open 15 new communities, and close out of 17, resulting in 128 active selling communities as of September 30, 2018 . In addition, the Company anticipates delivering 50% to 55% of its 2,271 units in backlog as of June 30, 2018 at an average sales price of $630,000 . The Company anticipates its homebuilding gross margin percentage will be in a range of 21.0% to 21.5% for the third quarter. Finally, the Company expects its SG&A expense as a percentage of home sales revenue to be in the range of 10.8% to 11.2% for the third quarter.

For the full year 2018, the Company is reiterating its guidance of growing average selling communities by 5% compared to 2017 and delivering between 5,100 and 5,400 homes. The Company is increasing its expected average sales price for the full year to $625,000 from $610,000 . The Company continues to expect its homebuilding gross margin percentage for the full year 2018 to be in the range of 21.0% to 21.5%, SG&A expense as a percentage of home sales revenue to be in the range of 9.9% to 10.3% and its effective tax rate to be in the range of 25% to 26%.