And while Horton hasn’t bet the company on the strategy—its core D.R. Horton brand, with a median sales price of $283,000, still accounted for 84% of homes sold, while its luxury brand, Emerald, with a median price at $660,000, made up 3%—the move is a contrarian one in an industry that’s gone gaga for the move-up and luxury end of the market. If Horton can sustain its momentum and success with Express—and analysts say if anyone can do it, Horton can—it may be a harbinger of things to come. But it will have to fight the forces that have bested other builders, and essentially have made the starter home a nonstarter for many, first.

One of those forces holding down entry level is the fact that the demographic most likely to want these homes—the millennial population—has been strapped with rising rents and steep student loans in recent years, which has made saving up a down payment and qualifying for a mortgage even harder in today’s environment.

“It certainly is an interesting time to be increasing your focus on first-time buyers because that’s clearly the market segment that has been most challenged with credit availability,” says Haendel St. Juste, an analyst with Morgan Stanley. “It’s also the segment that’s most sensitive to changes in not only interest rates, but also home price appreciation.”

While the recent cuts in private mortgage insurance premiums for FHA buyers may help curtail some of those issues, the challenges go beyond the makeup of the buyers. Stephen East, an analyst with independent investment banking advisory firm Evercore ISI, points out that even if you get the demand segment right, you’ve got to operate flawlessly when it comes to execution. “That is a tough segment of the market to make money in because you’ve got to buy your land right, and you have to control your costs extremely well,” East says. “It is a manufacturing process.”

Then, there’s the question of just how much closable demand is actually out there for these kinds of homes today. In a recent note, John Burns, founder of John Burns Real Estate Consulting (JBREC), wrote that building more entry-level homes is one of four key factors to getting this market right, but with one caveat: just not yet. “We see signs of the entry-level market starting to pick up again,” says Chris Porter, chief demographer at JBREC. “But it’s not necessarily going to hockey stick up right away. We’re still trying to figure out when exactly that household formation comes to market.”

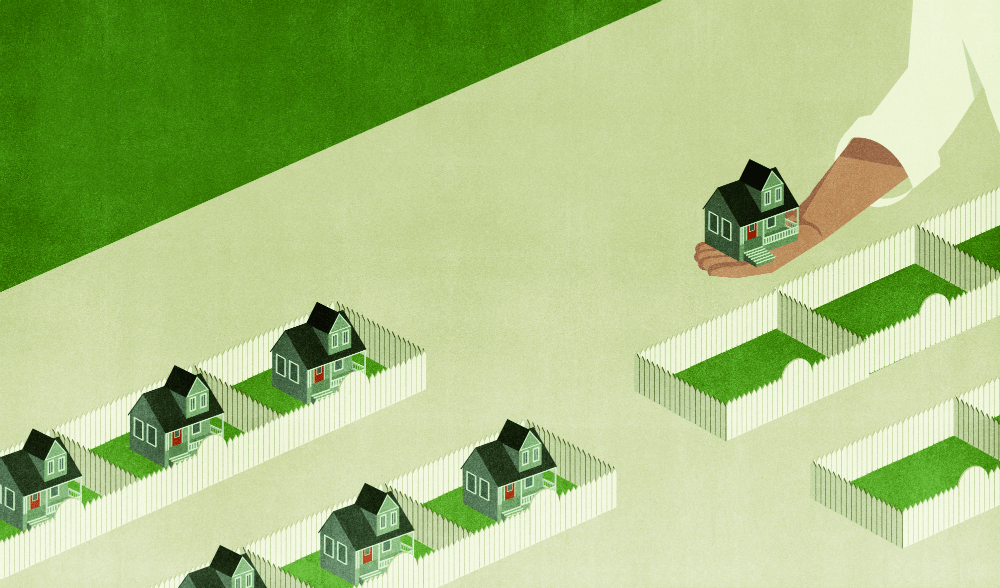

Analysts say Horton will look brilliant if that demand materializes sooner than expected. But the company’s strategy definitely has other risks, too. The first among them may be the land it has on its books. While the company currently holds a moderate six to seven years of land—compared with approximately eight for KB Home and 10 for Toll Brothers—analysts say Horton bought early in places where others have feared to tread.

“They’re definitely in the drive-until-you-qualify parts of town,” says Kim. “And the risk there is that if the demand doesn’t materialize, they’re not very well located. A lot of builders won’t go into those kinds of places until they can see the whites in the buyers’ eyes.”