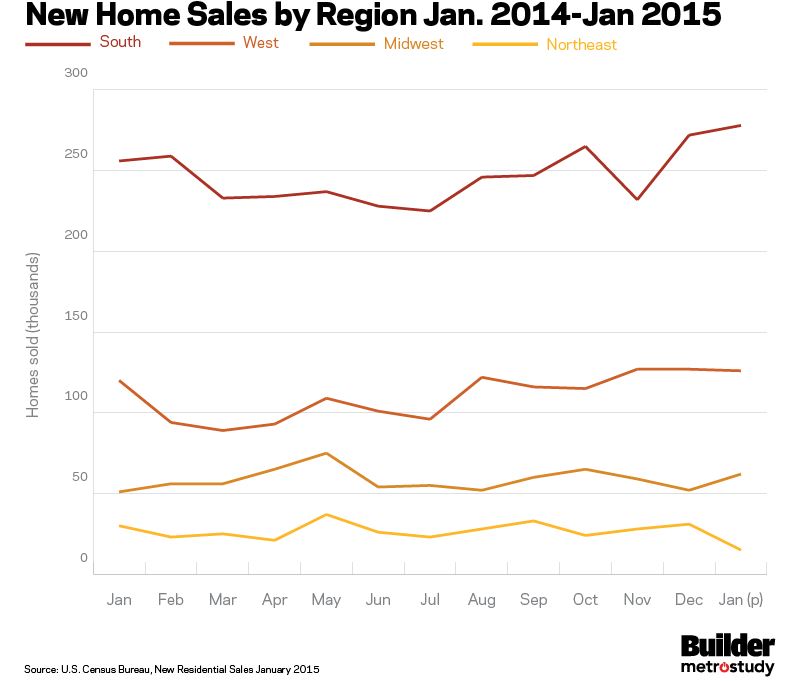

Sales of new single-family houses in January 2015 were at a seasonally adjusted annual rate of 481,000, according to estimates released today by the U.S. Census Bureau. This is 0.2% (±22.2%)* below the revised December rate of 482,000, but is 5.3% (±22.1%)* above the January 2014 estimate of 457,000.

Here are some key points to remember for new home sales in 2015:

- Although the Census Bureau’s data on monthly new home sales are notoriously inaccurate (due to their small sample size), we do see demand moving upward in the first quarter, and expect further improvement throughout the year.

- Some elements that we have been considering as we anticipate trends for this year:

- Metrostudy sees signs that builders are gearing up for more production in 2015, at least in certain markets. An excellent leading indicator for housing starts is the number of lots reaching development (ready for the builder to start building). Our in-field research shows that lot development has doubled in the last two to three years in many markets. In markets like Austin, SLC, Tampa, and others, lot development is running faster than starts. That strongly suggests increased housing starts in those areas.

- Builders are JUST starting to extend their geographic reach, looking at land or lots in the somewhat more remote suburban regions that exploded during the boom and then collapsed during the late 2000s.

- The entry-level new home market is still soft, but the builders who are targeting that group successfully are coming up with ways to keep their prices under $200,000, and they are finding ready buyers.

- Mortgage availability is still an issue outside the luxury demographic and the ‘elite’ active-adult buyers.

- Job formations are better, but the jobs that are being created are not those typically associated with high rates of home buying. Still, the overall “lift” that we are expecting from greater economic activity and increased aggregate income will have a simulative effect on new home demand throughout 2015.

See the full release from the Census bureau here.