Housing starts numbers out today surprised many observers with its strength (+15.7%), but we find it to have been in line with our actual counts, released earlier this month. As we predicted, last month’s Census estimate was revised upward, and now the numbers are back in line with the trends revealed by the Metrostudy roll-ups.

The last release of housing starts data from the Census Bureau caused undue alarm about a collapse of activity in the South. The Census release had shown a 29.6% decline for total starts in the South, but as we pointed out at the time, this exaggerated the weakness in the south. As a matter of fact Metrostudy’s research shows that several markets in the south are up, both based on prior quarter results, and year ago. Raleigh was down 5% versus a year ago, but Charlotte, Atlanta, Texas, and South Florida showed increases.

Metrostudy’s data show that some of the most “beaten-down” markets are now doing better. In Las Vegas, for example, starts of detached single-family homes were up 16% from 2nd quarter 2013 to 2nd quarter 2014, and Phoenix showed a 12.3% increase. Single-family housing starts in Chicago were up 87% quarter on quarter, and up 30% year on year. Naples Florida showed double-digit gains, both quarterly and annually.

Some significant trends were evident in Metrostudy’s data in California. Detached housing starts in the Riverside area rose 48.5% quarter on quarter, and are up 14% year-on-year.

We are seeing an increase in lot development in Riverside as lot shortages around the I-15 Corridor have intensified. The Inland Empire is developing its own economy, with 3% job growth, meaning that is it is no longer just a bedroom community for L.A.

Housing starts in Northern California rose 92% in the second quarter compared with the previous quarter, and are up 19% year-on-year. Starts there are at a record high since the boom. Contra Costa and Alameda County’s had particularly strong increases.

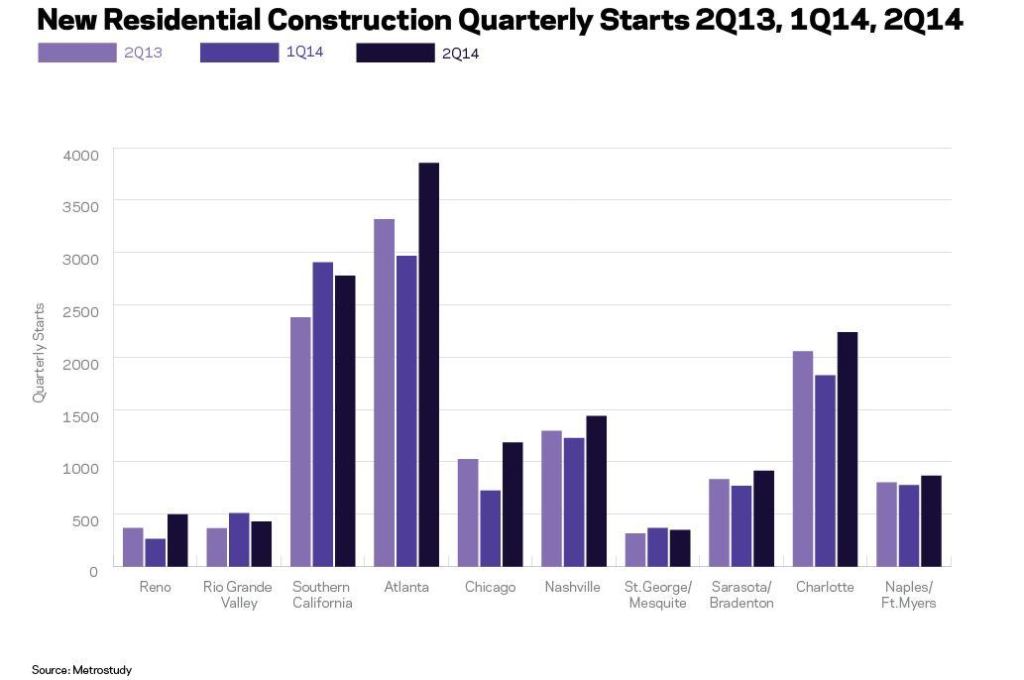

The chart that accompanies this note shows the data for total starts, including detached and attached, for the top 10 markets.

Metrostudy is calling for an 18% increase in single-family housing starts next year, based on an expectation of a (partial) return to normal rates of household formations. This represents a significant increase in the pace of housing starts compared with the 6% increase expected for 2014.

Here are the top 10 markets for year-over-year growth in housing starts based on second-quarter Metrostudy data.

1. Reno, Nev.

Reno was one of the worst ‘beaten-down’ markets during the downturn. Its recovery is from a very low base number.

2. Rio Grande Valley

The southernmost part of the State of Texas is still a small market, but starting to see more activity.

3. Southern California

Throughout coastal L.A. as well as the Inland Empire, housing demand has been recovering.

4. Atlanta, Geor.

The exurbs of Atlanta were hurt during the downturn, but demand in the central ‘Golden Triangle’ submarkets is now extremely strong.

5. Chicago, Ill.

Demand for new homes in certain Chicago submarkets is improving steadily.

6. Nashville, Tenn.

Builders have recently entered Nashville in larger numbers, seeking to serve growing demand here.

7. St.George/Mesquite, Ut.

St. George, Utah is still a small market, but it is recovering nicely.

8.Sarasota/Bradenton, Fla.

Retiree demand is coming back. That is helping Sarasota and other retiree-driven markets.

9. Charlotte, N. C.

We are seeing very strong demand from home buyers in Charlotte.

10. Naples/Ft.Myers, Fla.

Naples demand is pushing out to the more remote suburbs as prices continue to rise close to the beach.

Here, see Brad Hunter discuss the promising increases in the Residential Remodeling Index and New Residential Construction this month on Bloomberg TV.

Learn more about markets featured in this article: Atlanta, GA, Bradenton, FL, Charlotte, NC, Chicago, IL, Los Angeles, CA, Naples, FL, Reno, NV, St. George, UT, Riverside, CA, Phoenix, AZ, Orlando, FL.