A note from Orlando with a few early-going take-aways for home builders here and not here to think about, talk about, and, yes, do something about.

All the attention the Consumer Electronics Show is getting 2,300 miles away from Orlando, thanks to the drama of mortal combat between Google and Amazon for primacy in the kitchens, living rooms, and bathrooms of Americans everywhere, begs a question for those of us in housing’s trenches: Is the future here?

In real ways it is, and you don’t need to be in Las Vegas at CES to see it; and one only needs to consider how a scenario scarcely imaginable five years ago has changed that most basic of American human instincts: buying goods and services.

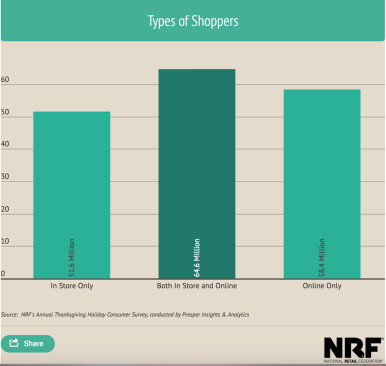

To get this party started, think back a couple of months to the holidays just past. National Retail Federation data claims that 174 million Americans shopped online and in stores between Thanksgiving Day and Cyber Monday, spending an average of $250 specifically on gifts.

Retailers’ technology investments paid off with consumers seamlessly shopping on all platforms through the long weekend. The survey found that over 64 million shopped both online and in stores. In addition, over 58 million shopped only online, and over 51 million shopped only in stores. The multichannel shopper spent $82 more on average than the online-only shopper, and $49 more on average than those shoppers who only shopped in stores.

Look again at the paragraph above. Almost half of all purchases in that three-day surge period leading up to the holidays were among shoppers who bought exclusively online.

Here’s another phenomenon to think about. We talk about a home being the most expensive “good or service” any of us purchases in our lives, and that may be true from a strictly financial standpoint. But what about choosing a life-mate, which is the No. 1 reason most of the millions of people who use online dating services cite for their participation.

Statista data tells us that, especially among more and more younger adults, finding a mate just doesn’t work the way it used to:

Dating sites and apps were most popular among younger internet users – 30 percent of U.S. internet users aged 18 to 29 years were currently using dating sites or apps and a further 31 percent had done so previously.

And what’s unnerving, especially to people in a business community and industry sector–like residential development and home building–that has been shielded, thus far, from the intensity and pace of change in other consumer marketplaces, is the speed with which the landscape is changing. It’s like the flip of a switch, and it has three huge implications for what should be very high, high priorities among participants in this week’s International Builders’ Show in Orlando, and in home building subdivisions large and small.

Implication No. 1, a Star [Rating] is Born

What major digital or real-world market–from travel, to restaurants, to retail, to any number of services–functions without some form of customer ratings and review system to assist online shoppers with their purchases and experience, through the entire value chain from prospecting to product and service satisfaction, and warranty?

Sam Rashkin, author and chief architect of the Building Technologies Office in the Office of Energy Efficiency and Renewable Energy, tells us that now that all homes can be energy- and water-performance rated just like MPG performance ratings for cars, it will not be long–months, maybe–before a standardized star rating and review system for builders will begin to gain adoption among builders, real estate agents, and consumers as a standard dimension of the buying experience. It’s what consumers, especially younger adult ones, want–and they’re voting with their feet and with their hard-earned household incomes to get that kind of experience, especially with the most important purchase they’ll make in the first third of their lives, anyway.

Implication No. 2, a New Model, Literally

One of the areas big builders are focused on most as they hammer away at opportunities to drive down their costs to expand their potential universes of buyers to ones who are currently priced out of the new-home arena, is the buying experience itself. In other words, think of all the resources production builders sequester and put in place to build model home parks and sales and design centers–the retail, consumer-facing dimension of many of their operations.

What if 75% of those same resources funneled instead into technology and data-enabled virtual and augmented buying experiences for prospects?

“What if we built just one model home per community vs. a model park of four?” the CEO of one of the nation’s top 10 publicly traded home builders mused as we spoke here in Orlando. “That changes the game economically, because what we’re investing in building, maintaining, warehousing, merchandising those models in all of our communities, we could instead develop rich experience with augmented and virtual reality tools that would both generate excitement among our future customers and strike them as relevant to their overall retail experience in all parts of their lives. It’s time for us to catch up to the rest of the way consumer businesses go to market, instead of doing this this antiquated, far more expensive way that we’ve been doing.”

So, look for a sea-change in production home building around model and design center investments diverting into technology-enabled buying experiences akin to the way 20- and 30-somethings interact with the world of commerce in general these days.

Implication No. 3, Mall Make-Overs

The Amazon-ing of America–e-commerce with its transformation of the buying, distributing, marketing, and logistics landscape–has exerted a sudden impact on traditional shopping malls, which were an innovation of the late-1950s and early 1960s. Today, many builders look at malls as so much real estate, ripe for re-purposing and, generally in very good locations given all the intense focus on the need for closer-in, more affordable housing solutions in many markets.

So, while online consumer purchase behavior and the technologies that power it are finally forcing big changes–right down to the real estate and operational resource and investment commitments builders make to give prospects a compelling buying experience, so to are those forcing new opportunities to look at land and product planning differently.

Malls that may have lost their path to the future as retail meccas may pick up a new, lucrative trail forward as repurposed, higher-density mixed-use, attainably-priced complexes perfectly situated for many metro area’s housing-starved workforce populations.

And that’s just Day One here in Orlando.

Back to you tomorrow.