Nathan Simmons and Photographics

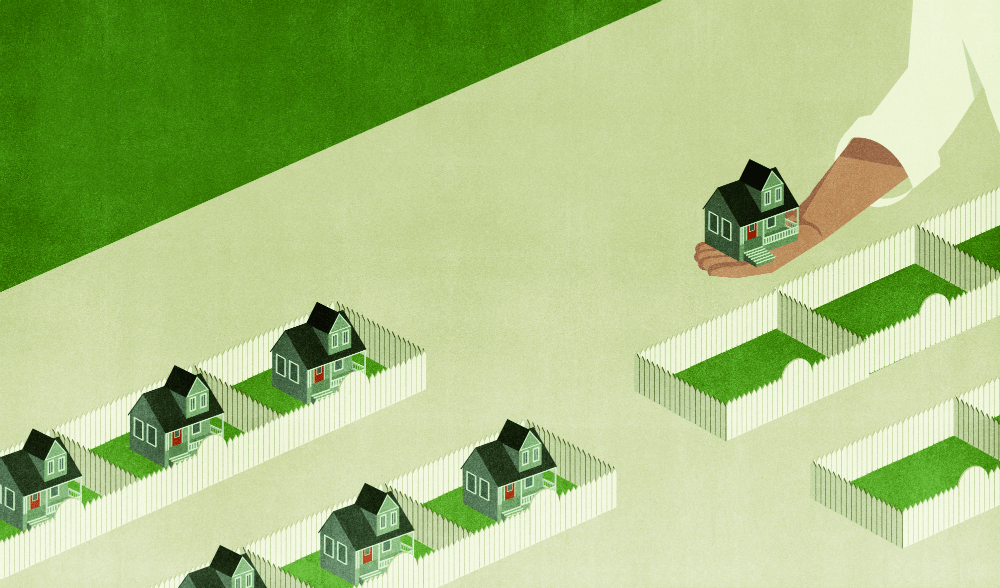

D.R. Horton’s sub-$200,000 Brunswick Place community in Houst…

Maybe D.R. Horton knows something the rest of us don’t.

Despite recent reports about the death of the American starter home, the biggest home builder in the U.S. has aggressively been rolling out its Express brand of entry-level homes nationwide. The company reported on its first quarter 2015 quarterly conference call that it had already launched the brand in 38 of its 79 markets, and planned to have it “in the substantial majority” of its markets by year’s end. So far, the results from Express—which the company introduced in early 2014 as a no-options, turnkey product priced from $120,000 to $150,000—have come in better than expected.

Express accounted for roughly half of Horton’s 35% jump in sales orders during the quarter from last year, and for 13% of Horton’s total homes sold, up from 3% a year ago. The median sales price came in at $169,000—already well above the company’s initial range, but still $100,000 less than the $275,500 median new-home price reported by the Census Bureau for February.

In an environment where many home builders say they can’t make a profit building starter homes today, Horton says its profits from the Express brand have been higher than anticipated.

“Margins have been a little better than our original expectations on Express,” said Bill Wheat, Horton’s CFO, on the company’s conference call. (The company declined an interview request for this article.) While he didn’t put an exact number on it, Wheat said it was below the company’s overall gross profit margin of 19.8%. That number was down significantly from 22.3% a year earlier, presumably because of the rise of the lower-margin Express line in its mix.

Stephen Kim, an analyst with Barclays, says D.R. Horton targets the mid-to-high teens for its gross profit margin on Express, and that the company exceeded that number here. “The initial run of Express homes generated gross margins somewhere in the high teens,” Kim says. “Horton is doing this, and apparently, they are doing it pretty well.”

Core Market

That Horton would launch a line of homes geared toward first-time buyers isn’t surprising in itself. The entry-level home has always been squarely within Horton’s wheelhouse, and analysts say its ability to leverage economies of scale and streamline processes is second to none. But it’s doing so at a time when other builders have explicitly abandoned the first-time market, citing land costs, entitlements, and an uphill battle to make even meager profits there.