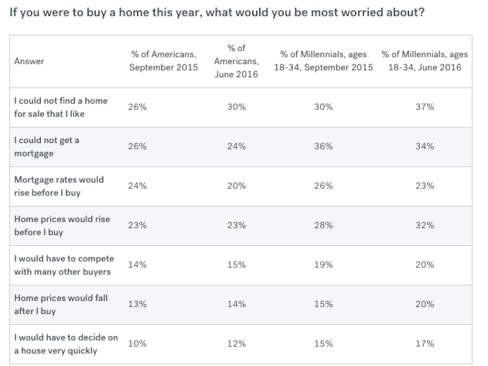

All eyes on Wall Street fixate on what’s next for the Fed and interest rates. Funny, that’s not what all eyes on Main Street focus on at all. Here, new data from Trulia–culled as recently as last week among 2,000-plus Harris Poll online survey respondents–suggests that interest rates take a decided second-place to a bigger fear among those surveyed: the fear of not finding a home they can buy.

Just shy of one in three “worry that they won’t be able to find a home for sale that they like, and no surprise here, that number rises to two out of five when you look at young adult respondents.

How many ways are there to say what we’ve been saying here for 18 months or more? Housing’s recovery is grinding its way through a supply trap. Mortgage and builder lending, labor, and lots each figure in inextricable ways into the mismatch between the prices builders’ business models can profitably deliver new homes to the market and the means of would-be buyers.

A decade ago, when the financial world was dreaming up impossibly complicated mechanisms whose aim was to keep lending money to people who were not going to pay it back*, the conclusion then was, “the models were broken.”

What about now, an environment that effectively shuts out would-be home buyers who–using background and qualification criteria that has proved to be reliable for many decades of mortgage lending history–most certainly would repay a mortgage loan on time and in full?

This model is broken too. It will lead to no good if household income levels and rent and home price levels continue to diverge, requiring debt to make up the difference. A healthy housing market–smart enterprise, solid operations and process, compelling design, and a fully-baked value and care proposition for consumers–should be able to navigate even such treacherous policy and infrastructure challenge.

Imagine this: it would take 1% of the 3.6 million Americans turning 35 this year–the leading edge of the Millennial cohort–to account for 36,000 new home deliveries.

We know that in many markets and submarkets, home builders and residential developers are ferociously working to crack the labor-lots-lending headlock and bring more lower priced homes to market in their newly-opened communities. Our 2016 Local Leaders series spotlights a number of firms making a move in their respective arenas on the back of solid entry-level and first-time home buyer community programs.

The hope is that a year from now, the No. 1 fear prospective home buyers worry about is something other than that there’s nothing out there in the market that they can afford and would be excited to own.

* Note: This is a paraphrase of a line from Michael Lewis’s “The Big Short”