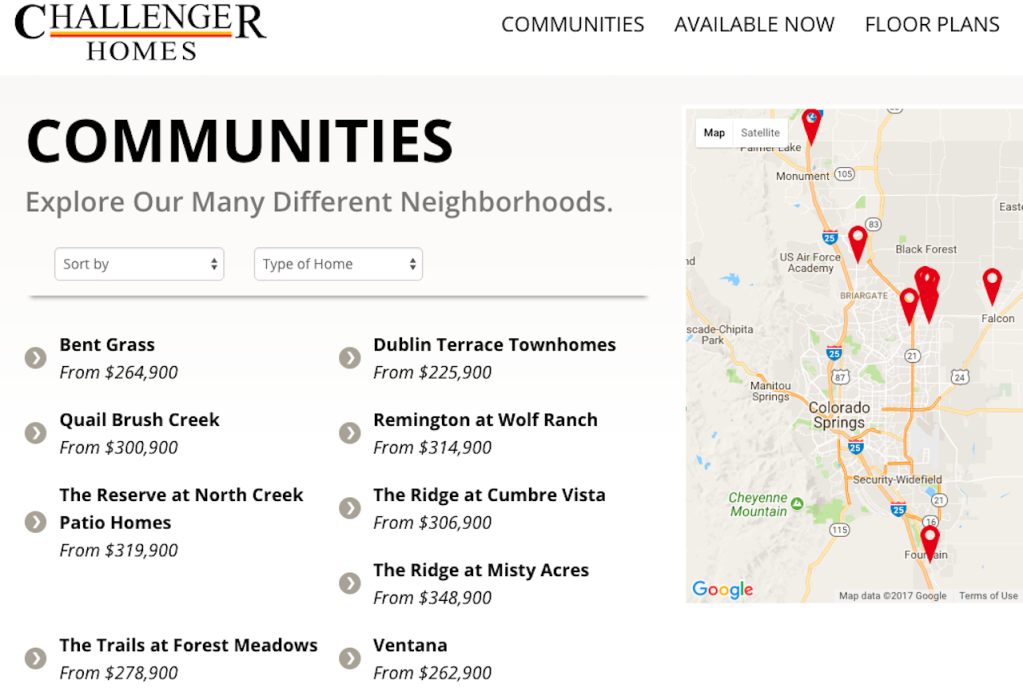

We’ll look at yesterday’s announcement that public builder-developer Green Brick Partners has acquired a 49.9% stake in Colorado Springs-based entry-level specialist Challenger Homes through three filters:

- Buyer motives

- Seller motives

- Broader home builder M&A context rolling into the latter part of 2017

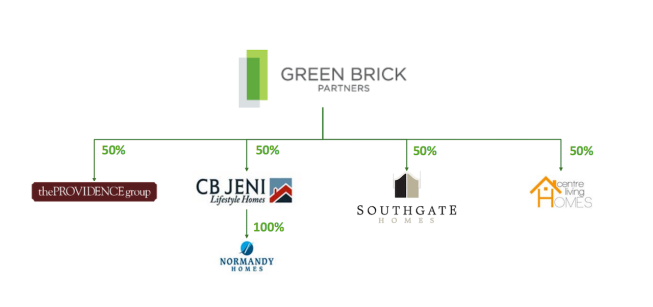

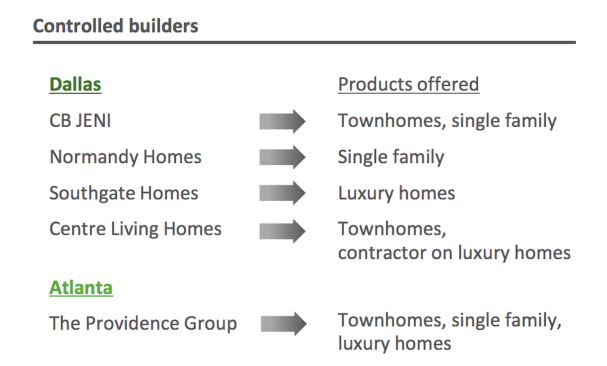

As a bit of context, Green Brick operates as a kind of capital, land development, and home building management strategic team that partners with well-led operator partners on the ground in each marketplace. This hybrid venture model taps into a “best-of-both-worlds” business structure that gives its operator partners strong entrepreneurial autonomy to do what they do best, and at that same time leverages scalable efficiencies around access to capital, purchasing, management systems, etc.

Source: Green Brick Partners

For Green Brick, adding Challenger to its stable of five partners–four in the U.S.’s hottest home building market of Dallas, and one in Atlanta–gives the well-managed, low-leverage enterprise a third geographical leg of its hot-market stool, the sizzling Denver market. The deal is the first transaction it has been able to get across the finish line since it formed in its current structure in 2014, with a platform of five builders–Atlanta-based The Providence Group, and Dallas-area operators CB Jeni, Normandy Homes, SouthGate, and Centre Living Homes. Not for lack of trying.

An executive with knowledge of the transaction notes that in the current recovery cycle’s 60-or-so mergers and acquisition deals since about 2011, this one is a first of sorts. No other public to private company venture has been a true minority–below 50%–ownership stake, which has compelling strategic implications in the current stage of housing’s recovery cycle.

In some ways, the deal bears striking similarity–from a strategic motivation standpoint–to the venture Colorado-based public firm Century Communities formed with Wade Jurney Homes last Fall with a $15 million investment for 50% of the firm. What distinguishes the two deals, however, is important to note, especially given that the Green Brick-Challenger is a first of its kind.

Source: Green Brick Partners

First, there’s the geographical footprint expansion; second, access to a well-modeled fast absorption-rate land-light lot acquisition system and access to 4,000 lots under control, to boot; third, highly regarded expertise in new home building’s fastest-growing customer segment and price point, entry-level; and fourth, a management team and company culture with pronounced strength in construction management and operational programs hell-bent on growth and further process improvement.

However, as we’ve said, the noteworthy difference between the Century-Wade Jurney deal, as well as some of the transactions Japanese companies Sumitomo Forestry Group, Sekisui House, and Daiwa House are structuring with U.S. private operators is that Green Brick’s stake is a true minority, not a controlling, interest.

This has both financial and strategic significance, for this structure reduces Green Brick’s on-the-books financial exposure as well as its out of pocket cash for the equity stake it has acquired. To the extent that Green Brick–which is also a land developer–gets access through the deal to Challenger’s 1,800 owned home sites, and 4,000 controlled lots, the deal also hearkens to the Lennar-FivePoint, and the D.R. Horton-Forestar deals that pair home building and development skillsets and put them into more manageable discrete financial and accounting buckets.

Further, this capital investment runs consistent with the relationship Green Brick has with its other owner-operator partners, which strongly affirms current management, culture, and local operational models.

From seller Challenger’s–which was advised in the transaction by Zelman & Associates–perspective, the deal reflects private home builder operators’ solid position of strength these days among the various and sundry would-be buyers out there, ranging from strategic public home builders looking to scale up in their current footprints or expand opportunistically in markets with growing jobs economies, to the aforementioned Japanese companies, to Berkshire Hathaway manufactured home giant Clayton Homes, which has also been buying site build operators.

“Challenger management’s ability to negotiate a minority transaction gives a sense of the leverage private companies have as sellers,” an executive close to the deal told us.

Reflecting the trust, the chemistry and shared vision of the respective leaderships, and the strategic view Challenger’s management is taking regarding the Green Brick partnership, its principals accepted equity in Green Brick stock for consideration as part of the value of the deal.

“From Challenger management’s perspective, receiving shares in Green Brick can be seen as their belief in the upside of the partnership. It gives them the liquidity optionality if they want it, or the greater returns long-term as well.”

The Colorado market, we’ve seen, is a hot one given the constraints on lot pipelines in a heavily regulated, expensive area to develop, and the ongoing flow of strong demand in a complete spectrum of customer segments ranging from entry-level, through move-up, luxury, and 55+ buyers. A capital infusion allows Challenger to smooth out its forward-looking operational model, which can help secure a more stable team of labor crews with guaranteed work, both present and future, and measured construction cycles.

Stepping back, the August deal suggests that even in an environment where certain strategic players are trying to reality-check their growth plans for a period of increased uncertainty, volatility, and a possible pause in economic growth in the next couple of years, others are pressing forward to grow aggressively.

We expect deal flow to continue to reflect the continued execution of Japanese company investment and operations strategies, as well as Clayton Homes’ ongoing exploration of synergies between site-build and offsite manufactured housing, and public-to-private opportunism for deep market scale and hot-market expansion.

Lastly, we see the possibility that one or more of the smaller, more recently formed public companies may–due to capital investment triggers or strategic constraint–find an interest in selling to a major public while the getting is good.