It’s one thing to recognize a material risk to housing’s continued recovery–the real and widening gap between the financial means of would-be new home buyers and the availability of homes within those means–and it’s another thing to do something about it.

A known critical contributor to that challenge has been student debt, which has been the source of both real and psychic drag on a full housing market recovery because it has diminished the universe of young would-be home buyers with the means to buy, as it has muted confidence as well.

A piece of research published this past July from the Federal Reserve Bank of New York helps illustrate and quantify the effect of college loans on recent homeownership trends. The New York Fed’s analysts track a pattern of increased college tuition to increased per capita student debt to an increased level of educational attainment, but to a decreased overall spending power among young adults. They write:

Analysis demonstrates that the tuition hike and student debt increase, despite leaving higher educational attainment unchanged, can explain between 11 and 35 percent of the observed approximate eightpercentage-point decline in homeownership for 28-to-30-year-olds over 2007-15 for these same nine cohorts. The results suggest that states that increase college costs for current student cohorts can expect to see a response not through a decline in workforce skills, but instead through weaker spending and wealth accumulation among young consumers in the years to come.

Here’s a view of the increase in student debt load averages among 24-year-old adults.

Source: NY Federal Reserve

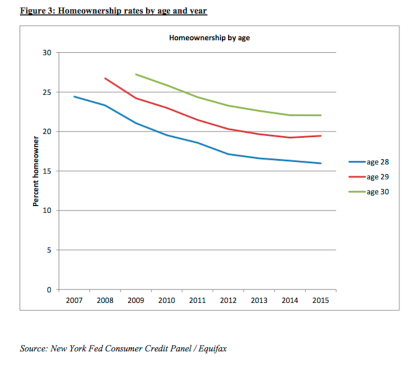

And here’s a look at homeownership rate trends that follow the Great Recession and the spike in college tuitions and student debt.

Source: NY Federal Reserve

Now, two positives have occurred in the past 24 to 36 months, as the millennial cohort’s leading edge began crossing the threshold in to their mid-30s.

One is that that vanguard of mid-30-somethings has gone some distance at paying down or retiring their student debt. Job formations have been strong over the past half-dozen years, and household incomes have showed signs of strengthening over the past year or two. What’s more, biological clocks continue to do their thing, albeit on a later timetable than has been the case in the past, so family formations among millennials are slowly gaining momentum.

The other positive is that more builders have fully activated entry-level home and community product development, an operational dimension most of them had mothballed during the early stages of housing’s recovery when most of the buyers were discretionary luxury and first- and second-time move-up type home buyers.

Now that those entry-level operational programs are fully-engaged among the production builders, they’re anxious for ways to amp up the volume so that they can pull greater overhead costs through a higher rate of orders per community per month.

The chicken-and-egg situation for them is that they need demand to pick up so that they can scale up operations, spec building, and starts on the ground, gain efficiencies, and try to drive those cost efficiencies back into how they price homes for entry-level customers.

With value-engineering, square footage managment, streamlined floorplans, density, and efficient materials selection, builders have gone about as far as they can to get price tags as close to existing home prices as they can. But there’s still a wide premium gap.

To gain more flexibility on pricing, builders need visibility into a greater stream of demand, and one of the only ways to gain that visibility is to expand the net of potential buyers. Here’s where we come back to young people encumbered by student debt.

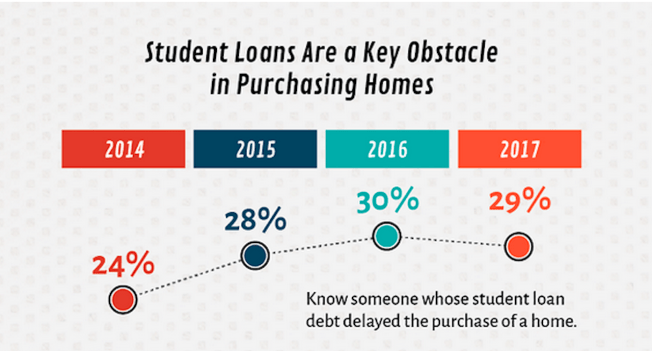

A new study from NeighborWorks America spotlighted student debt as a real drag on the current recovery. The fifth annual national housing survey dramatically affirmed that more than 9 of 10 adults believe homeownership and the American Dream are directly connected, but it also raised the specter of diminished attainability. It notes:

In 2017, 29 percent of adults knew someone who delayed the purchase of a home because of student loan debt, compared to 30 percent in 2016* and 28 percent in 2015*. Among millennials (adults ages 18-34), 38 percent knew someone who delayed buying a home because of student loan debt.

The moment of truth for the housing recovery comes down to this. How do you close or narrow that gap between wage-earning households who are on a low-but-upward income trajectory and the types and costs of homes available on the market right now?

Lennar’s announcement this week that its Eagle Home Mortgage unit has unveiled a mortgage program with a feature that helps pay off outstanding student loans – up to $13,000, depending on sales price, is a salvo intended to expand the home buying universe to include young people still paying off their college loans.

Will others follow suit?

Here’s three points of commentary from Cleveland Research Company partner and analyst Omaar Aleem.

- We believe this is a move by Lennar (a move that seems to have been determined somewhat recently) to generate some incremental volume heading into 2018 particularly in an area where they have struggled to gain traction to this point in the recovery (entry level buyers).

- We do expect other top 50 builders to follow suit with similar new programs shortly.

- Fannie has agreed to back the loans (and also ensure the value of the loan payment is not included in appraisal).

This business has always had strategic leaders, and many others who follow, recognizing a tide of support for doing so.

We see that changing, gradually. First to market strategies will leave fewer and fewer spoils to followers. That’s why it’s noteworthy when an organization shifts from recognition of a challenge to action to address it head-on.