Builders, to listen to them, spend serious time wondering what planet people from the business press, like yours truly, are on.

The questions keep focusing on “what’s going to happen as mortgage rates go up?” and “how are new tax laws about what’s deductible or not affecting buyers?” or “won’t the threat of a global trade war dampen consumer confidence?”

The answers, up to now, anyway, are along the lines of “demand is not the problem in housing right now.”

Add up the negatives, the suppressors, the drags that could potentially dent or diminish the number of people looking right now to buy a home, and stack them against the trifecta of a growing economy, solid jobs and income outlook, and sheer demographic patterns of adult household formation and housing preference, and you can’t but agree with builders who feel the press simply ask the wrong questions.

Doug Bauer, ceo of TRI Pointe Group, a top 15 home builder in the United States, puts it this way:

“The real story,” says Bauer, “is the shortage of housing throughout the United States, which is creating jobs, and now wages are going up, and you’re seeing Millennial household formations picking up. We’re in 15 markets in eight states, and I can tell you, there’s demand out there. From what we’re seeing, issues like interest rates and the new tax laws may be exerting some impact on how much people are able to or willing to pay for a home, but those factors are not affecting the fact that they’re going to buy something.”

In enough cases, Bauer believes, the effect of rising cost of monthly payments and the disappearance of tax benefits in having a mortgage and paying property and local taxes is neutralized by growing expectations for higher income, a larger standard deduction for individuals and married couples and the fast-ticking biological clocks of a Millennial generation whose leading edge has reached its mid-30s.

“We’re seeing what we characterize as a ‘pull-push’ effect,” says Bauer. “Rising mortgage rates, and the prospect of them going up more, is pulling people off the sidelines into the market for home purchase now. And the calculations on how the new rates, or loss of tax benefits push them, perhaps, to a lower price point, a less expensive plan than they might have, but those influences don’t change the decision to buy in the first place.”

Bauer’s take on the Spring 2018 market–as much as my fellow journalists might see it otherwise–is simple. And it’s a take that’s well understood by every home builder, big or small, in the business right now, fighting the three-headed monster of impact-and-entitlement fees, labor expense volatility, and materials price spikes. It’s the supply, stupid! Other topics than that, right now, add up to little more than the noise of “headline risk.”

National Association of Home Builders chief economist Rob Dietz phrases it succinctly in another, albeit more evidence-based, way:

A lack of existing home inventory continues to drive growth for residential construction and sustain strong home-builder confidence—now hovering near a two-decade high. The limited inventory currently represents only a 3.4 months’ supply, which is pushing up prices for homes and intensifying the demand for construction activity.

However, limited access to labor and rising prices for building materials continue to inhibit the expansion of construction. For example, there are roughly 250,000 unfilled positions in the construction sector, which is near a post-recession high.

While materials prices and capital costs rise and fall cyclically, aided by the switches and levers of capacity and constraint, the more structural impediments to better balancing new home development and construction with the needs of people who want to access it based on a reasonable combination of household savings and earning come down to two areas of focus.

They are productivity (a combination of skilled labor and skilled management of value creation) and real estate acumen (a combination of land buying and the ability to generate value on it disproportionate to the purchase price of the lots).

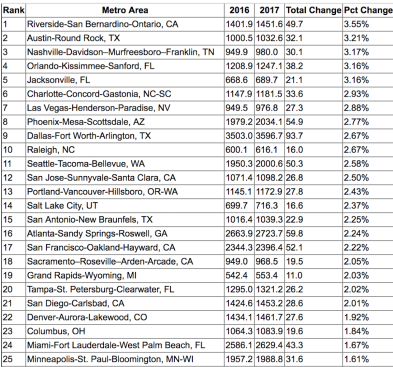

You will notice no mention of terms often used to characterize builders’ and developers’ obstacles to offering more of what a seemingly deep and growing pool of people demanding homeownership would willingly pay for: new homes priced below a symbolic line of say $260,000, depending on the market. Here’s a look, from the Wall Street Journal at where incomes are growing the fastest.

We’ll, this once, refrain from using those terms, because we’d like to imagine that builders and developers–being nothing if not one of the shrewder, most clever, opportunistic, and inventive business community when it comes to dealing with adversity and constraint–are quietly figuring out how to turn these externalities into matters they can do something about.

Put into a framework of productivity and real estate acumen, adverse conditions for a majority of players in the business community are what precisely define opportunity for a few.

A few builders today look at job growth, household income growth, household formation, and a burgeoning economy that’s pivoting into a new technology-enabled era of value creation, and they see purpose, productivity, and precision–after all, strong data can turn a municipality’s costly resistance to growth into wholehearted support for it on a dime–as the difference they can bring to home building’s challenge of the moment. It’s all about supply, what you supply, how, and for how much.