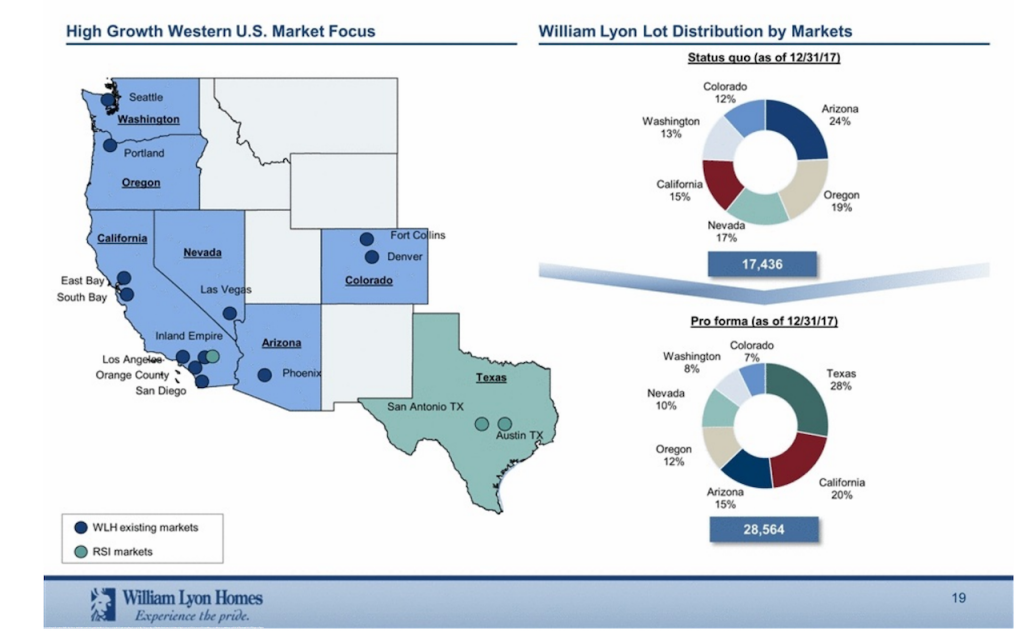

On the surface of yesterday’s announcement, William Lyon Homes entered the Texas market–Austin and San Antonio– and added Inland Empire California operating leverage with its $460 million all-cash purchase of RSI Communities.

The deal, building on William Lyon’s 2014 acquisition of Washington and Oregon regional power builder Polygon Northwest, expands one of home building’s smaller publicly-traded builders in geographical footprint and local scale in the resurgent California Inland Empire market.

Adding in RSI Communities‘ expected volume and sales in 2018, William Lyon could leapfrog in its position in the Builder 100 from 20 to among the top 15, in the unit sales and revenue categories of TRI Pointe and M/I Homes, which currently rank 13 and 14 in the rankings. As of the time of the deal, RSI has 29 actively selling communities, with a total of 11,128 owned and controlled home sites. In 2017, RSI started 920 homes and delivered on 461. So, now, William Lyon begins to look more like an enterprise that may continue to grow as a strategic acquirer and through organic growth, vs. become an acquisition target among home building’s ever-more concentrated mega-publics in the top five.

Important to remember here as well, the William Lyon purchase is about more than footprint.

Reminiscent of the November 2016 investment by Century Communities in fast-growing Southeastern U.S.-based Wade Jurney Homes, the William Lyon Homes acquisition of RSI gives the buying organization an instant rocket-boost in capability, designs, platforms, and operational processes to engage the expanding addressable market of entry level home buyers.

William Lyon can now deploy much deeper resources than RSI would have had access to on its own to expand its model, enter new Texas markets, and even port the operational and design template into William Lyon’s other operating spheres.

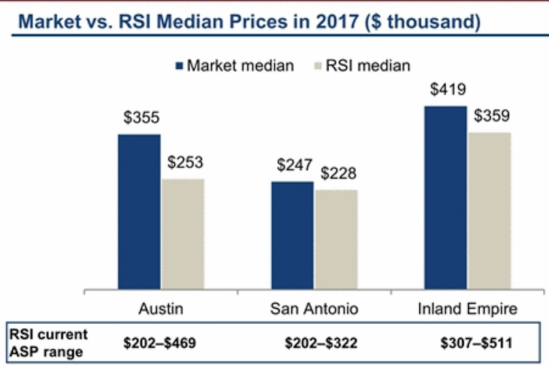

Here’s a key metric in why RSI Communities matters to William Lyon well beyond the land asset of 5,620 owned and 5,508 controlled building lots, the buyer now adds to its pipeline.

70% of RSI product is below FHA limits

Millennial buyers are a thing now, if not yet a phenomenon, and entry-level has entered a “great expectations” stretch in the current construction economic cycle. Tax cuts, the smart money’s betting, will likely wind up net favorable on the lower-priced tiers of the market even as they may do some harm to prices and movement in the high-end. The RSI Communities acquisition gives William Lyon not only immediate, accretive volume, revenue, efficiency opportunity, and, in some cases, deeper local scale, but something else. A hedge against exposure to above FHA-level price-points.

Moreover, it’s not simply about the product or the pricing, it’s about understanding the entry-level buyer and how to offer homes and communities that compel and excite them about moving.

And this is where there may even be an unstated third agenda item influencing William Lyon’s interest in RSI. While its core business has been for-sale single rental, RSI has also been a pioneer in the building-new-for-rental business, an asset class and housing preference type that has been getting more and more attention from single-family for-sale builders.

Having developed a couple of the first fully-strategic single-family rental communities, RSI’s understanding of that millennial adult who may or may not be ready or willing to make the choice of new homeowership is part of the RSI DNA now.

We’ll be curious to see whether that business model becomes one that William Lyon considers as among its strategic opportunities or not. But it does make sense, and we’ve heard that other big public builders are putting single-family for-rent into their business model mix in the present or near future as well.