We’re catching up here, on Five Point, the boldly modeled, 360-degree wager that expertise in the art of hairy deals and a real-world balance of residential, commercial, and industrial development will make for a good fit in the California economy over the next decade.

Just before we departed for holidays, on May 9, Aliso Viejo-based Five Point Communities took itself public on the New York Stock Exchange, raising just shy of $300 million, thanks in large part to an infusion of $100 million from Five Point’s loving parent and biggest fan, Lennar.

The heart and soul of the venture, visionary Emile Haddad–it could be said–saw promise and never wavered in an obsessive pursuit of Five Point’s assemblage of high-risk, high-reward exclusive real estate plays–Great Park Neighborhoods, Newhall Ranch, and The San Francisco Shipyard in Candlestick Park–three moonshot masterplans that collapse the bounds between residential, commercial, and light industrial real estate development. Together, the tracts are zoned to include 40,000 residential homes and 21 million square feet of commercial space.

Orange County Register reporter Jeff Collins offers an overview, highlighting the risk-reward proposition in Haddad’s Five Point vision here:

While environmental concerns have hampered some of FivePoint’s projects, the Great Park Neighborhoods development remains a bright spot for the company.

In its pre-IPO filing, FivePoint reported the project has generated nearly $1.6 billion from sales of 41 percent of the planned Great Park Neighborhoods home sites on the former Marine base. If the remaining 5,634 home sites sell for the same amount as FivePoint got for properties sold so far, it stands to get $2.3 billion more, generating a total of $3.9 billion.

Per a statement, Zelman recently served as Joint-Bookrunner for Five Point Holdings’ successful $338 million Initial Public Offering on the New York Stock Exchange (Ticker: FPH) that priced May 9, 2017. The offering generated significant investor interest and shares have appreciated ~14% in aftermarket trading.

What we find to be most intriguing about the Five Point strategy is its holistic, mixed-use community model that can avail of its own and Lennar’s deep and diverse bench of expertise in both residential and commercial development, design, marketing, and local planning, political, finance, and customer relationship management. Collins reports that Lennar CEO Stuart Miller was undaunted that the IPO priced shares a good deal lower than Five Point’s initial targeted share price, focusing instead on the opportunistic position, strategy, and business plan in a market whose dynamics would appear to need what Five Point offers. Collins notes:

“Remember, around the residential side of this business, you’re looking at supply constraint. And California is ground zero for supply constraint,” Lennar CEO Stuart Miller told CNBC on Wednesday. “Demand continues to grow, and the job market is strong, especially in these markets in California. It’s a great time to be a residential builder.”

In addition, FivePoint will be able to capitalize on the latest trends in office and retail development, without being “locked into yesterday’s obsolescence,” Miller said.

We think the business model, which leverages a hybrid commercial, residential, for-sale, for-rent, and below-market-rate affordable offerings in land-constrained infill areas might be a viable, iterative, and potentially scalable business plan in other markets that we may see others–Toll Brothers, most evidently, and others–try to map to.

Home builders have thrived as community builders for decades. It’s the definition and make-up of community itself that’s changing and it seems that Five Point and it’s god-parent Lennar seems to have recognized that earlier on than most.

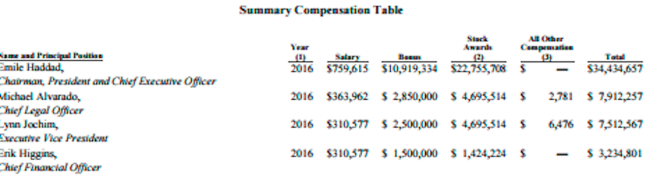

On a side note, we’re intrigued that Emile Haddad would have ranked No. 1 in our line-up of public home building enterprise CEOs for 2016, with a $34 million total package, including stock in the new company.

Probably deserved, since Haddad made believers of so many after it was only he who believed in what Five Point could be in 2009, in the throes of the downturn when Five Point started up

.