The end of 2006 is just around the corner and with it comes the end of the accounting year for many builders. Is your custom building company ready? Are there any last-minute tax-saving steps that you can take to cut your company’s and your personal 2006 tax bill? Are there any transactions you need to make to beef up your year-end financial statements? Following are some ideas to discuss with your tax professional prior to your company’s year-end:

Tax Deferrals

The deferral of income and the associated tax can be the equivalent of an interest-free loan from the government. Additionally, if the proceeds of that loan are invested wisely enough, money can be earned to pay the original tax on the income. A basic principle of taxation is to accelerate deductions. The acceleration of deductions by a taxpayer postpones the payment of taxes and thus gives the taxpayer the use of the money in the intervening period. This is true whether the taxpayer’s bracket is expected to go up or down. With rare exception, it is always better to defer income taxes. Following are some ways to do it:

- If your company files its tax return on a completed-contract basis you should consider deferring closings on house sales. When scheduling closings around year-end, you may want to consider pushing as many as possible into 2006 in order to accelerate income or postponing them until 2007 in order to defer income.

- Accelerate payment of overhead expenses. This technique works best for cash-basis taxpayers. To accelerate deductions for 2006 you may want to pay as many overhead payables in the current year as possible. If you have cash available you may want to consider prepaying some of your January 2007 expenses. If you will owe state tax for 2006 you may want to prepay it before year-end to get the deduction for your federal tax return (but be aware of possibly getting hit by the alternative minimum tax if you are in a state with a higher state tax rate).

Domestic Production Activities Deduction

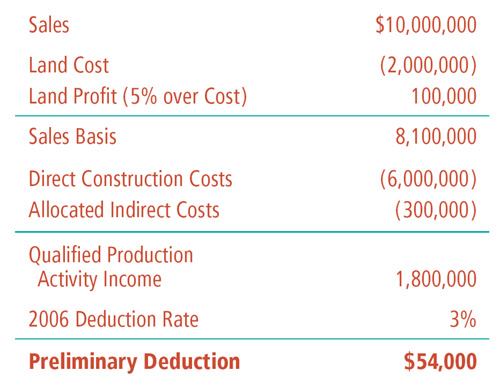

Section 199 of the IRS code provides builders with a tax deduction in 2006 of up to 3% of qualified production activity income with the deduction increasing to 6% in 2007 and 9% by 2010. Qualified production activity is equal to adjusted gross profit, which is defined as sales less direct construction costs less an allocation of indirect construction costs as outlined in section 263a of the IRS code. For custom builders building on their own land the market value of the land (defined as cost plus 5% if the land was held for less than five years, cost plus 10% for land held for up to 10 years, and cost plus 15% for land held up to 15 years) needs to be deducted from sales while the land cost is deducted from direct construction cost. This deduction is limited to 50% of W-2 wages paid in the calendar year.

The following is an example of how this deduction works. ABC Custom Homes, a builder electing to report earnings on a completed-contract basis, closed 10 homes with total revenue of $10 million. Construction costs included direct construction costs of $6 million and land held for less than five years with a cost basis of $2 million.

As long as the W-2 wages for the year exceed $54,000 and do not put the company into a loss for tax purposes, ABC Custom Homes can claim a deduction of $54,000. If ABC is a flow-through tax entity (S Corp, LLC, sole proprietorship, partnership), the deduction flows through to the stockholders, members, or owner.

Owner’s Compensation

Custom builders who are S Corporations should talk to their tax professionals about possibly reducing their W-2 wages, resulting in a reduction in payroll taxes. According to the IRS, shareholder-employee wages of S Corporations need to pay themselves “reasonable” wages. How low can you go? This is a matter of judgment, and documentation supporting your position is strongly recommended. Clearly, the stated salary need not be any more than what would be necessary to hire an outsider to perform the same job. One note of warning: When deciding to replace wages with distributions, be careful not to reduce your basis in the company (tax basis equity) below zero. Distributions in excess of an S Corporation’s stockholder’s basis may be subject to additional capital gain taxes.

For C Corporations it is important to pay any bonuses to over 50% of stockholders and officers prior to the end of the year in order to get the tax deduction in 2006. Employee bonuses can be accrued and paid in 2007, but officer and stockholder bonuses must be paid in order to take the deduction.

Home Energy Credit

If you are building energy-efficient homes, you may be entitled to a tax credit of up to $2,000 per home. This credit is available on homes built with heating and cooling consumption less than 50% of a comparable home constructed in accordance with certain federal standards. The home must also have building envelope component improvements providing a level of heating and cooling energy consumption that is at least 10% below that of a comparable home.

Depreciation

Pay attention to your equipment purchases. The proper timing of equipment acquisitions can increase or decrease the overall depreciation deductions for the year. A general depreciation rule—called the half-year convention—is that a business can deduct an entire half-year’s depreciation for all equipment placed in service anytime during the year. However, if more than 40% of the cost of all equipment purchases took place during the last quarter of the year, the “mid-quarter convention” rule kicks in. Under this rule, depreciation on assets placed in service during the last quarter of the year is limited to only one and one-half months instead of six months of depreciation. If this rule comes into play, depreciation is also limited on purchases made during the first three quarters of the year.

If you are looking to purchase a new vehicle to be used in the business beware of depreciation limits on the purchase of passenger vehicles used in the business. A passenger vehicle with an enclosed body that is built on a truck chassis is not considered a passenger vehicle if it has a gross vehicle weight rating above 6,000 pounds.