Equal parts brand new and deja vu, the first of what strategists and investors intend to be a roll-up series of private firm acquisitions into an eventual super regional home building powerhouse got done last week.

Stoneridge Homes, an eight-year old company with strong pedigree, “cred,” and a solid growth trajectory from its base out of Huntsville, Ala., and the Nashville, TN, market periphery, is the charter seller to American Southern Homes, (ASH) of Vienna, Va., an entrant with plans to scale over the next year or two into a Southeast regional moonshot.

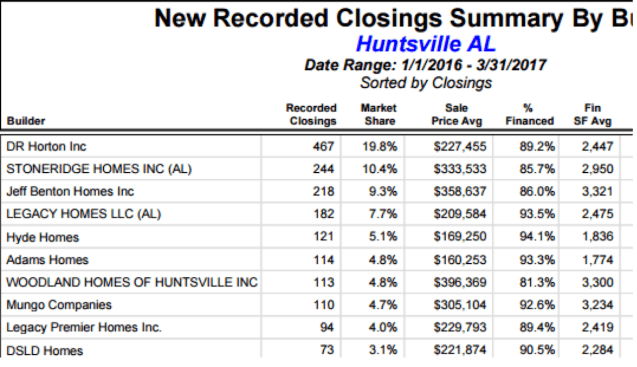

Stoneridge, ranked No. 157 in our Builder 100/Next 100 rankings, closed on 214 homes on revenue of $69 million in 2016–22% growth in volume and 25% revenue growth vs. 2015–is the No. 2 home builder by volume in the Huntsville, second to D.R. Horton, according to BUILDER sibling analytics company Metrostudy.

Acquirer American Southern Homes plans to establish its beachhead with Stoneridge, and build out an NVR-like “land-light” business model and market scale by purchasing home building entities–with their principals and operating teams staying in place–rather than acquiring the land assets owned and controlled by the seller.

“In the Southeast, there are fewer government and regulatory controls and fees to deal with than in other U.S. regional marketplaces, and this region has truly become the growth sector of the U.S. economy,” says James Martell, founder and principal at American Southern Homes.

If the American Southern Homes roll-up idea strikes you as familiar, so will the name of the business model’s principal architect and strategic driver, James Martell. Yes, the very same Jim Martell who helped Dwight Schar take NVR public in 1986. Also, the same James Martell who spearheaded the mid-1990s formation of the Fortress Group, a public home building organization that popped up practically out of nowhere with a capital strategy, rapidly acquired and assembled a dozen private home builders into a new national confederation of operators generating nearly $700 million on 4,000-plus home deliveries, and–within six years–broke down and dissolved under the weight of its debt-load.

J. Marshall Coleman, a former Virginia state attorney general and a legal, investment and advisory partner in the Fortress Group brain trust, is part of Martell’s current board of advisors, as American Southern Homes prepares for a more expansive capital structure. So too is Steve Friedman, formerly a vice president with Ernst & Young and most recently chief financial officer for Walton Development & Management.

“The lessons we learned from back then apply now,” says Martell. “We’re going to take our time, put the right operational, technological, and financial platforms and processes in place at Stoneridge to allow it to grow, and then move forward to assemble our program with other builders. The other big lesson is that the type of builder, the people matter to us. In the past, we didn’t pay as much attention to the people, but we’re interested in keeping the management team in place, so it’s got to be a good, smart cultural fit.”

The “fit” with Stoneridge pairs Martell with one-time Kimball Hill division president Jim Wright and his wife Kim (president of Stoneridge), who started Stoneridge during the throes of the downturn in 2009, and have grown it steadily as a move-up and second-time move up builder with an emphasis on customer care, personalization, and close ties with its subcontractor base.

“To be honest, we were not looking to sell, but when [mergers and acquisition advisor] Michael P. Kahn introduced us to Jim [Martell], my wife and I felt this was the right thing to do for Stoneridge and the original team of people who’ve been helping build it,” says 69-year-old Jim Wright, a U.S. Air Force vet with home building experience as both an entrepreneur–he co-founded Huntsville-based Alabama Heritage Homes–and a big builder associate with Westminster Homes (bought by K Hovnanian), as well as Kimball Hill. “We’ve been in the Huntsville market now for 18 years, and we’ve got the lot positions and the relationships to keep growing here, and I’d like to take it up to 250 or 300 closings this year, and possibly expand into Birmingham.

“Our team of construction managers and other folks are like partners, and this deal allows us to move forward with that team and grow.”

Martell’s focus for the moment will be on integrating Stoneridge operations, construction, finance, and customer data into a Constellation Financial Systems software platform built for expandability.

“Our structure, which takes a position in the entity, but keeps the land assets separate, puts us in a position to take down the lots on a real-time basis, but they’re not on our balance sheet,” says Martell. “With a financial approach we adopt from the NVR model, and an approach to taking a top position in secondary markets like D.R. Horton does, we reduce our land risk and improve the odds of being able to grow off the radar of competition from a lot of the big public builders.”

Stay tuned for more deals ahead for American Southern Homes.