FLUSHED FROM THE EXCITEMENT OF committing to a new home—and the whirlwind of option decisions that follow—buyers all too often find their emotions tanking as they plunge into the unforgiving reality of financial and closing details. Buyers often feel whip-sawed as they trade pleasant notions of design flourishes for the arcane world of variable versus fixed rates, sliding points schedules, amortization options, balloons, escrow arrangements, and settlement costs.

It is little wonder buyers feel like they’ve hurtled into a dark tunnel, facing a process fraught with frustration and seemingly incomprehensible requests. Even the best lending representatives have their work cut out for them trying to make an inherently joyless experience somehow enjoyable.

Once again, the challenge for most builders is recognizing how best to satisfy buyers’ objectives in addition to their own.

The Buyer’s Objectives

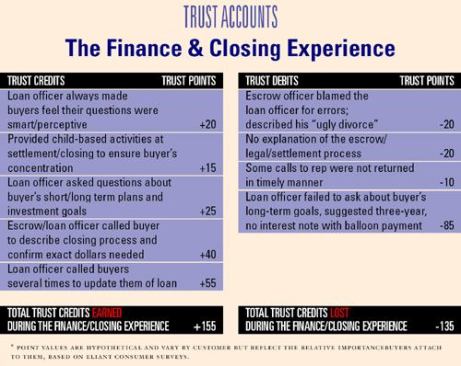

Finance and closing is the phase of the home buying experience in which many buyers say their trust is most severely tested; where the buyer’s faith in the skills and sincerity of the team’s personnel—while absolutely required—too often seems unjustified.

It’s often evident to the buyer, rightly or wrongly, that the builder is aiming for profitability and process efficiency, while the buyer’s primary considerations are affordability, anxiety reduction, and a sincere desire to trust the finance personnel.

Due to the general uncertainties inherent in this phase of the home buying experience, buyers’ anxieties are as high during financing/closing as they will later be during move-in. According to ongoing surveys of new home buyers conducted by Eliant, high anxieties about the financing and closing process generally emanate from several contributing, yet controllable, factors.

To turn this situation around, sales and lending teams need to consider the process from the buyers’ eyes and ask: What would the builder, lender, and escrow agent have to do to absolutely delight you?

Beyond A Good Rate Many builders believe that the lending representative can earn a fairly good satisfaction rating by simply providing the buyer with a loan at a good loan rate. However, this basic assumption—comparable to the belief held by most builders that simply providing a quality product should be enough to earn the buyer’s loyalty—is an efficient route to mediocrity.

Builders that approach this standard usually begin by defining the kind of experience they want their buyers to have. For instance, how would they like their buyers to feel during this part of the home buying ride? Ecstatic? Delighted? Comfortable? Anxious? If delighted, how does their process need to be designed to ensure this reaction from the buyer? The goal is to reduce the buyer’s anxiety about financing and closing. Some suggested actions: