In announcing that it has agreed to acquire AV Homes for $490 million, Taylor Morrison would come within reach of leap-frogging KB Home in the Builder 100 pecking order, creating an 11,000-plus home, $5 billion top-five home building empire.

The $21.50 per share–60% cash and 40% in Taylor Morrison stock–deal’s details in market geography, customer segmentation strategy, price-point positioning, and construction operational processes reflect both a strong incoming fit and a big ongoing demographic opportunity for Taylor Morrison over the next stretch if the transaction closes as expected sometime in the third or fourth quarter of 2018.

For fit and immediate synergistic opportunities to capture a promised $30 million and more in operational efficiencies in the first 12 to 24 months, the 1.1 times book value deal checks several important boxes apart from its attractive pricing, not the least of which that the two are headquartered in Scottsdale, Az., within a stone’s throw from one another. Additionally:

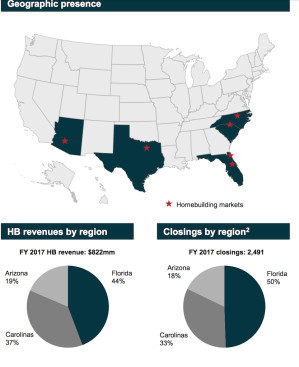

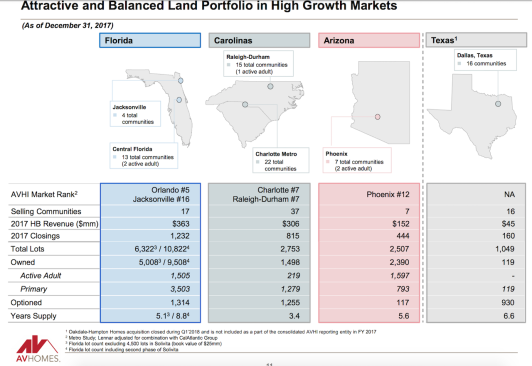

- AV–which will add 70 new active communities and a 17,000-lot pipeline to the Taylor Morrison asset portfolio–operates in the same geographic footprint as Taylor Morrison, with the exception of the hot Jacksonville, Fla., market, which Taylor Morrison would gain entree into via the deal.

- AV’s customer segment focus on active adult buyers and entry-level first-time buyers matches strategically profiles of buyers Taylor Morrison now serves and plans to grow over the next decade.

- A third “fit” might be considered to be business cultures that have been on a fast-growth trajectory over the past few years, both Taylor Morrison and AV having been active acquirers of private operators, especially in hot southeastern U.S. markets stretching from the Carolinas, through Tennessee, to Atlanta, and down on into Florida.

- As for the opportunity ahead for Taylor Morrison, it’s all about the “who” and the “where” of growth over the next 10 years, and the extent of hedging and financial prudence needed both to emerge as one of the few dominant players serving 55+ and young adult Millennial home buyers in the next decade, and to safely navigate expected economic and housing cyclical pivots and challenges during that 10-year stretch ahead. Fundamentally, the operational model and $100,000-plus average selling price differences that currently separate Taylor Morrison from AV in both active adult and entry-level segments give Taylor Morrison an almost entirely new pricing platform in what’s considered to be home building’s hottest, most opportunistic growth area: the below $300,000 price range.

So, importantly, the timing and magnitude of the purchase and the strongly optimistic take on the current housing cycle they reflect–especially as some builders, economists, observers, and experts see clouds of uncertainty forming on the 2020 horizon that might influence their land investment and exposure–have material bearing on both whether the deal is a success or a bomb, and the implications it has on continued consolidation among America’s largest home building enterprises.

Taylor Morrison CEO and Chairman Sheryl Palmer.

“This deal, first and foremost, signals our confidence in the housing cycle,” Taylor Morrison chair and ceo Sheryl Palmer tells us. “Consumer optimism, thanks to an improving economy, job formation, and wage growth has created a very healthy environment of demand in a housing market that is the most undersupplied it has ever been in history.

“What’s more, we’re confident that it’s a deal that aligns well with Taylor Morrison’s long-term strategies, our footprint, our focus on the demographic ‘barbell’ customer segments, and AV brings us the unique ability to serve a subset of the entry-level first-time buyer and 55+ markets with more affordable products and communities.

“Also, we’ve been an active acquirer in the home building market over the past few years [in Atlanta, the Carolinas and Florida, primarily], and we have learned to be skilled, rigorous, and successful in our acquisition and integration disciplines, which also makes me confident and excited that this is the right deal, at the right time, and at 1.1 times book, the right price for us.”

At this point, only time, and Taylor Morrison’s effective execution on one of its strategic pillars–operational excellence–will tell whether taking on an additional year-plus of lot pipeline creates a bigger risk or a bigger reward.

A key will be the extent to which Taylor Morrison can and will be able to leverage “local scale,” as both an efficiency driver–taking out overheads and direct costs in strategic product and materials sourcing, etc., and accessing construction trade contractors with greater, more consistent volume–and an effectiveness driver, matching and delivering homes to buyer prospects at a faster, more efficient cadence.

Vindication should become clear within the next 24 to 36 months as integration plays out, Taylor Morrison’s product and asset vetting process gets completed as planned, and the Taylor Morrison industry-standard marketing, data, the customer care process kicks into full gear, and the business model–as both community developer and merchant builder–resets.

“As they say, the devil is in the details, and we have a lot of the work left to do to make this integration succeed as we know it can,” says Palmer, who says Taylor Morrison will set up an Integration Management Office, advised by a third-party consultancy, to drive the process, review the portfolio on an asset-by-asset basis, look at floorplan consolidation and value engineering, trigger new marketing, and, above all, work out ongoing divisional and regional leadership and management. “The people part of it is what we absolutely have to get right,” Palmer says.

For several critical months of the integration, at least, Palmer can count on the willing and able partnership of AV Home turnaround architect and ceo Roger Cregg, who affirmed that the deal represents the best way forward for a company that learned to stand on its own two feet under his leadership, but needs deeper resources to grow value.

“We’ve built a great deal of momentum in growth markets with products and positions that have a lot of upside in the current environment,” Cregg tells BUILDER. “We look forward to becoming part of the Taylor Morrison team and adding value as we leverage local market share gains for greater local economies of scale, and an opportunity to grow regeneratively in key markets.

“The land game right now is not for the feint of heart,” says Cregg. “It takes years these days to bring raw land through the municipalities for permitting, and more time, then, to plan, engineer, and develop lots into home sites. So the value of a deal that extends the lot portfolio in a way that aligns strategically with products and customer segments can hardly be overstated in this climate.”

Let’s look at yesterday’s announcement for a moment in light of ongoing mergers and acquisitions trends in home building.

- We see further public to public opportunities, especially ones that would match top-10 publics with the smaller-capitalized mini-publics, that would check boxes similar to the Taylor Morrison-AV Homes deal.

- We also see seller motivation increasing among privately-held operators in faster-growing economic areas who 1) may seek a “gracious,” peaking-value exit strategy, or 2) want quicker, deeper access to growth capital.

- Too, both offshore-based–Japanese and Chinese–organizations and Clayton Homes, remain as motivated strategic buyers who have not completed their empire-building footprints and operational puzzles as yet.

So, we’re looking at a 2018 that will be a busy one on the mergers and acquisitions front, adding to the uncertainty–and the fun–of guessing how long the current recovery trajectory has ahead of it.