As the picture of a super power–combining the heft of the No. 2 and the No. 5 home building businesses under the Lennar umbrella as a 43,700-home, $17.2 billion enterprise–comes clear, it’s hard to overstate the role technology and data will play in the bold plan’s success.

Both to reach the kinds of synergies necessary to capture $85 million in overhead efficiencies, and to leverage national scale and local market share to capture another $165 million in direct cost savings on purchasing and labor, technology and data-evidenced operations will be critical. What’s more, to unleash the fullest upside scenario possible–removing a competitor in many important markets, and integrating that oppositional force into one’s own supportive efforts in the market–market intelligence, analytics, and real-time data-driven decision-making are non-negotiables.

Lennar’s embrace of transformational use of technology to drive its business forward became clear to audiences of Hive last fall as Lennar CEO Stuart Miller, a Hive dean, demonstrated ways that data would change local and enterprise decision-making and resource allocation from top to bottom.

Stuart Miller

Miller spotlighted local marketing and advertising, activities builders traditionally spent in the $100s of millions of dollars supporting, as a prime example for where innovation and data use would change how the company makes decisions and supports them. Business intelligence, fueled by access to and use of data, would change not only marketing and sales, but land strategy, product design, construction operations, and management at every turn, Lennar’s Miller asserted, noting “what we can measure, we can change.”

Too, in integrating Ryland and Standard Pacific, CalAtlantic’s leadership under executive chairman Scott Stowell and ceo Larry Nicholson re-engineered the enterprise’s entire network of data systems.

Speed, or rather, velocity–in integration and execution of new systems and workflows, from headquarters, to regional and divisional offices, right out to the 1,317 combined actively selling communities–will be a critical stress-test to the combination.

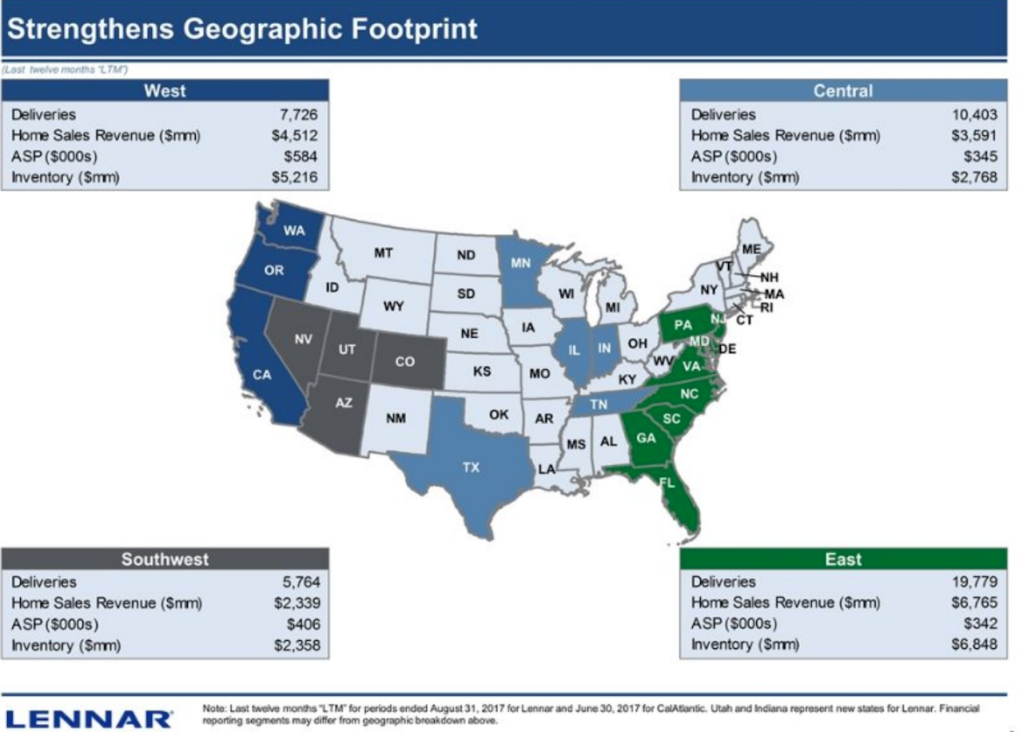

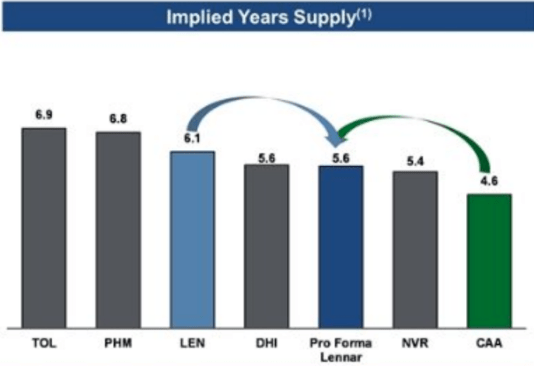

For, even though Lennar has effectively added 67,662 new lots to its pipeline, in combination with 176,142 lots Lennar has in its owned and controlled portfolio, the net pace on the absorptions and inventory turns actually reduces Lennar’s implied land supply, which makes its assets more profitable.

Again, the linchpin of success as Lennar becomes either a No. 1 or a top 3 builder in 25 markets it serves, will be the ability to leverage its technological investment into accelerated integration, operational excellence, and customer centric services that mask a fine-tuned construction and delivery process.

Time wasted is money lost, and everything from Lennar’s Everything’s Included floorplan portfolio to its rigorous balance-sheet management systems suggests that its strategic leaders expect data to play a lead role in making the CalAtlantic acquisition work.

In a partial answer to one of the big questions we recognized yesterday as the news of the $5.7 billion acquisition bid broke, Lennar put out word that CalAtlantic’s Stowell would join the Lennar board, as Orange County Register staffer Jeff Collins reported yesterday.

Also, in Securities and Exchange filings related to the merger, it’s evident that the partners are doing their best to keep key strategic leaders from CalAtlantic on board at least though the close of the deal, which Lennar hopes might happen by the end of 2017.

A proxy statement passage reads:

On October 29, 2017, concurrently with the execution of the Merger Agreement, the Company entered into retention letter agreements with each of Scott D. Stowell, Jeff J. McCall, Wendy L. Marlett, and John P. Babel (the “Retention Agreements”). The Retention Agreements provide for the payment to each executive of the following lump sum cash retention bonus on the date the Merger is consummated so long as the executive either remains employed with the Company through the consummation of the Merger, or is terminated prior to the consummation of the Merger by the Company without cause at the request of Lennar: Scott D. Stowell: $8,250,000, Jeff J. McCall: $3,050,000, Wendy L. Marlett: $2,000,000, and John P. Babel: $2,250,000. The bonuses under the Retention Agreements are in addition to, and not in lieu of, other payments due and payable under the Company’s employee benefit plans and/or any other agreement between each executive and the Company. The Retention Agreements are contingent upon the Merger having been consummated prior to December 31, 2018, and will be null and void if the Merger is not consummated by that date.

In addition, on October 29, 2017, concurrently with the execution of the Merger Agreement, the Company entered into an amendment of the Senior Executive Severance Agreement between the Company and Pete Skelly (the “ Severance Agreement ”) to provide that, in the event that Mr. Skelly’s employment is terminated in a manner entitling him to outplacement benefits, in lieu of such benefits Mr. Skelly will be entitled to receive a lump sum cash payment equal to the maximum amount he could have been reimbursed for under the Severance Agreement. This amendment to the Severance Agreement is contingent upon the Merger having been consummated prior to December 31, 2018, and will be null and void if the Merger is not consummated by that date.